25 April 2023

The UK is showing that inflation continues to remain stickier than forecasted as consumer price inflation for March slowed by less than expected to 10.1% from 10.4% in February. The largest downward contributions came from motor fuels and heating oil prices, alongside soaring food prices which weighed heavily. Notable rising food prices included olive oil prices rising 49% in the year to March, sugar up 32% with milk, cheese and other dairy products all up over 30%. Food price inflation remains a thorn in the side to the Bank of England (“BoE”) achieving its inflation target of 2%. The Office for National Statistics (“ONS”) stated that this is the strongest increase in food prices in more than four decades. Retailers said that food inflation is a delayed effect of energy and commodity price rises during the past year along with poor harvests and a period of sterling weakness. As we enter the UK growing season, we are more likely to see a slowdown in food inflation, which hopefully will provide some ease to consumers.

The ONS separately released data showing wage growth demonstrated little signs of moderating in the three months to February as pay excluding bonuses increased 6.6% compared to a year ago. This is also a contributor to the continued high rate of inflation and could prompt the BoE to raise interest rates again in May. Many investors are forecasting that the BoE will need to raise rates by a further 0.25% as it continues to attempt to control inflation.

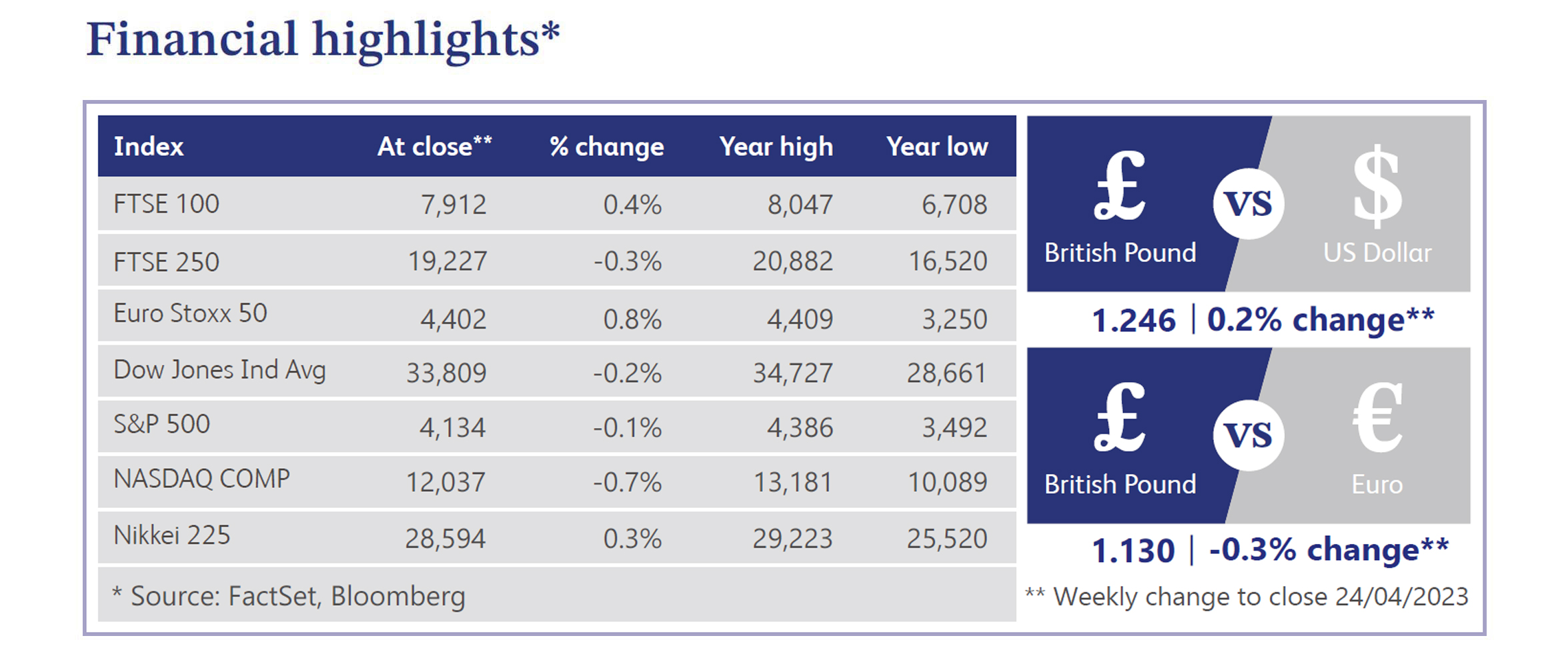

Despite inflationary pressures, the FTSE 100 was up 0.4% on the week as the index closed at 7,912 with a number of UK and US earnings announcements being eagerly anticipated by investors. The markets appear to be demonstrating a lack of any real conviction from investors as uncertainty remains. The continuing uncertainty regarding how long inflation will remain and therefore how high the BoE will need to raise rates is weighing negatively on UK equity markets. The forecasted outlook continues to remain more positive than a few months ago, but inflation remains one of the main areas of focus within the markets.

This week sees a number of US tech results being announced with the likes of Microsoft, Alphabet, Meta and Amazon all announcing their results. These announcements will provide some useful insight into how some of the largest companies in the world are performing in these uncertain conditions.

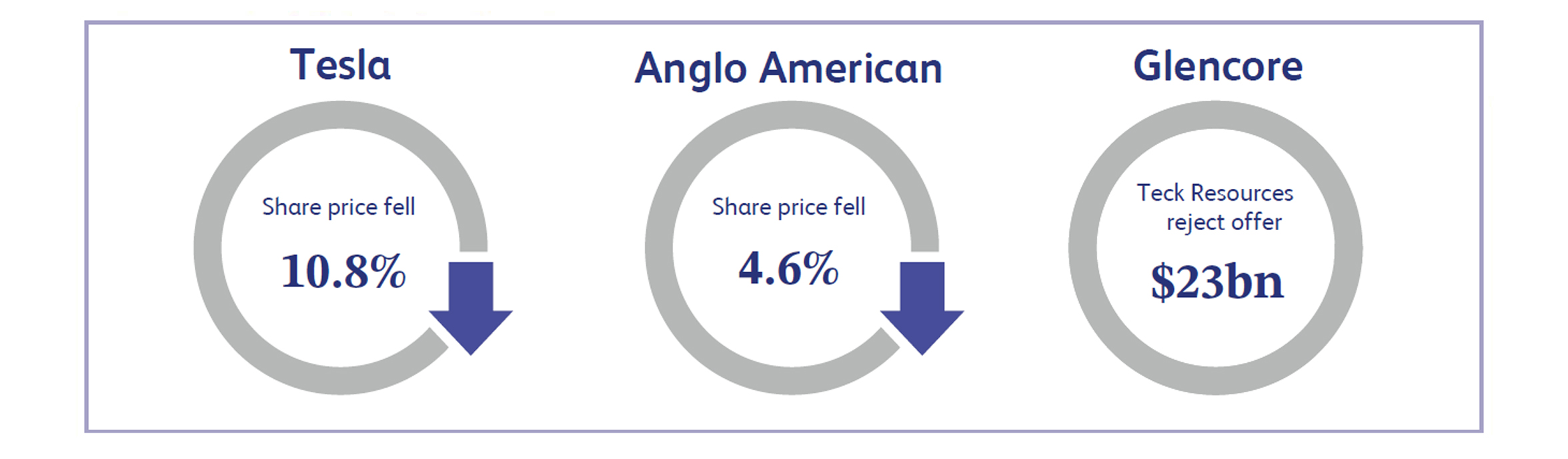

Tesla shares plummeted by approximately 10.8% last week as the company announced its first quarter earnings. This was largely due to gross margins dropping from 29.1% to 19.3% year-on-year as price cuts were a key theme for the first quarter. Tesla has implemented a short-term strategy of lowering prices in order to maintain high levels of demand and continue building the brand as the leading electric vehicle manufacturer. The company’s long-term strategy still remains to build the prices back up over time, but given the significant pressures within markets currently, Tesla aims to continue making its products affordable to consumers. The hope is that in time this will pay dividends by allowing Tesla to become the market leader in the electric vehicle manufacturing industry.

Anglo American shares fell 5.95% on Friday and were down approximately 4.6% for the week as miners had a tough week due to metal prices falling. The decline in copper prices was a key area of focus for miners as it has a significant impact on the revenues generated by miners throughout the year. It will be interesting to see whether this will be a continued trend over the coming months, but for now it appears to be a very short-term view.

Glencore announced that its trading business is on track for another strong year as a result of a strong quarter of energy trading. The company also recently offered to buy a Canadian mining rival Teck Resources for $23 billion, but Teck rejected the offer. This deal was intended to help Glencore become less reliant on coal and stock up on green energy fuelling metals such as copper and zinc. Glencore is still trying to bring Teck to the negotiating table, but time is beginning to run out as Teck is due to vote on its own spin-off plans later this week. Merger and acquisition activity within the industry is likely to pick up pace as some of the biggest commodity companies begin to prepare for life after fossil fuels.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.