11 April 2023

The Easter bank holiday saw many people enjoy a longer weekend as markets were on hold for a couple of days. Nonetheless, news was still plentiful as global markets continued to move in multiple different directions. One of the key news stories was that Saudi Arabia made a surprise decision to cut oil production by 500,000 barrels a day, alongside other OPEC+ nations joining them to result in a total production cut of 1.65 million barrels a day until the end of 2023. This saw the oil price surge by approximately 6% last week and it will be interesting to see what impact this will have on the price of oil for the remainder of the year.

French President Emmanuel Macron also made headline news after recently visiting Beijing and commenting that Europe should reduce its dependency on the US and distance itself from the tensions between the US and China over the conflict in Taiwan. The US and China have been battling it out as China continues to further assert itself on the world stage. There has been talk of "de-dollarisation" in recent times which has slowly picked up momentum. Therefore, the timing of Macron’s comments is interesting and may show some potential indication about future long-term plans.

It was also announced last week that growth in the UK construction sector continued to slow last month as borrowing costs remained high; the result of the interest rate hikes to try and deal with persistent inflation. However, optimism among builders rose to the highest level since February 2022 as total construction output for the year ahead was forecast to increase by 46% of the panel, with only 11% expecting a reduction. It will be interesting to monitor inflation figures in the coming weeks as well as the next interest rate decision from the Bank of England, which will have a significant impact on the construction industry.

Another key development last week came within the artificial intelligence (“AI”) space which saw Google CEO Sundar Pichai announce that Google will integrate chat AI into Google Search to compete with Chat GPT. This is a big development as we have seen the impact that ChatGPT has had on the market – becoming the fastest consumer app to reach 1 million users in just 5 days, and only two months to reach the 100 million user milestone. Google currently has more than a 90% market share in search and has been one of the most successful companies in recent history. Google has made it clear that it intends to compete within the AI space. It will be interesting to see how the company implements AI into its business alongside the impact this will have on everyday lives.

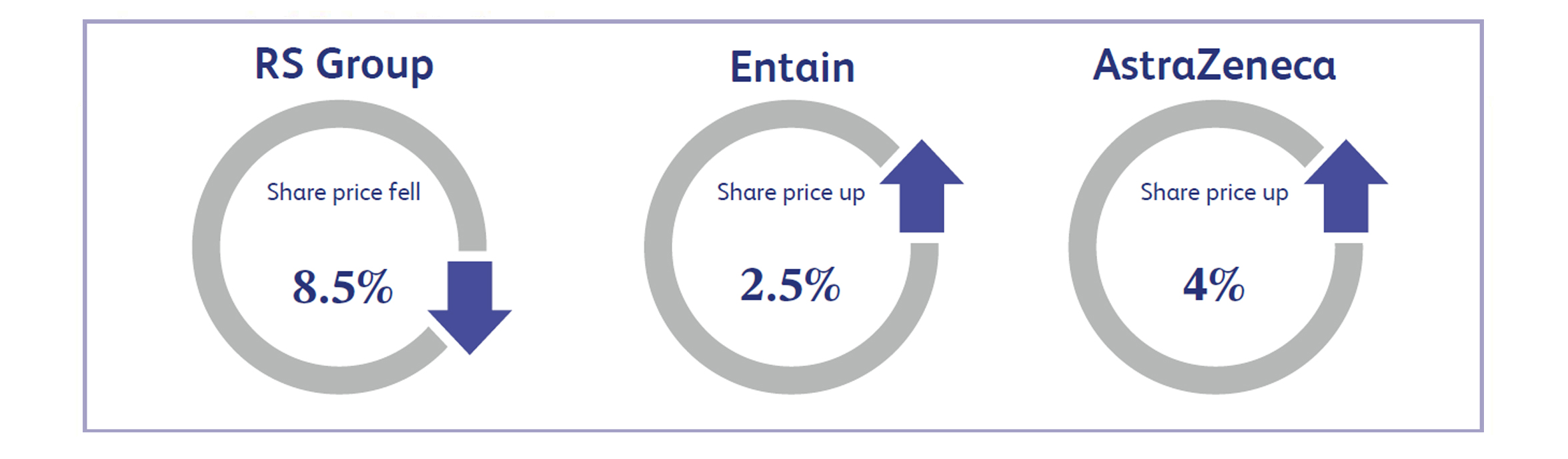

RS Group shares fell approximately 8.5% last week after it issued a trading update for the fourth quarter ending 31 March 2023 ahead of publishing its full-year results on 23 May 2023. The UK-based firm, which offers electronic products and solutions, reported that its electronic revenue had declined by 14%, which disappointed market expectations. Industrial products saw like-for-like sales increase by 10% in the final quarter. This segment of the business accounts for approximately 77% of group revenue. Markets were hoping the electronic business would continue to grow and diversify its revenue streams. Therefore, the slowdown in the electronic business sent the shares tumbling.

Ladbrokes’ owner Entain Plc saw a small share price increase last week as the market appeared to react positively to the announcement that it has agreed to purchase sports media business 365scores for up to £128 million. Entain said that 365scores is one of the world's leading scores and sports media companies providing scores, sports information, editorial and social content, as well as sports focused free-to-play games. 365scores is one of the top-ranking scores apps worldwide and has a global audience of more than 15 million active users. This acquisition is intended to bring a combination of Entain’s global scale and market leading platform capabilities and 365scores’ expertise in data-driven sports media content, which should provide customers with a broader offering of interactive experiences. The share price rose by approximately 2.5% last week, with investors positive about the potential long-term benefits of this strategic acquisition.

AstraZeneca shares surged approximately 4% last week after announcing positive high-level results from analysis of an ongoing ovarian cancer treatment trial on Wednesday. The trial tested a combination treatment which demonstrated a statistically significant and meaningful improvement in comparison to the current methods of treatment. The overall trial has been a positive development, but the product is currently not ready to be implemented into modern treatment practices.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.