22 August 2023

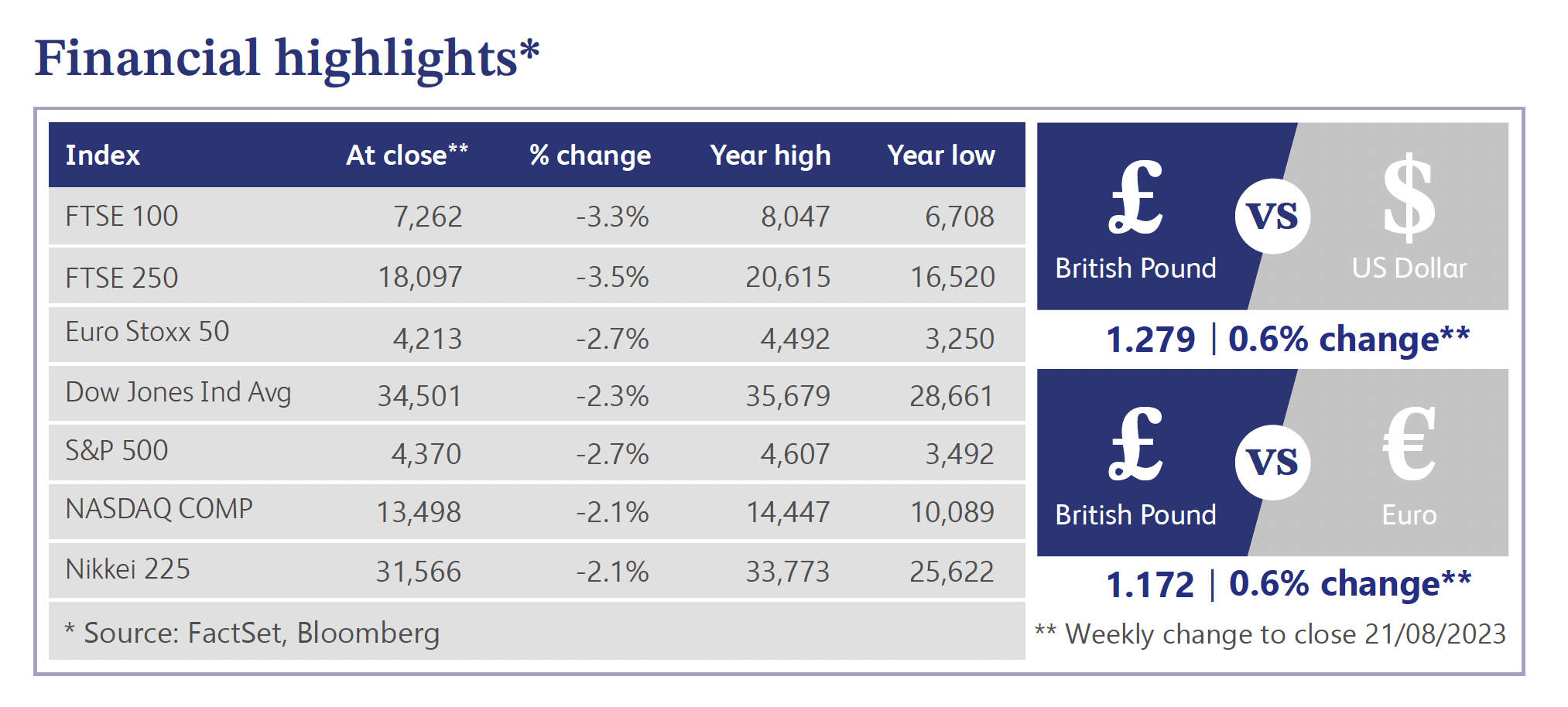

It was announced last week that inflation in July had eased to 6.8% from the previous reading of 7.9% in June. Falling gas and electricity prices were amongst the largest downward contributions, alongside easing in food price inflation. The headline figures appeared to be encouraging, however, core inflation remained unchanged from June at 6.9% and services inflation rose from 7.2% to 7.4%. Last week also saw a record jump in wages, which when coupled with the disappointing core and services inflation figures, is likely to reinforce market expectations for a further Bank of England (“BoE”) interest rate hike in September. Markets currently anticipate another 0.25% increase, which would take the base rate to 5.50%, although some economists have warned over the possibility of a larger increase. It should be noted that the BoE has previously mentioned that core and services inflation would take longer to ease, meaning the more resilient inflation figures than previous BoE projections should not be too much of a shock. Markets are still anticipating that the BoE will keep rates higher for longer and are currently forecasting a peak rate of 6%.

Last week also saw Bloomberg report that British wages are currently on track to rise at a faster rate than inflation for the first time in 19 months as a result of the sharp decline in headline inflation in July. This should provide some long-awaited respite for UK households as the cost of living crisis continues to impact household budgets. Analysis by Cornwall Insight predicts that when Ofgem announces a new official price cap this week, energy bills for the average household are expected to fall by a further 7%, reducing the typical household energy bill to £1,926 a year. This drop in energy prices is a welcome development, however, Cornwall Insight also warned that this decline is slightly less than anticipated and long-term forecasts suggest prices will continue to stay high for the rest of the decade.

Research by Hamptons, a UK estate agent, showed that more landlords are looking to sell their properties, even if it means losing money due to falling house prices, rising mortgage rates and savings accounts that offer better returns than buy-to-let mortgages. Hamptons reported that 6% of landlords sold for less than they bought, compared to 5% last year. It was also reported that approximately 35,000 landlords are coming to the end of the fixed period on their fixed rate mortgages each month. This may lead to an acceleration in the number of landlords exiting the market. Despite this, the Office for National Statistics reported that UK house prices increased by 1.7% in the 12 months to June, although this was the smallest rise since July 2020.

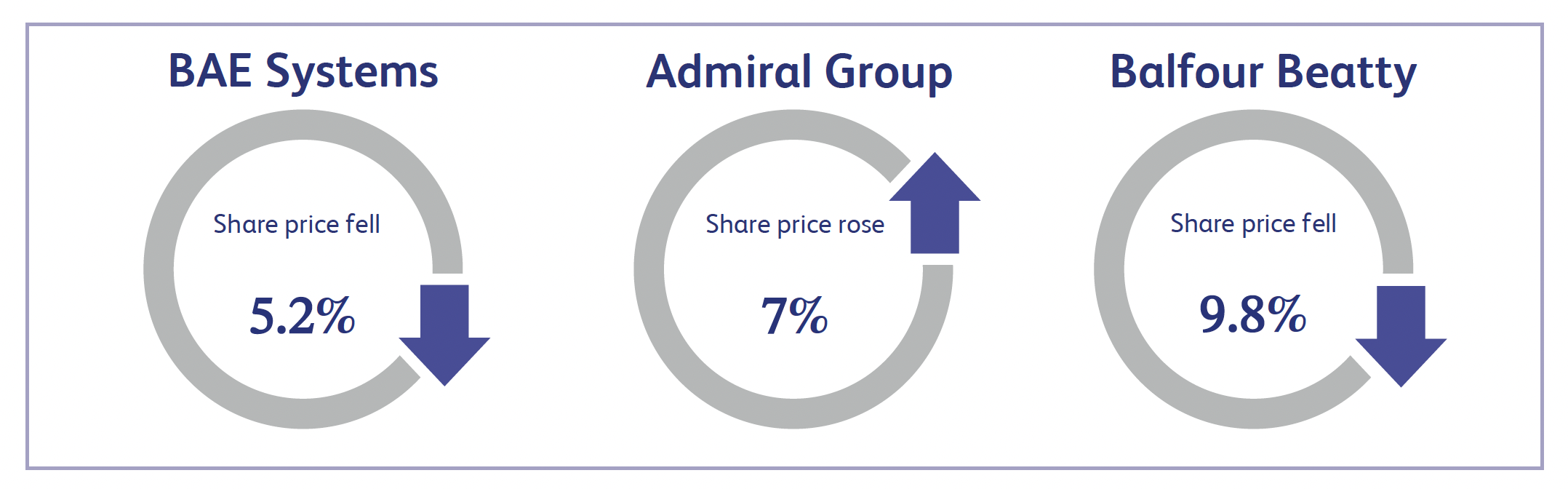

BAE Systems, the defence, aerospace and security company, announced it has agreed to purchase Ball Corporation’s aerospace business for approximately $5.55 billion in cash. The company said that it entered into a definitive agreement to purchase the unit, which manufactures instruments and sensors for everything from space travel to weather forecasting. The acquisition is expected to add to BAE’s earnings per share and margins in the first year following completion. The unit is also expected to generate approximately $2.2 billion in revenue this year. BAE shares dropped by approximately 5.2% last week as a result of the news with investors viewing the deal as expensive.

Admiral Group, the UK based financial services company, saw its share price increase by approximately 7% last week after announcing its first half results. The company reported that pre-tax profit for the first half of the year had increased to approximately £233.9 million, compared to approximately £224.6 million a year earlier. Revenue for Admiral also increased to £2.2 billion compared to £1.8 billion in the previous year.

Balfour Beatty, the UK based international infrastructure company, announced its first half results last week which sent its share price plummeting by approximately 9.8%. The company announced that profit for the first half decreased to £74 million compared with £80 million a year ago, whilst revenue increased to £4.5 billion compared to £4.1 billion in the previous year. Investors generally viewed the results unfavourably due to the decline in profit and challenging economic outlook, resulting in a decrease in the company’s share price.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.