27 June 2023

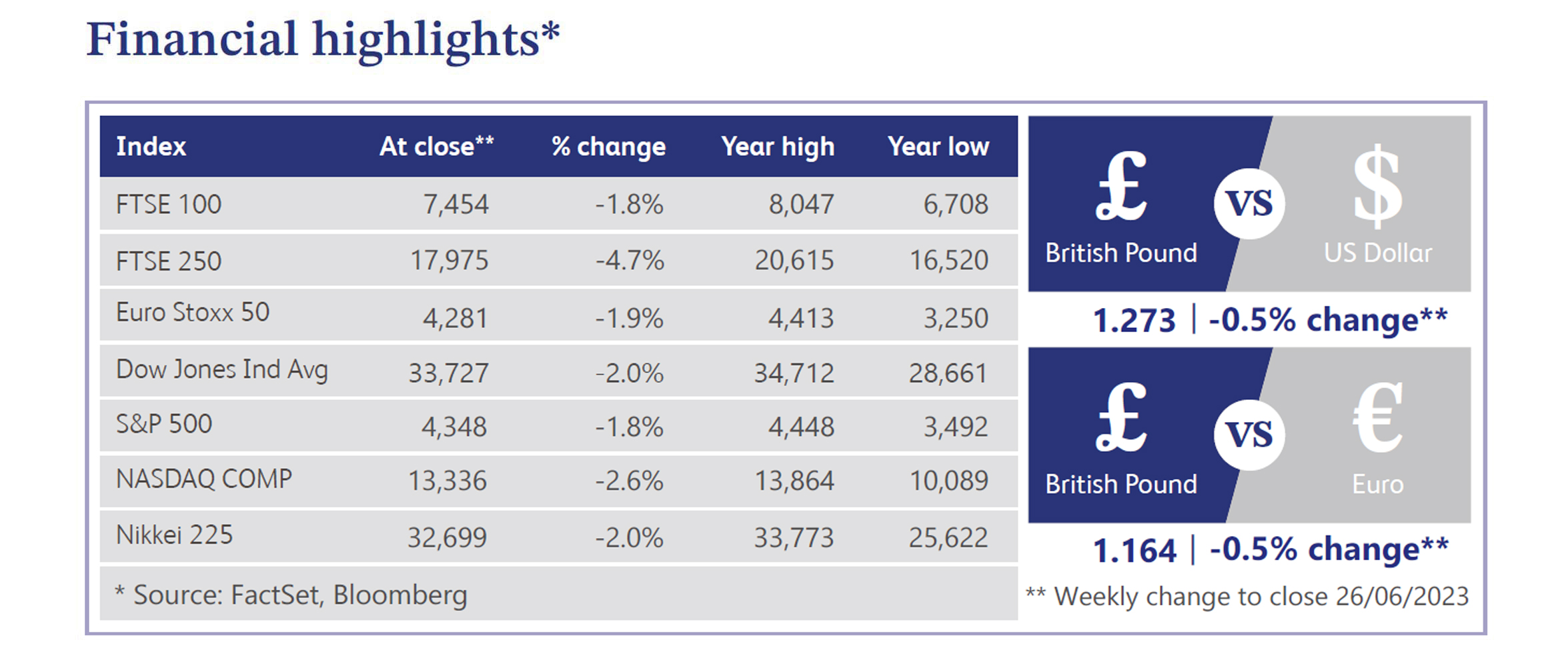

The beginning of last week saw investors and some sell-side economists speculating that market estimates for the Bank of England (“BoE”) rate outlook may have been too aggressive. At the start of the week, markets were pricing a peak rate close to 5.75% based on forecasts for inflation figures on Wednesday to decelerate to 8.4% from 8.7% in May. However, when Wednesday arrived, inflation figures unexpectedly rose to 8.7%. Inflation has now registered 22 months above the 2% target with expectations for any meaningful slowdown in inflation unlikely to arrive before July. This led gilts to come under pressure as the yield on two-year gilts increased by approximately 0.2%, firmly above 5%. The ten-year benchmark was more than 0.1% higher, just short of 4.5%, close to its highest levels since last October. This has resulted in the spread between two-year and ten-year gilts to be the most inverted it has been since 2000. Markets therefore anticipated an increased likelihood of more aggressive rate tightening, increasing the risk of a recession.

After the unexpected rise in inflation, the BoE raised interest rates by 0.5% on Thursday, resulting in the base rate increasing from 4.5% to 5%. Seven of the nine Monetary Policy Committee (“MPC”) members voted in favour of the increase, with the possibility of more tightening. The MPC members voting in favour of the hike stated that it was as a result of domestic price and wage developments, which were likely to take longer to unwind than they had done to emerge. The statement highlighted significant upside news in recent data that indicated more persistent inflation, against a backdrop of a tight labour market and continued resilience in demand. It is now expected that the BoE will focus its attention on official data rather than some of the forward-looking surveys, which have shown more encouraging price developments. A primary reason for the likelihood of further tightening is the BoE’s expectation that services inflation, or its core measure, will not ease until much later in the year. This has led markets to price in rates reaching 6% by the end of the year, with a 30% chance of rates hitting 6.25% by February 2024.

As a result of higher-than-expected inflation and interest rates, the cost of two-year fixed-rate mortgages rose to above 6%. In 2024 it is expected that approximately 1.6 million households will need to remortgage at higher rates. This has led to fears of mass defaults which would put pressure on both borrowers and lenders. However, mass repossessions appear to be relatively unlikely due to regulatory reform, embedded levels of equity and fixed rate mortgage deals. It is estimated that around two thirds of dwellings are owner-occupied, of which 28% are with a mortgage or a loan. An Institute for Fiscal Studies report stated that approximately 1.4 million mortgage holders will face a 20% hit to disposable income. This represents a relatively small cohort of households, despite the fears dominating headlines in recent weeks and months.

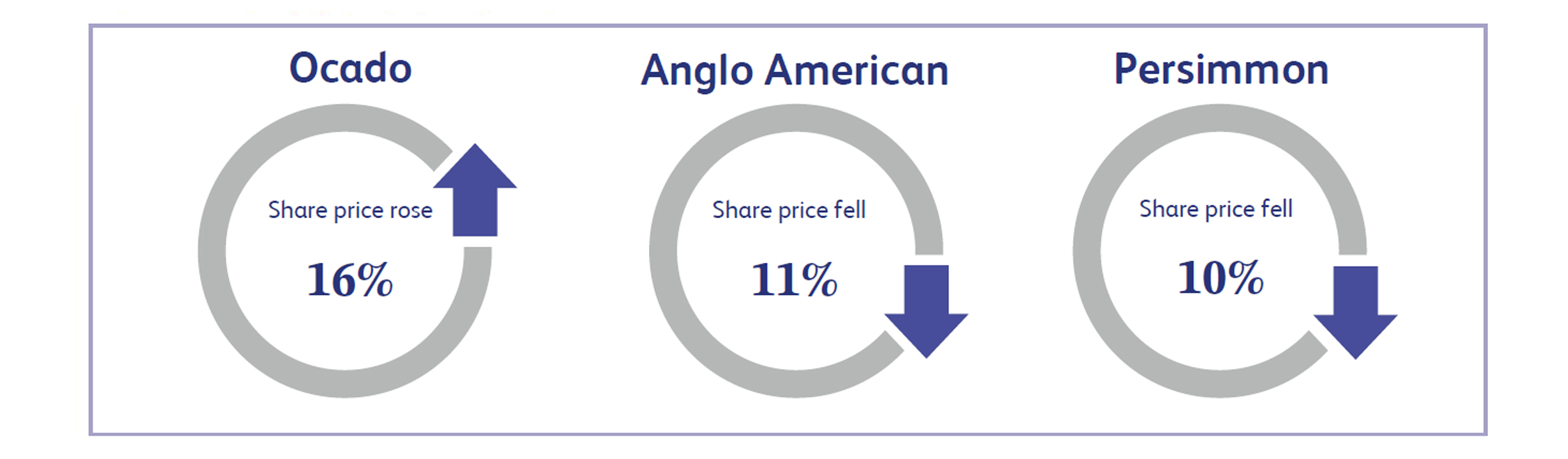

Ocado, the global technology-led software and robotics platform business with a strong retail heritage, saw its shares soar approximately 16% last week. This was due to a speculation that Ocado had gained the interest of Amazon and other tech heavyweights as a potential takeover target for approximately 800p per share. Shares were trading at approximately 450p prior to this and the price increased to approximately 530p on the news. The stock has fallen out of favour with many investors recently, as shares were trading down approximately 40% over the past 12 months. This has led to more attractive valuations for opportunistic investors who can utilise Ocado’s technology, even at a significant premium to the current trading price.

Anglo American, the global mining company, experienced a decline in its share price of approximately 11%. The company announced that provisional rough diamond sales of its De Beers subsidiary were lower than in previous years. The fifth sales cycle, out of ten for the year, saw sales of $450 million, down from $657 million in the previous year. This was also a fall from fourth cycle sales of 2023 which came in at $479 million. The slowdown in demand was cited to be the result of global macroeconomic challenges which continue to weigh on end-client sentiment.

Persimmon, the UK housebuilder, saw a decline in its share price of approximately 10% last week. Rising inflation and interest rates weighed on the housing sector due to the larger than anticipated rate hike by the Bank of England. This created a gloomier outlook across the sector and led to a downgrade of Persimmon by HSBC analysts.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.