14 March 2023

It was always going to take a big news story to divert the attention of equity markets away from hanging on every word that Jerome Powell (Chair of the US Federal Reserve, "Fed") utters about inflation and the likely path of interest rates. The sudden collapse of Silicon Valley Bank ("SVB") proved to be just the story. To put it simply, the Fed's policy of aggressively raising interest rates has had the effect of pushing borrowing costs to a level above where many cash-hungry start-up companies can sustainably raise finance. At the same time, those very same high interest rates feed into (and have a negative effect on) the discounted cash flow valuations which are commonly used to value unprofitable start-up companies - the result being to effectively starve them of the opportunity to raise equity finance. So, choked of all forms of finance, their only option had been to draw upon cash reserves held with the likes of SVB. As cash calls gathered pace, SVB had to liquidate some of its "low risk" capital (i.e. US Treasuries) much earlier than it had expected it would need to. Due to the rate hiking over the past year, those “low risk” Treasuries were not worth nearly as much as they had been 12 months prior - and so SVB faced a cash shortfall, which it tried to plug via a hastily arranged equity fund-raising. If there is one thing guaranteed to cause panic amongst investors and savers alike, it is a bank that admits it cannot meet customer redemption requests.

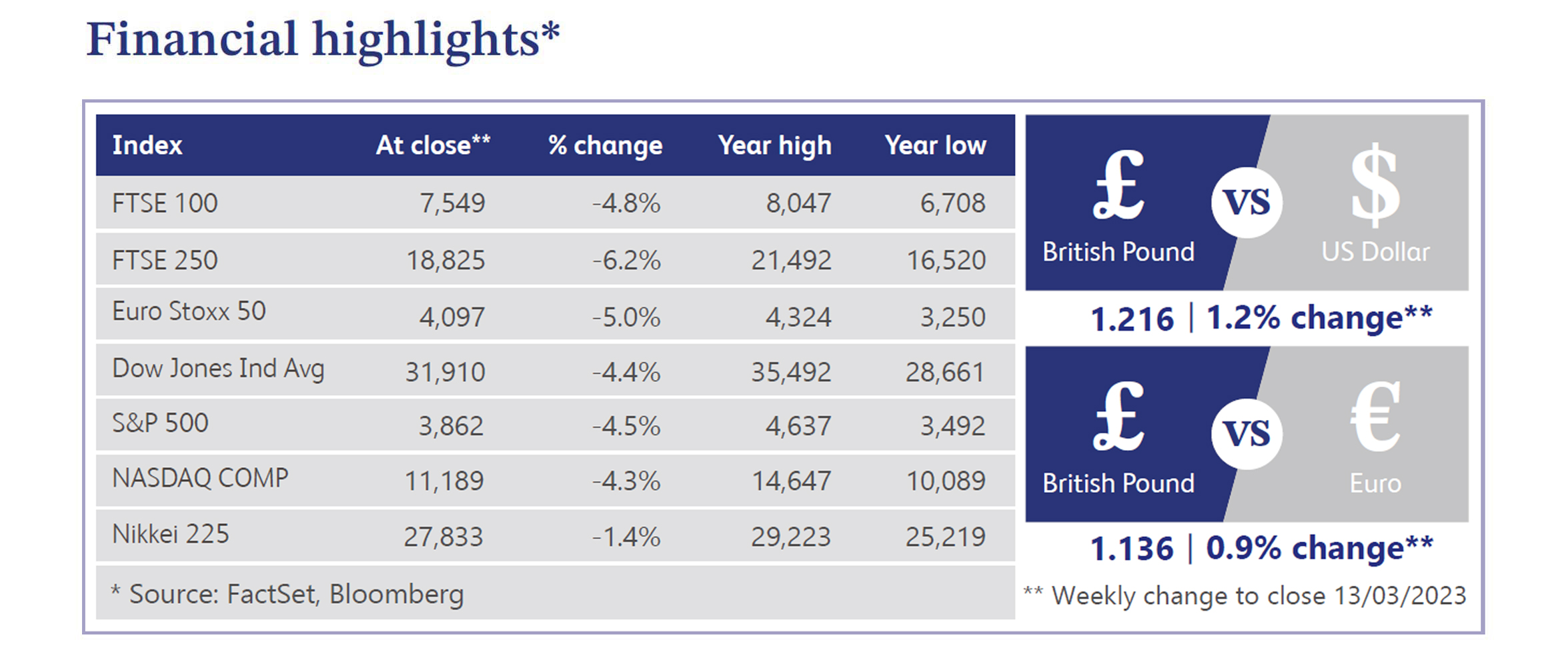

Despite central banks' best efforts to reassure equity markets that SVB is an isolated incident, they could not be reassured - the FTSE 100 Index fell some 2.58% on Monday alone, with banking shares amongst the biggest fallers on what was a difficult trading day. Now it has been brought to everybody's attention that banks do not necessarily hold all their customer deposits as cash (rather they invest some of it in "low risk" bonds or Treasuries) there is a tangible fear of some degree of contagion across the wider banking sector. Financial institutions are built upon confidence and when cracks begin to appear, those cracks can very quickly turn into chasms.

In contrast to the turmoil in equity markets, the usually much more staid bond markets could not help but keep at least one eye firmly focused on the potential impact all of this could have on the Fed's stance toward monetary policy tightening. The US 2-year Treasury yield duly fell an astonishing 55 basis points on Monday from approximately 4.5% to 4%. This marked its biggest one-day yield decline since Tuesday 20 October 1987 (i.e. the day after "Black Monday"). A falling yield means that the price is rising as investors buy the asset in a "flight to safety". The obvious conclusion to draw is that bond markets feel there is some chance that the Fed may at least pause its rate hiking cycle in order to calm markets. Whilst it may seem like much longer ago, it is only a matter of days since Chair Powell reacted to February's larger than anticipated rise in US payrolls by warning markets that the Fed may have to keep raising interest rates. As well as the usual raft of data, the Fed now has the not so small matter of the SVB fallout to add to its weighing scales as it tries to balance everything ahead of its next eagerly anticipated move.

Legal & General announced a better than expected operating profit of £2.5 billion for the 12 months to December 2022, which represented an increase of approximately 12% on the prior year. This came despite an approximate £200 billion drop in assets under management within its Investment Management division (from £1.4 trillion to £1.2 trillion) over the course of the year. This came as a result of turbulent investment markets including a significant impact of over £100 billion from the well-publicised liability-driven investments debacle triggered by Kwasi Kwarteng’s fiscal statement in September. Against a minimum requirement of 100%, Legal & General ended the year with a reassuringly high solvency II coverage ratio of 236% (up from 187% 12 months earlier).

Direct Line blamed factors such as greater than expected weather event and motor claims as well as new regulatory changes as it reported a combined operating ratio of 105.8% (a ratio above 100% indicates an underlying loss). This compares to a much healthier ratio of 89.5% in the prior year. The company expects the volume of motor claims to remain elevated throughout 2023 and noted that "challenging" investment markets were having an impact on the business. Insurance companies are forced to invest in portfolios of bonds and the unusually large price movements in bond markets over the past year appear to be having a negative impact on companies such as Direct Line. Whilst still well above minimum regulatory requirements, the deterioration in the Group's solvency ratio from 176% to 147% may be a cause for concern amongst management and shareholders alike.

Recruitment firm Robert Walters is proving to be a rare beneficiary of the tight labour market as it announced a 13% increase in revenues to £1.1 billion for the 12 months to December 2022. The company admitted it had benefitted from "fierce competition for talent and significant wage inflation", seeing growth across all geographies and all areas of recruitment, whether it be permanent, interim or contract. However, despite strong growth over the year as a whole, the company did note that macroeconomic uncertainty in the second half of 2022 (and into 2023) had caused some degree of softening in terms of demand.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.