18 August 2020

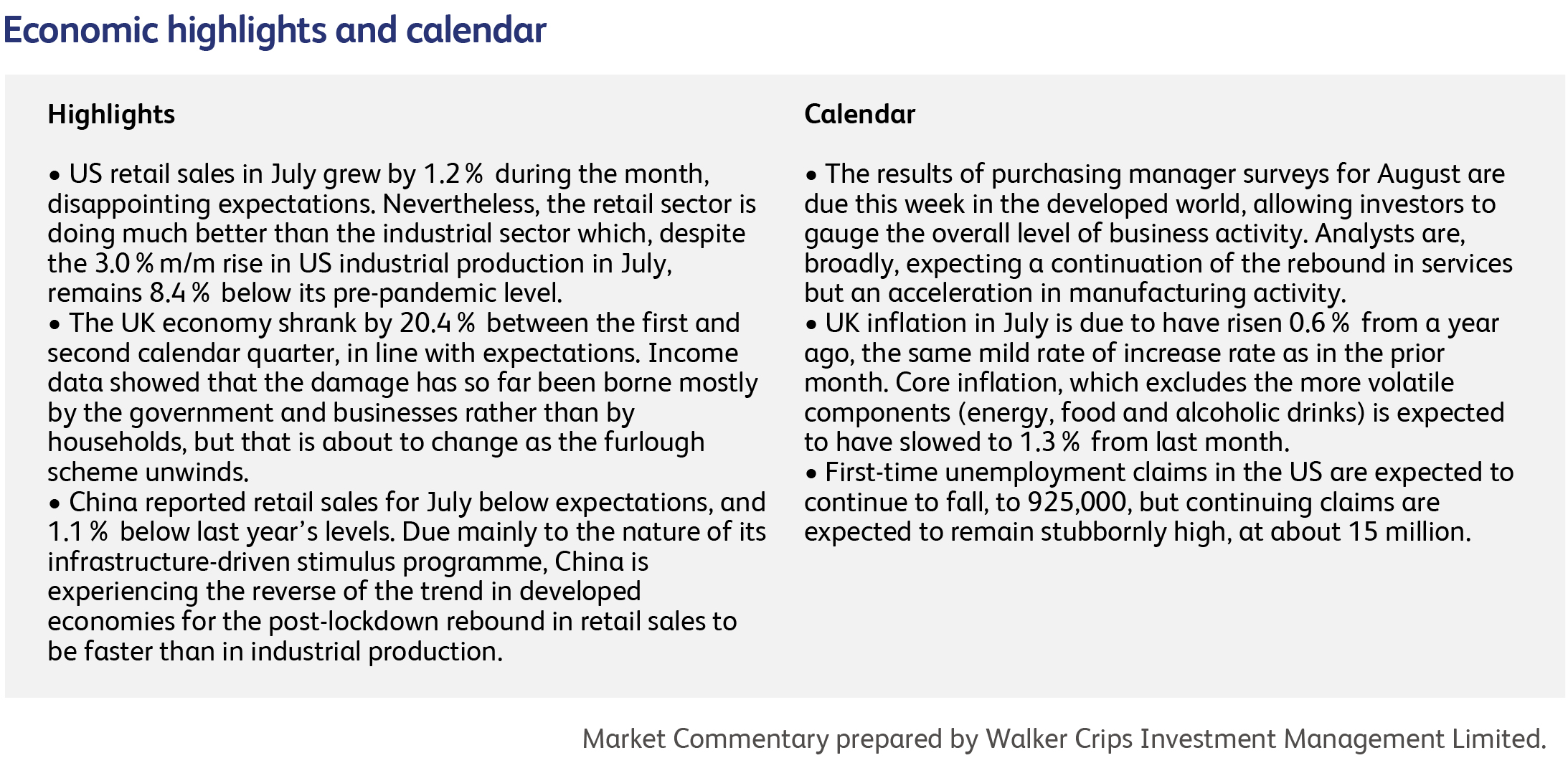

GDP data for the second calendar quarter confirmed the sharp decline in activity in all major economies except China, driven primarily by slumps in consumer spending. The data conceal the fact that consumer spending rebounded towards the end of the second quarter, but that recovery appears to have slowed more recently in response to renewed virus outbreaks. Even after the latest outbreaks are brought under control, the pace of recovery will be held back by social distancing. Moreover, there will be further outbreaks, exacerbated by the reopening of schools and universities. Labour market disruption has been limited by government support, but governments have recently begun the process of weaning the unemployed, the economy and investors off stimulus.

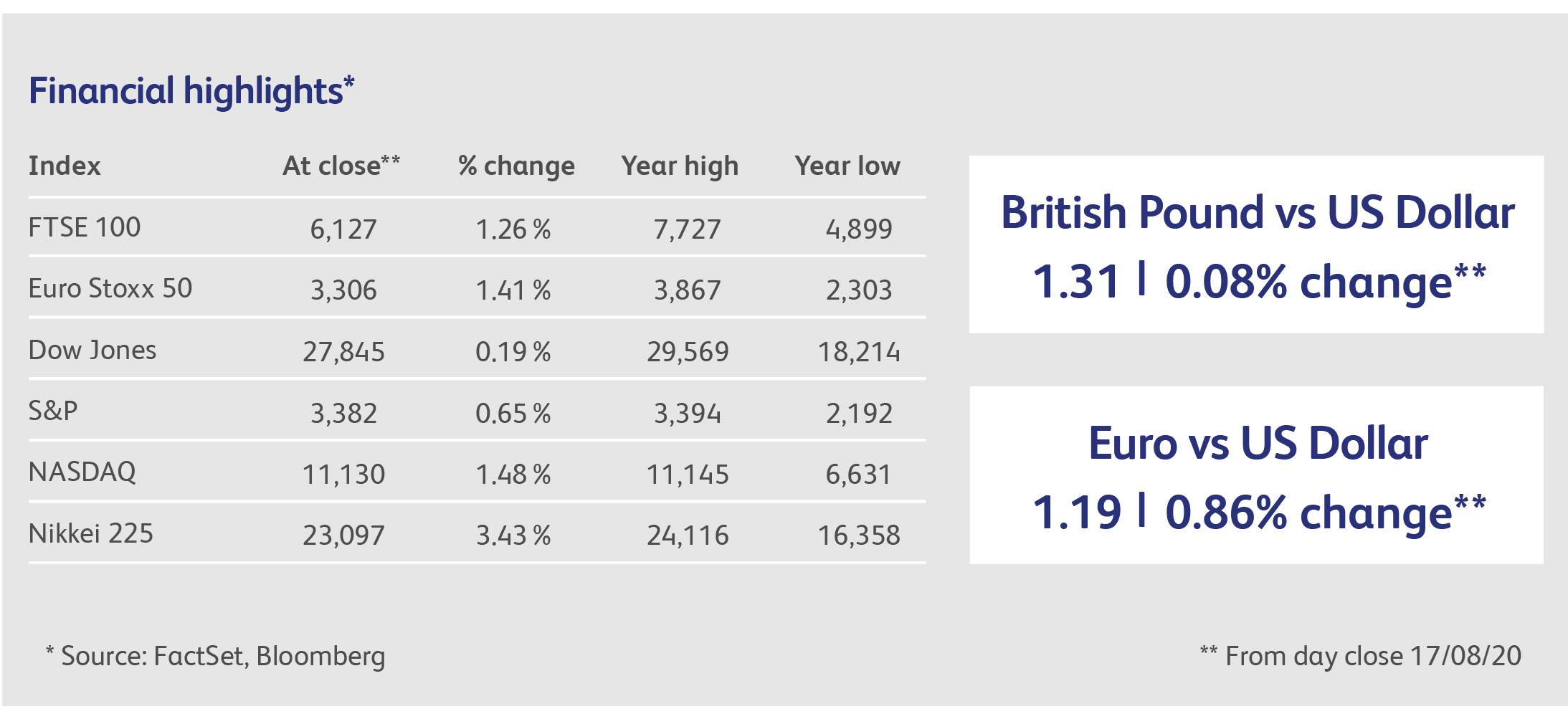

Stockmarket performance in the developed world has, to some extent, reflected economic performance although allowance must be made for the industry sectors making up each stockmarket index and, in particular, the exposure to technology companies. At the bottom of the scale are the Spanish, UK, Italian and French stockmarkets, down between 15% and 25% since the start of the year against a backdrop of economies that are expected to have fallen about 10% by the end of the year. At the other end of the scale, Japan’s main stockmarket index is down only 6% whereas the broader US indices are only slightly down, after eliminating the impact of technology stocks. Both these economies are expected to have fallen only 5% by the end of the year.

The star performers within Europe have been the German and Swedish stockmarkets, which are also only slightly down since the start of the year, and whose economies are also expected to have fallen only 5% by the end of the year. While the success of Germany’s response to the pandemic is acknowledged, Sweden’s contrarian approach has been the subject of much debate. Junior schools, nurseries, restaurants, and non-essential shops were allowed to stay open and the government did not impose any restrictions on leaving the house for work or exercise. The government advised the public to take precautions, and many citizens did - but they remained voluntary. Economically, the approach has been more successful than stricter lockdowns: Sweden’s 8.6% drop in GDP between the first and second calendar quarters was about a third less than most large European countries. Swedish policymakers emulated the methods of their global peers, with the central bank offering cheap loans to the banking sector and expanding its purchases of financial assets. The government deferred taxes, offered loan guarantees and has supplemented the incomes of about 11% of the workforce.

Covid-19 case numbers in Sweden did not peak until June and remained elevated longer than elsewhere. On a per capita basis, daily deaths were the highest in world over the period between mid-May and end-June, and Sweden is among the worst developed countries in terms of cumulative deaths per capita. All told, the policy appears to have caused a higher rate of deaths, especially when compared with other Nordic countries: mortality rates have actually been lower than usual in Denmark and Norway, despite the pandemic. Sweden’s example illustrates the moral dilemma facing governments: 5,783 deaths are attributable to Covid-19 so far, but 4% to 5% of GDP has been preserved. On the face of it, China’s combined medical and economic response has been the most effective, though China’s underlying growth was already much faster than the developed world and the data are less reliable. Nevertheless, China stands alone among large economies in having very low per capital death rates, a relatively small stimulus programme and an economy that is expected to have grown during 2020. Its stockmarkets also stand alone: the Shanghai Composite Index is up more than 10% since the start of the year, and the more technology-biased Shenzhen Stock Exchange Composite Index is up over 30%. Time to dust off Das Kapital!?

The US further restricted access by Huawei Technologies to items produced from US technology and software. In addition, another 38 Huawei affiliates across 21 countries were added to the Entity List, which imposes export restrictions. The actions are designed to “prevent Huawei’s attempts to circumvent U.S. export controls to obtain electronic components developed or produced using U.S. technology”. The new rule is the most serious yet and could cut Huawei off from all foreign chip suppliers.

British retailer Marks & Spencer Plc (MKS.L) has announced they are to cut 7,000 jobs over the next three months across its stores and management. The coronavirus pandemic has hit high-street retailers, with M&S saying there has been a “material shift in trade”. In a statement, they said it was “too early to predict with precision where a new post-Covid sales mix will settle. We must now act to reflect this change”.

Cranswick Plc (CWK.L), the UK meat producer and processor, has announced it saw revenues surge 25% in the previous quarter. It was driven by the current shift towards in-home consumption and robust retail demand which more than compensated for lower sales from the hospitality sector. The company said “the outlook for the current financial year ending 27 March 2021 is now expected to be ahead of its previous expectations”.

British homebuilder Persimmon Plc (PSN.L) has said it will restore its dividend despite profits sinking 43%. Since lockdown measures were eased in May, property buyers have returned in force, with July the busiest month in a decade as £37 billion worth of deals were agreed according to Rightmove. This better than expected demand for its houses has allowed it to reinstate a dividend of 40p per share the company said. The coronavirus pandemic had caused profits to fall as the company was forced to shut construction sites and the economy ground to a halt.

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.