25 July 2023

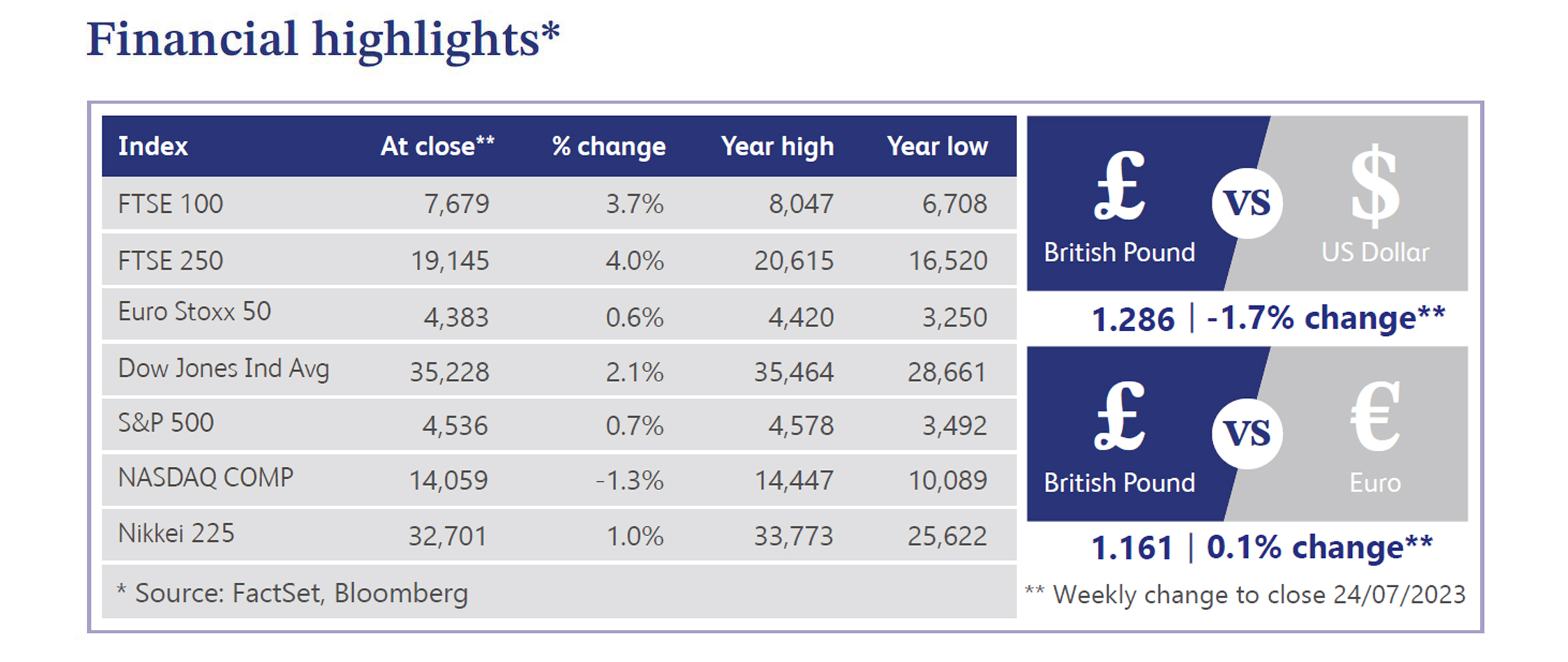

Inflation once again dominated the news in the UK last week as Office for National Statistics (“ONS”) figures showed headline inflation eased sharply in June to 7.9%. Core inflation also fell to 6.9% in June, versus consensus expectations of 7.1% and a prior reading of 7.1%. This is the lowest level of inflation since March 2022 with the ONS stating that falling motor fuel prices were one of the largest downward contributors, alongside no large offsetting upward contributions. The previous month’s inflation figures surprised to the upside and caused the Bank of England (“BoE”) to raise interest rates by 0.5% against an expectation of 0.25%, which led to markets increasing their peak rate expectations to 6.5%. The market therefore reacted positively to the June inflation figures as investors began to unwind their expectations of continued aggressive rate hikes by the BoE. Markets now anticipate the base rate to peak below 6%, which caused the FTSE 100 to rise more than 3% last week. It should be noted that the June figures are still high, but they have reinforced market expectations that the BoE is nearing the pivot point in the battle against inflation.

Other contributing factors to inflation falling included food and drink manufacturers cutting their prices in June for the first time in more than three years, according to a Lloyds Bank Survey. This was also supported by Kantar, the data market researcher, who reported an acceleration in the drop of UK food price inflation. Kantar stated that inflation fell to 14.9% in the four weeks to 9th July, down from 16.5% in the previous month. This is now the fourth month grocery inflation has fallen after hitting a high of 17.5% in March, with one of the biggest recent contributors being retailers boosting loyalty card deals. This data is a further positive development for the inflation outlook, although it is likely to take time to filter through to consumer prices.

Last week saw the publication of Deloitte’s quarterly CFO survey which showed that the biggest threat to the corporate outlook is higher interest rates. Sentiment among firms dipped in the second quarter after persistent high inflation led to further aggressive rate hikes by the BoE. Deloitte highlighted that credit is now more costly than at any other time since the global financial crisis in 2009. The survey also stated that CFO expectations for inflation in two years’ time have increased from 2.9% to 3.6%, indicating that inflation will remain above target for at least two years. Based on this expectation, survey participants expect revenues to rise over the next 12 months. However, profit margins are anticipated to continue decreasing as a result of cost pressures. Therefore, the biggest priority over the next 12 months for businesses is to reduce costs and seek to increase cash flow.

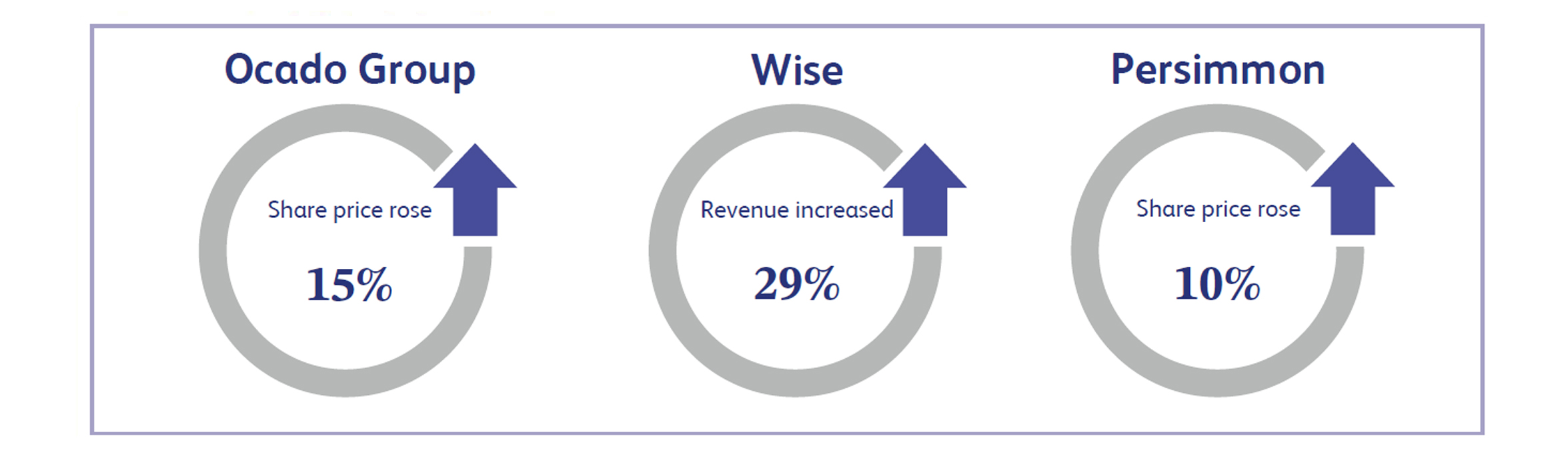

Ocado Group, the UK based technology-led software and robotics platform business, saw its share price soar by approximately 15% after announcing first half earnings. One of the main positive takeaways from the results was that Ocado has been delivering on its promise of reducing its cash burn. The company also announced that group revenue grew by 9% year on year, with its Technology Solutions division seeing revenue increase by 59% year on year. Investors viewed this announcement positively and believe that the company is well positioned to deliver on its long-term objectives.

Wise, the UK based global technology company, announced its first quarter results last week which showed a good start to the year, leading to its share price increasing by approximately 12%. Wise announced a 33% year on year increase in its quarterly active customers to 6.7 million, driven by strong customer retention and customer acquisition primarily through word of mouth. The company’s revenue also increased by 29% year on year to £240 million, alongside volumes increasing by 16% to £28.2 billion driven by the continued growth in active customers.

Persimmon, the UK based housebuilder, saw its share price surge by approximately 10% last week as better than expected UK inflation figures provided positive news for the UK housebuilding sector. Persistent high inflation and rising interest rates have led to increasing pain for home buyers as well as construction companies and any businesses linked with the sector due to the increased cost of capital. The easing of inflation has led to expectations that the UK is approaching the pivot to cut rates, which should open up the housing market.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.