6 January 2026

UK markets endured a cautious week as fresh data reinforced concerns about a softening economic backdrop and limited policy headroom. Surveys of economists pointed to a deteriorating labour market outlook, with unemployment expected to rise toward 5–5.5% by the end of 2026 amid weak growth and slowing wage momentum. Business sentiment also weakened, with a British Chambers of Commerce survey showing fewer firms expecting turnover growth and rising concern around tax and inflation pressures. Consumer behaviour remained subdued with KPMG and Barclaycard data highlighting reluctance to spend heading into 2026, with the first annual decline in card spending in five years. Manufacturing data offered some relief, with the Purchasing Managers’ Index (“PMI”) revised slightly lower but still at a 15-month-high, though growth remained skewed toward larger firms and exports continued to contract.

Fiscal uncertainty continued to dominate the UK narrative. Economists surveyed by the FT broadly expect further tax rises before the next election, reflecting structurally weak growth, rising health and defence spending, and limited fiscal flexibility. Business groups criticised recent budget measures, warning that higher national insurance costs, minimum wage increases and changes to salary sacrifice schemes would constrain investment and undermine productivity. These concerns were reinforced by Office for National Statistics (“ONS”) data showing the UK has attracted the lowest level of investment in the G7 in 2025, exacerbating long-standing productivity challenges. While some firms plan to increase artificial intelligence investment, confidence that fiscal policy will meaningfully lower the cost of doing business remains low.

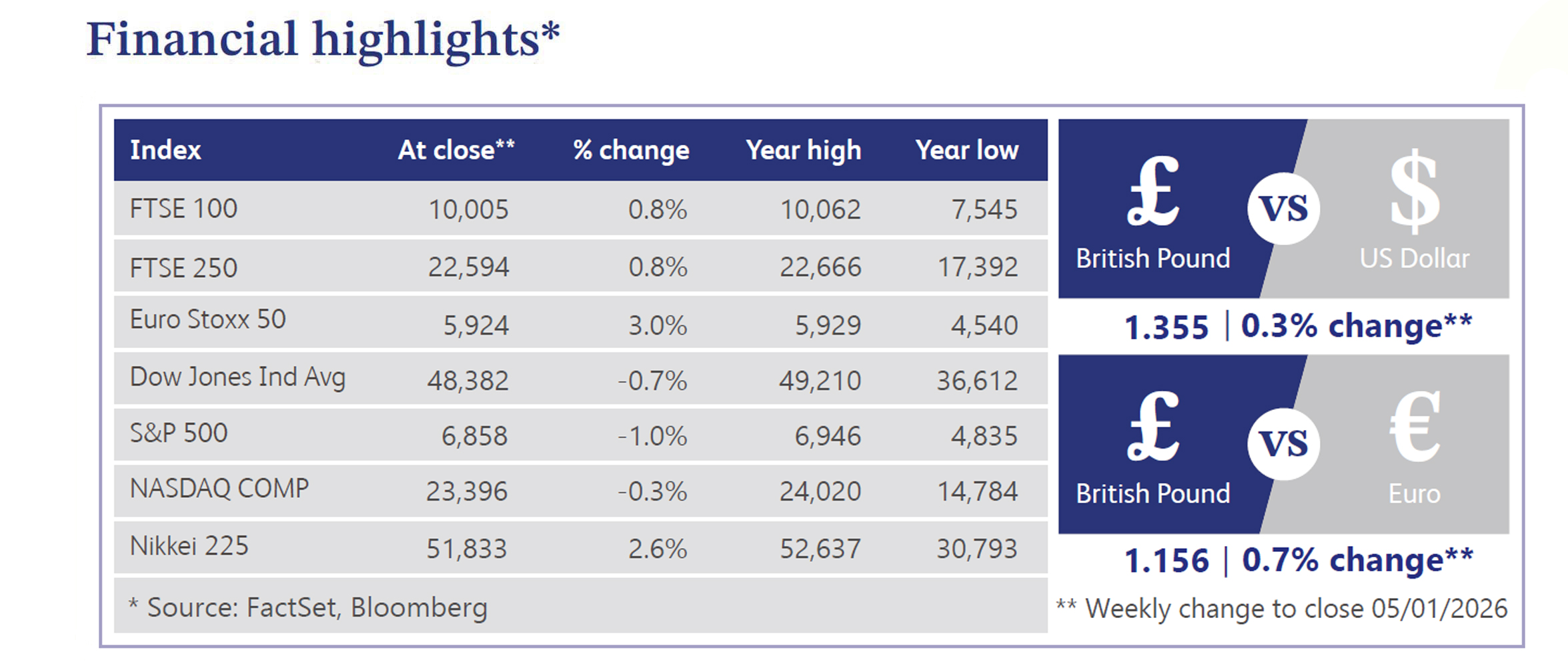

UK markets reflected this fragile backdrop. Equity sentiment stayed subdued as investors weighed weak growth prospects against persistent fiscal risks, while gilt markets remained sensitive to medium-term borrowing dynamics. Sterling traded defensively as markets assessed the outlook for growth, rates and fiscal sustainability.

Across the Atlantic, US equities finished the week lower, with much of the discussion centred on the failure of a seasonal rally rather than a single macro shock. The Federal Open Market Committee (“FOMC”) December minutes reinforced expectations for cautious, gradual easing in 2026, while housing data surprised modestly to the upside and weekly jobless claims eased. Sector performance was uneven, with defensives, utilities, energy and metals outperforming, while consumer-facing sectors, small caps, banks and software lagged. Treasuries firmed with some curve steepening, the dollar strengthened modestly, and precious metals pulled back sharply. Geopolitics added another layer of uncertainty following the US capture of Venezuelan President Nicolás Maduro. Markets focused on implications for energy, though oil prices rose only modestly given Venezuela’s diminished production capacity, structural challenges and political instability. The episode heightened broader geopolitical risk, adding to an already complex global backdrop.

UK housing data remained soft. Mortgage approvals eased slightly, pointing to resilient but cooling demand, while Nationwide data showed house prices falling 0.4% in December after a prior increase, underscoring a market constrained by affordability pressures and policy uncertainty rather than outright stress.

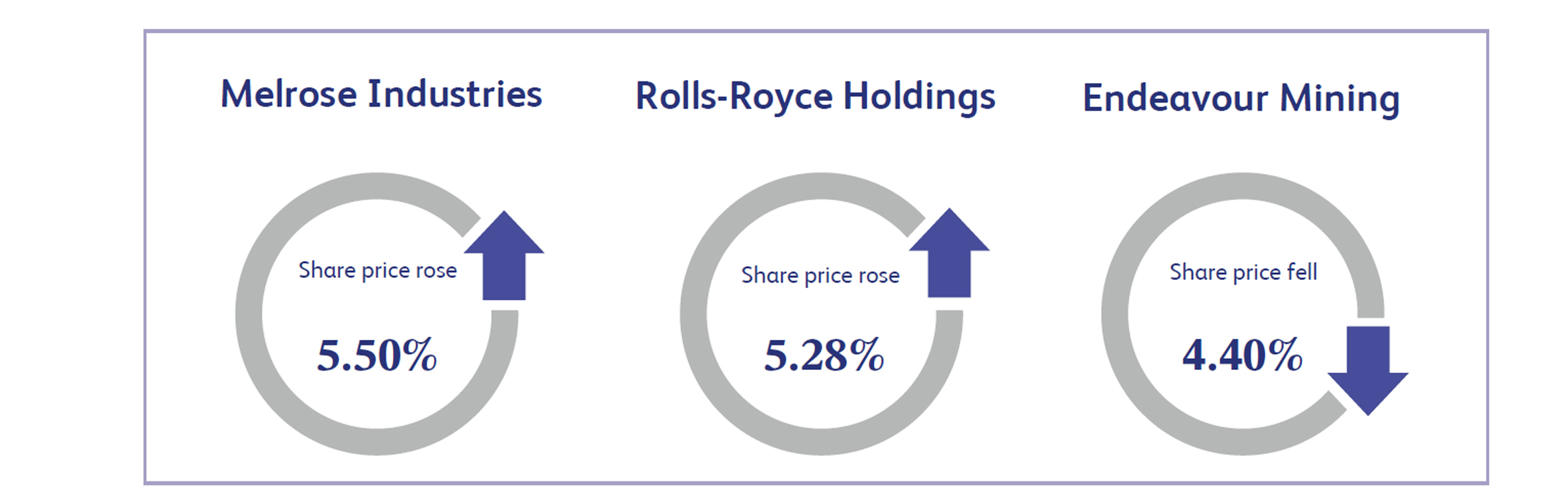

Melrose Industries, an aerospace manufacturing group focused on civil and defence engines and structures, led the FTSE 100, gaining 5.5%. The company's shares advanced, driven by investor confidence in a forthcoming "golden age" of aftermarket revenue. Industry analysts praised the firm's strategic focus on high-margin maintenance contracts and its growing military order book, positioning it as a key winner from sustained aviation recovery and the elevated geopolitical tension expected in 2026. However, the rally's momentum was tempered by persistent industry-wide worries over the fragility of the supply chain. This remains the most significant obstacle preventing the conversion of the record backlog into reliable free cash flow.

Rolls-Royce Holdings, the renowned British engineering group delivering power systems for the civil aerospace, defence and nuclear markets, gained 5.28% last week as it extended its multi-year rally into the new year. The stock was ignited by fresh optimism surrounding its nuclear division, following confirmation that its Small Modular Reactor design has secured preferred bidder status for key government projects. This nuclear narrative, combined with data showing civil widebody flying hours finally eclipsing 2019 levels, has reinforced investor confidence in the group's upgraded free cash flow targets.

Endeavour Mining, the largest gold producer in West Africa with key operations across Senegal, Côte d'Ivoire and Burkina Faso, fell 4.4% to finish as the week’s worst performer. Following a period of fervent buying, the stock succumbed to a wave of profit-taking as the underlying gold price retreated from its recent historic highs, prompting investors to lock in gains. The sell-off was exacerbated by a slight pivot in sentiment, as the market briefly turned its attention back to the geopolitical risk premium inherent in the region, overshadowing the company's otherwise solid production fundamentals.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management's own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority (FRN:226344) and is a member of the London Stock Exchange. Registered office: 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.