21 March 2023

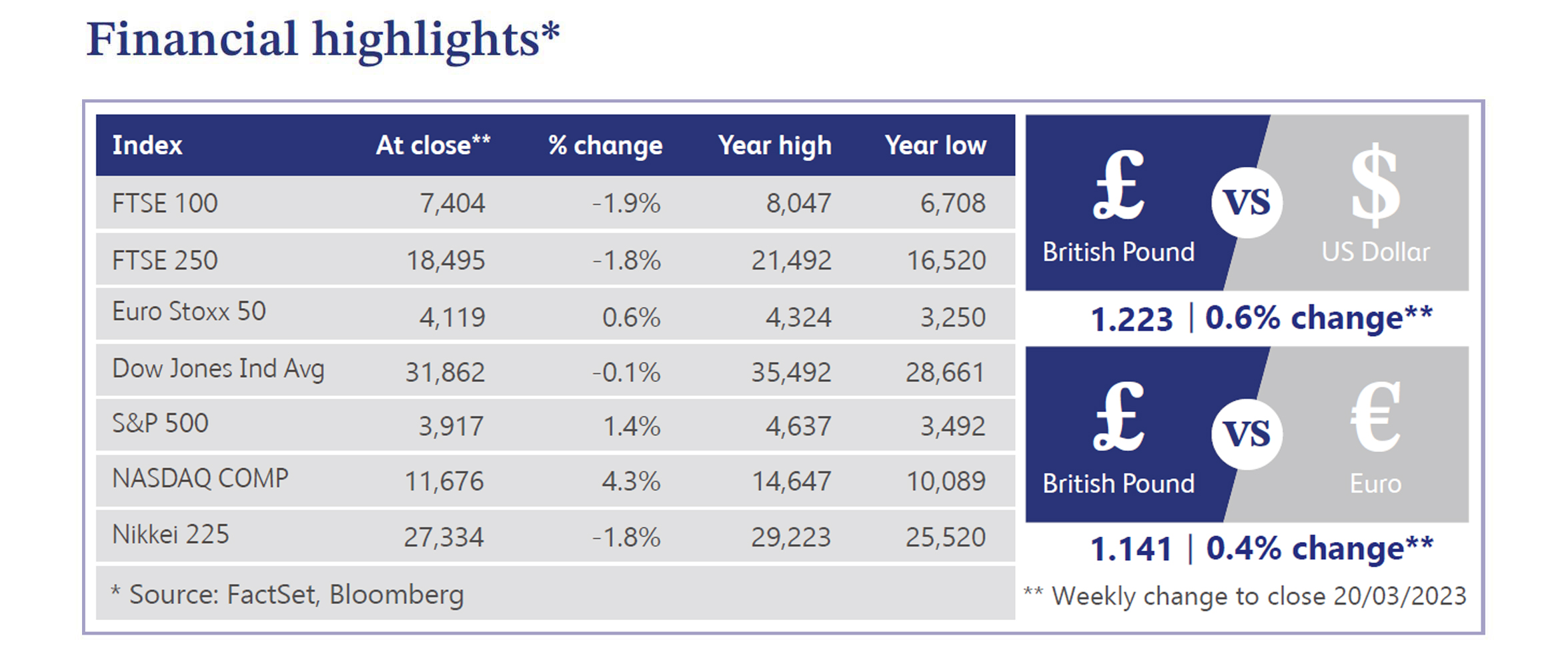

As European and US indices turned lower last week, investors were left pondering: can multiple financial rescues and a government budget keep a hibernating bear at bay?

Last autumn, UK pension funds that use liability driven investing as a core investment strategy were the first to experience a mismatch in assets and liabilities, necessitating a liquidity backstop. The Bank of England had to step in with a short-term quantitative easing program to prevent a crash in the gilt market and stabilise the UK pension sector.

Fast forward from last year to the present day, and three US banks have failed, demonstrating that the banking sector is not immune to the harsh realities of quantitative tightening. The troubles these banks faced were not triggered by a disastrous mini budget but rather a fall in the value of crypto currency assets. Nonetheless, a mismatch in assets and liabilities has resulted once more albeit in a different sector. Each bank has had its own White Knight come along to the rescue in the form of a bid from a competitor or a ‘bailout’. Although the US Federal Reserve (“Fed”) has been careful not to use that word, all the while emphasising support is going directly to depositors - not to the banks.

Moody's, the well-known rating agency, recently changed its outlook for the US banking industry. On Tuesday, the agency changed its prior “stable” outlook to a more pessimistic “negative” outlook for the US banking system. While some banks may have weathered the storm of rising inflation and interest rates by skilfully managing their assets and liabilities, others could face rough patches ahead. It is worth noting the recently failed US-based banks were somewhat unconventional; focusing on tech-driven lending and being crypto friendly. But here is the anomaly – Credit Suisse. Its downfall suggests that the troubles facing the banking system are not limited to the US and Switzerland: they are global in nature. The weekend set the stage for another rescue in the form of a takeover bid for Credit Suisse from competitor UBS.

The UK Chancellor had some upbeat news to share during his first Budget speech on Wednesday. According to the latest projections, the UK economy is likely to steer clear of a technical recession, meaning two consecutive quarters of decline in GDP can be avoided. Additionally, the Office for Budget Responsibility predicts that inflation will dip to 2.9% by the end of 2023. However, the possibility of a banking crisis might make the Chancellor second-guess whether he should have maxed-out his fiscal headroom, leaving little wiggle room for further fiscal adjustments if things do not go as planned.

Direct Line announced a loss in its full year results which was mainly attributed to pricing not reflecting claims inflation in the Motor segment, regulatory changes and higher weather-related claims in Home and Commercial. Operating profit from ongoing operations in 2022 was £32.1 million compared with £590 million a year earlier. The company had flagged an expected underwriting loss for 2022 earlier this year. Alongside the results came the announcement that it will not be paying a full year dividend due to its deteriorating solvency ratio. The solvency ratio was reported as being 147%, sitting towards the lower end of the risk appetite range of 140% - 180%. Self-help actions outlined to improve the Group’s solvency ratio included motor margin restoration by using a new pricing system, exiting low margin partnerships, further asset de-risking and introducing new reinsurance options. The ratio could have been 5% lower had there been no improvement in the value of the bond portfolio. Shares are currently trading near a 10-year low.

Close Brothers announced a fall in half year profit primarily driven by further write downs relating to Novitas which it acquired in 2017. There was very little to cheer about in the results with statutory profit before tax falling 43% compared to the same period a year ago. A fall in assets under management negatively impacted operating income by 7%. Excluding the impact of Novitas impairment charges were around £47.6 million, accounted by weaker macroeconomic variables and a rise in Motor Finance arrears due to cost-of-living pressures on customers.

Insurers, like pension funds and banks, can lose money when interest rates go up. These companies collect money from customers and invest in assets that they think will generate enough money to cover future expenses and earn a profit. The Embedded Value of a life insurance company is the current value of future profits plus the adjusted value of their assets. If interest rates go up, it means that profits expected to be earned in the future may be worth less today. This can result in losses for the insurance company. In recent results it was revealed Prudential's embedded value fell from $47.4 billion at the end of 2021 to $42.2 billion at the end of last year. Despite this fall it still has a strong capital position.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.