11 August 2020

Europe is in the news this week, for the wrong reasons, with its own second wave of the virus now threatening to slow the recovery. Spain, the epicentre, had 580 active outbreaks as of Thursday last week, an increase of nearly 100 compared to a week earlier. Localised outbreaks in food processing and agricultural settings are one part of the explanation but another, more worrying, trend is emerging. Data from the Spanish Health Ministry suggest that nearly 10% of the current outbreaks come from community spread in bars and nightclubs, averaging 32 infections per case, twice the spread in the workplace. In other words, the social activity to which everyone wants to return seems to be incompatible with keeping the virus under control. With schools and universities about to reopen across much of the western world, the odds are not good for containment but, instead of assuming second and third waves as a matter of course, most economic forecasts assume a steady return to normality.

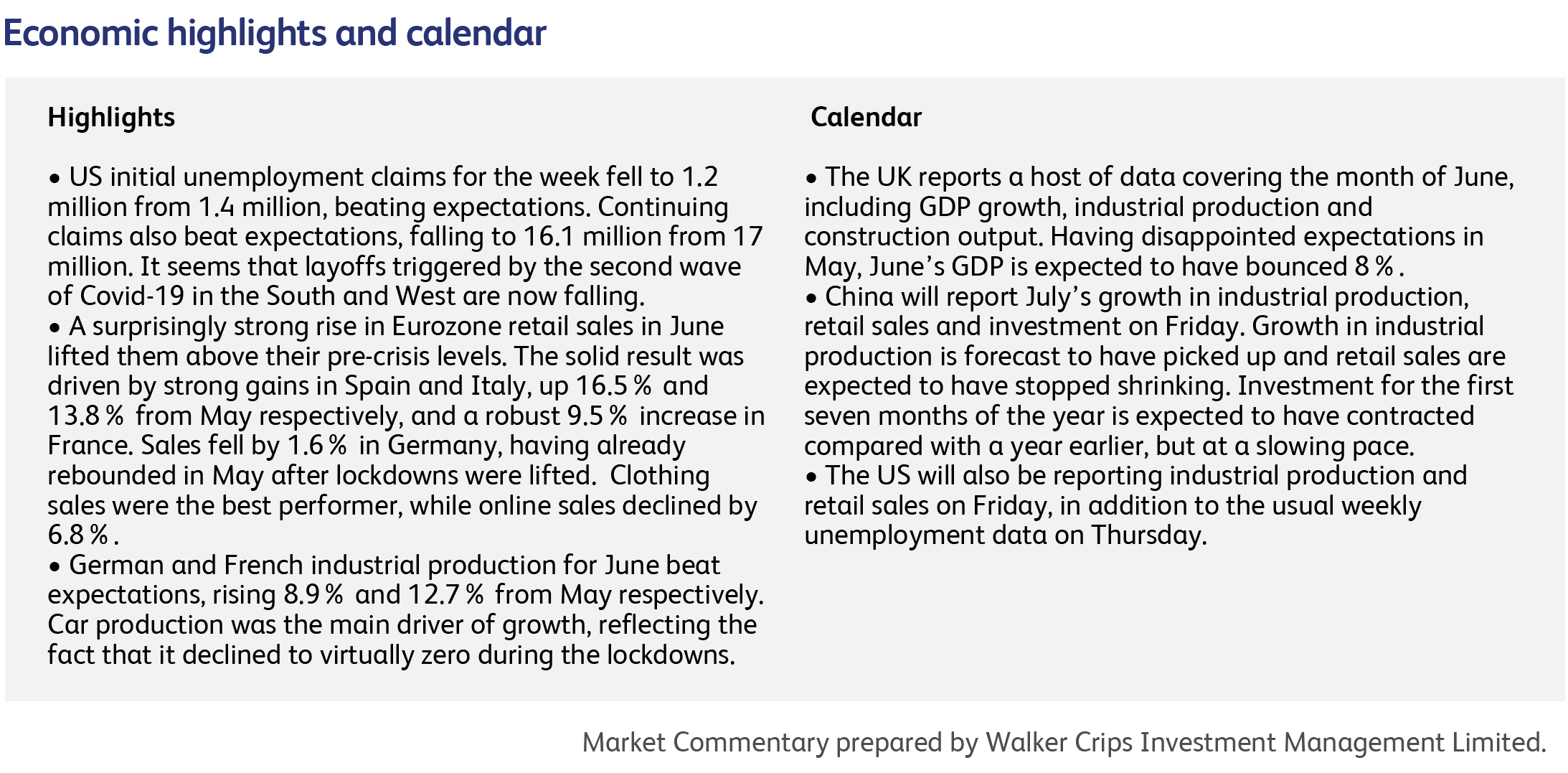

Against a domestic background of increasing cases and localised lockdowns, the Bank of England’s Monetary Policy Committee released its latest forecasts last week. It expects a drop of 21% in GDP between the first and second calendar quarters. By contrast, the U.S., Germany, Italy, France and Spain all saw smaller quarter-on quarter drops of 9.5%, 10.1%, 12.4%, 13.8% and 18.5%, respectively. The UK's under-performance reflects the longer duration of its lockdown, high labour market participation among parents and consumer services spending's relatively large share of GDP. The committee then expects a rapid rebound in the latter half of the year, followed by steady growth in 2021. Relatively optimistically, it expects the size of the economy to reach its pre-Covid peak by the fourth calendar quarter of 2021, and for inflation to return to its 2% target two years from now. In an interview after the forecasts were published, Governor Bailey said he saw an "awful lot of risk" to the downside.

A common factor in second waves everywhere, however, is much lower hospitalization and death rates, due to a combination of younger infectees and better treatment. The other good news is that health systems have been able to keep up with the rise in infections, offering politicians some flexibility in reopening. This may have driven some optimism in stockmarkets last week, with Asian and US markets particularly buoyant. The South Korean stockmarket’s KOSPI Index is now 8% above its February highs. The Russell 2000 Index, an index of small and mid-sized US companies, rose over 5% during the week and is now back to its levels of December last year. By comparison, European stockmarkets continued to drift sideways, as they have over the last month.

If the short-term looks problematic for economic growth and asset valuations, the long-term is equally uncertain. Surging stock and bond markets might please investors now, but they have given cover to politicians to embark on policies that will ultimately damage the prospects for longer-term economic growth. An example of this is the dismantling of US-China relations. In the latest exchange, the US imposed bans on more Chinese-owned apps (see the Stock Focus section below), and placed sanctions on 11 Chinese officials and their local allies in Hong Kong, including Chief Executive Carrie Lam, over their roles in curtailing political freedoms. In retaliation, China said it will sanction 11 Americans “who behaved badly on Hong Kong-related issues”. The list doesn’t name any members of the Trump administration, but does include four US Senators.

Uber Technologies showed that not every technology company is the beneficiary of the pandemic when it reported a steep and prolonged decline in ridership. Revenues from riders plunged 67% to $790 million in the second calendar quarter. Ride demand has rebounded in cities like Hong Kong that have re-opened, but remains low in San Francisco, Los Angeles and other areas struggling to contain the virus. But all is not lost: for the first time, Uber generated more revenue from delivering food than transporting people. Delivery revenue, which was growing even before the pandemic, surged 103% during the quarter and is now central to Uber’s strategy. Separately, Uber and its rival Lyft were ordered by a court in California to convert their drivers from independent contractors to employees with benefits. Unsurprisingly, Uber and Lyft vowed to appeal.

US President Trump extended the technology war with China by banning US residents from doing business with the Chinese-owned TikTok and WeChat apps. With the U.S. election less than 90 days away, Trump is making his challenge of China a central theme of his campaign. The vaguely-worded executive order prompted confusion, sending the share price of WeChat’s owner, Tencent Holdings, down 10% at one point, equivalent to a loss of $46 billion in value. A US official later clarified the ban will only cover WeChat, rather than Tencent’s other US operations.

Technology and pharmaceutical company The Eastman Kodak Company has seen its shares tank this week after news that a planned $765 million loan to the company was halted after the deal has come under congressional and regulatory scrutiny. Kodak, which historically has been a photography company, had planned to use funds loaned from The US International Development Finance Corp. to produce drug ingredients. The Securities and Exchange Commission (SEC) is investigating how Kodak disclosed of the loan and is also expected to examine the stock options granted to executives on July 27th. Concerns have also been raised by several Democrat-led congressional committees about the “lack of pharmaceutical experience” at Kodak.

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.