15 August 2023

Bank of England (“BoE”) chief economist, Huw Pill, said last week that UK inflation remains too high and too persistent, especially as food prices may not decline in the short term. Pill stated that food price inflation may decline to 10% this year, but actual disinflation in food prices may not occur for some time after this. The BoE now forecasts that inflation will decline to 5% by the end of this year, but will not drop to the 2% target until the second quarter of 2025. Pill commented that higher and persistent inflation in the UK is mostly to do with higher imported goods prices and stressed that much of the monetary policy tightening has yet to impact the economy. However, there are signs that recent rate rises are working through the economy as inflation is falling and the labour market is cooling. The BoE remains committed to monitoring economic data and will continue with monetary tightening until it sees a further slowdown in inflation, but there is increasing optimism that we may be approaching the pivot point after fourteen consecutive rate rises.

The National Institute of Economic and Social Research (“NIESR”) published research last week which detailed that there is an approximate 60% chance of a recession in the UK by the end of 2024 due to higher interest rates putting pressure on families and businesses. The NIESR also sees the UK economy remaining at pre-pandemic levels until 2027 and expects house prices to fall for three years in a row. Forecasts also suggested that real wages are expected to be below pre-pandemic levels by the end of 2024 in many regions within the UK, particularly in the East of England, South-East and West Midlands. The publication also stated that one further 0.25% increase in the base rate is expected, resulting in a peak base rate of 5.50%.

Despite this, Bloomberg data showed that wages in the UK are on the verge of growing faster than prices for the first time in almost two years. This should provide relief to households which have been under pressure as a result of the cost of living crisis. Inflation is now forecast to fall to 6.8% in July as a result of the energy regulator cutting the maximum amount that households pay for gas and electricity, allowing wages to outpace inflation for the first time since September 2021. However, the housing market experienced the most widespread fall in prices since 2009 last month due to interest rates hitting a 15-year high, alongside rents surging at the fastest rate since 1999. A report from Nationwide recently stated that average house prices in July were 3.8% lower than a year earlier, although house prices remain over 20% higher than before the pandemic.

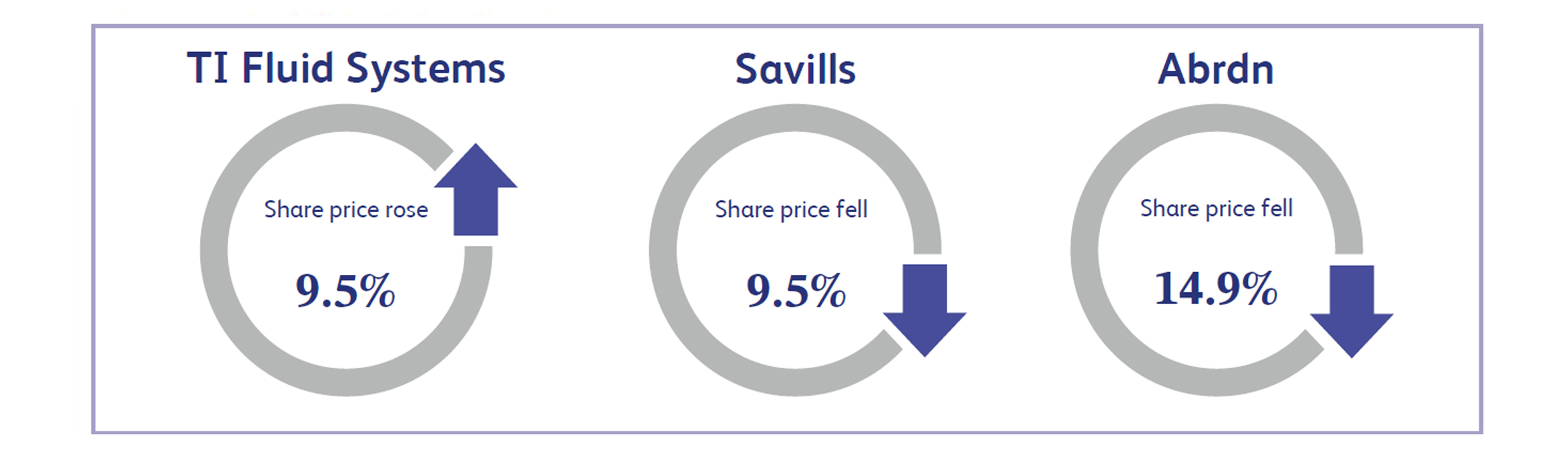

TI Fluid Systems, the UK based manufacturer of engineered automotive fluid storage, carrying, delivery and thermal management systems for light vehicles, saw its share price increase by approximately 9.5% last week after announcing its first half results. The company raised its 2023 guidance and changed its dividend policy to target progressive annual growth to increase shareholder payouts. The new dividend policy aims to return €35 million to shareholders in 2023, increasing from €13 million previously.

Savills, the UK based global real estate services company, announced its first half figures last week which saw its share price decline approximately 9.5%. This came as interim profits fell sharply to £16 million against an expected £59 million as lower activity due to rising interest rates hit the business hard. The biggest hit was experienced in transaction activities which declined to a £17 million loss compared to £23 million in profit the previous year. The company also lowered its guidance, largely as Europe and China are anticipated to remain difficult markets for the rest of the year.

Abrdn, the UK based investment company, experienced an approximate 14.9% drop in its share price last week after announcing larger than expected outflows in its first half earnings which disappointed investors. The company’s assets under management were £495.7 billion, below the consensus estimate of £500 billion, with £4.4 billion of net outflows compared to an estimated £2.6 billion. The company also announced that its share buyback has been increased to £300 million from £150 million, but this was in line with previous commitments.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.