12 July 2022

A bounce in equity markets had been overdue, and was duly delivered, with the US technology sector leading the way. Investors were initially somewhat cheered by an American service industry survey that showed only a slight reduction in activity from the previous month, bucking the trend from other nations for much larger declines. More importantly, the minutes of the US Federal Reserve’s last meeting did not derail the rally, despite demonstrating plenty of determination to fight inflation combined with precious little concern for the weakening economy. Thanks to recent downward revisions to economic data, it’s possible that America is already in recession, but the Fed’s minutes seemed to emanate from a different dimension, stating that “overall economic activity appeared to have picked up”. The minutes referred to inflation as being “more persistent than they had previously anticipated”, ignoring the recent reduction in so-called “core” inflation, which strips out less-controllable items such as food and energy. In summary, there were suspicions that the Fed may have cherry-picked data to support its current, aggressively anti-inflation policy. But that stance seems to please equity markets, which continued their rally on the day the minutes were published, though bond markets reversed their recent strong run.

More positive news from China supported sentiment once again, this time the main story being a government plan to deploy another $220 billion in support for the Chinese economy, which would add to the $160 billion already announced in recent weeks. These are huge numbers, enough to move the needle on the entire global economy. This was followed by the all-important monthly US jobs data, which also surprised to the upside, with the US economy creating 390,000 jobs in June versus the expectation of 265,000. Initially, stock markets dropped on fear that this would bolster the Fed’s case for rate rises but, along with a downward revision to the previous month’s jobs, the data ended up being in the “Goldilocks” zone, neither too hot nor too cold, and cementing the rally.

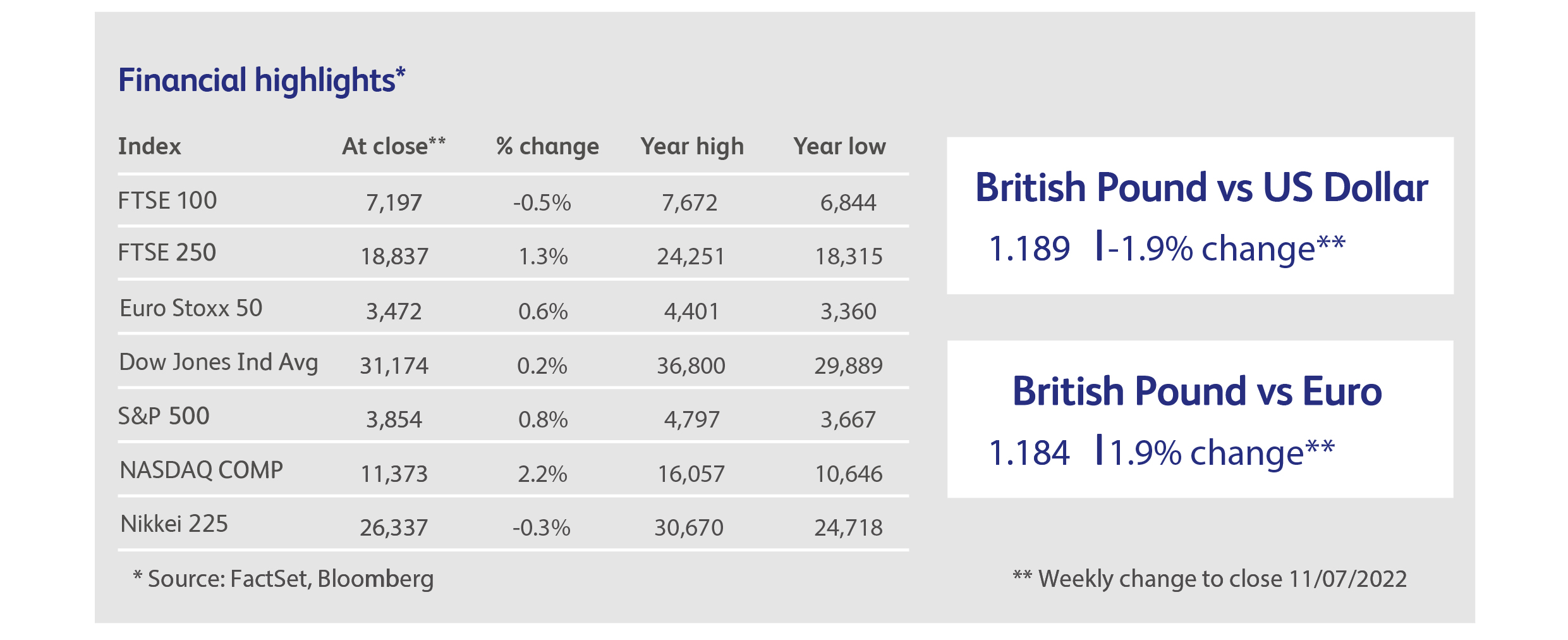

Investors don’t need an excuse to buy US dollars, one of the world’s truly safe havens, causing the dollar to rise an extraordinary 12% on average against other major currencies since the start of the year. This has sent some major currencies to multi-year lows against the dollar: the Japanese yen lost its safe-haven status because the Bank of Japan has refused to raise rates or allow government bond yields to rise, prompting a devaluation against the dollar to 25-year lows. Traders are questioning how long this policy can hold, given that Japan is now importing a great deal of food and energy-price inflation. Japanese exporters, meanwhile, must be rubbing their hands with glee. Another major currency in traders’ sights is the Euro, but this time the consensus seems to be for further declines: the economic consequences of Germany’s over-dependence on Russian energy has been the Euro’s undoing and, with the flow of Russian gas to Germany in a perilous condition, there is much talk of the Euro breaching parity with the US dollar, something which hasn’t happened for 20 years. Investors might be surprised to learn that the Brazilian real has been the strongest major currency against the dollar this year, rising by 6%, with the Mexican peso in second place, mainly due to the massive influx of dollar-flows from oil and other commodity exports.

Tesla founder Elon Musk finally backed out of his bid to acquire social media platform Twitter, triggering a round of litigation as the company seeks to enforce the terms of the deal that had supposedly been agreed. In order to secure a rapid deal, early on in the transaction Musk waived his right to scrutinise the company’s non-public financial information. But market conditions were difficult and Musk’s commitment soon wavered. Even to the end, Musk maintained his claim that Twitter had mislead him about the number of fake, automated users of the platform.

The roller-coaster ride in the shares of semiconductor manufacturers continued. The entire sector sold off after news emerged that the US government was pressuring the Dutch manufacturer ASML, as well as the Japanese manufacturer Nikon, to suspend exports of chip-making equipment to China. This was followed by a strong rally later in the week after Samsung Electronics reported results that beat expectations, including a 21% surge in revenues.

The French government announced that it will nationalise the nuclear energy producer EDF, in which it already owns an 84% stake. The move is designed to improve government control over energy policy in the face of the Ukraine war and associated energy shortages. EDF shares jumped 30% on the news, but the longer-term has been a disaster for investors with the shares having peaked in 2007 at over seven times their current level.

A trial brought by the American financial regulator against traders of gold and silver at JPMorgan alleges that the traders used illegal fake orders to drum up the impression of market activity in order to move prices ahead of real trades, before subsequently cancelling the fake orders. The defendants, on the other hand, will highlight that such activity is actually the norm in today’s markets, where trading is dominated by computer-generated algorithms seeking to gain a competitive advantage.

Highlights

Calendar

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.