9 April 2024

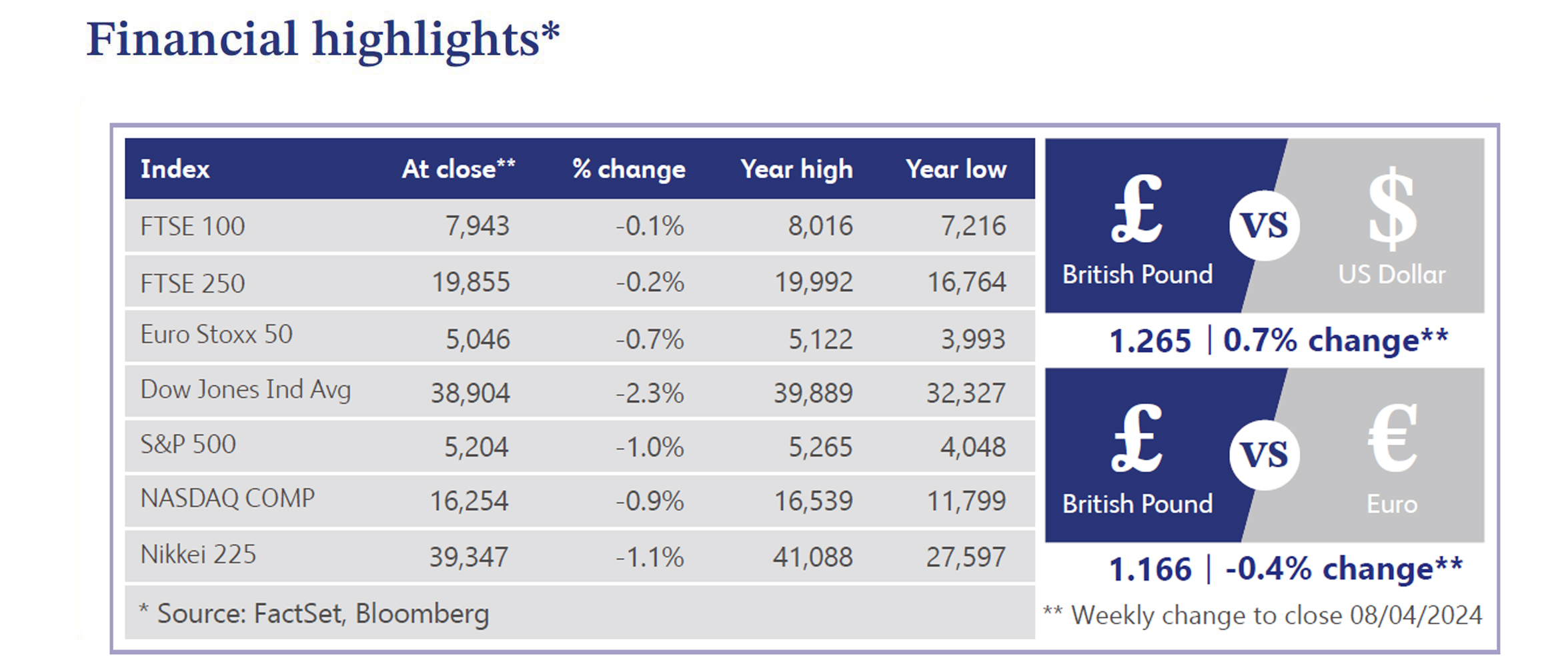

Amidst evolving economic indicators and shifting market sentiments, the Bank of England's ("BOE") latest Decision Maker Panel survey indicates a moderation in both inflation and wage forecasts. The survey highlights a decline in year-ahead own price inflation to 4.1% in the three months to March, down from 4.3% in February, suggesting a slight easing in price pressures. Similarly, one-year ahead Consumer Price Index ("CPI") declined to 3.2% from 3.3%, while three-year ahead CPI stood at 2.7% versus the previous 2.8%, indicating a tempered inflation outlook. Moreover, the survey reports a year-ahead wage growth of 4.9% on a three-month moving average basis, coupled with an annual wage growth of 6.4% in March, reflecting a gradual slowdown in wage growth momentum.

While the UK economy continues its recovery trajectory, the pace appears to have eased slightly, particularly within the services sector. The final services sector Purchasing Managers' Index ("PMI") for March came in at 53.1, slightly below the estimate of 53.4, indicating a modest upturn in activity. However, this moderation leaves the composite reading at 52.8, below February's nine-month high of 53.0. Despite this, the rise in new work remains somewhat weaker compared to February, while the rate of prices charged has eased to its lowest in six months, despite persistent input cost pressures.

In parallel, recent research from the BOE’s research portal highlights a reduction in debt levels within the UK economy, signalling a response to higher rates by households and corporates. The winding down of pandemic-built deposits and a decrease in debt accumulation indicate a cautious approach amidst evolving economic conditions. However, concerns loom over potential ramifications, with investment bank Peel Hunt warning of a potential exodus of firms from the UK equity market. The prevailing low valuations may incentivise larger buyers to take advantage, exacerbating the ongoing trend away from equities.

Furthermore, market observations reveal a contrasting picture in the UK's capital markets, with the UK equity market falling further behind its peers. Consultancy firm PwC's figures underscore a growing discrepancy, highlighting a preference for domestic firms to choose their own markets, with London trailing behind. Despite these challenges, business-to-business firm Calastone’s data shows record flows in equity funds in the first quarter of 2024, indicating investor confidence in the asset class. There was, however, a notable divergence between UK-focused and North American funds.

On the retail front, UK shop price inflation has slowed sharply, reaching its lowest level in over two years, driven by a decline in food prices. While this has boosted supermarket sales, the retail sector continues to grapple with challenges, as evidenced by a consecutive drop in total in-store and online sales. Footfall remains soft, with adverse weather conditions and the early Easter weekend contributing to subdued consumer confidence.

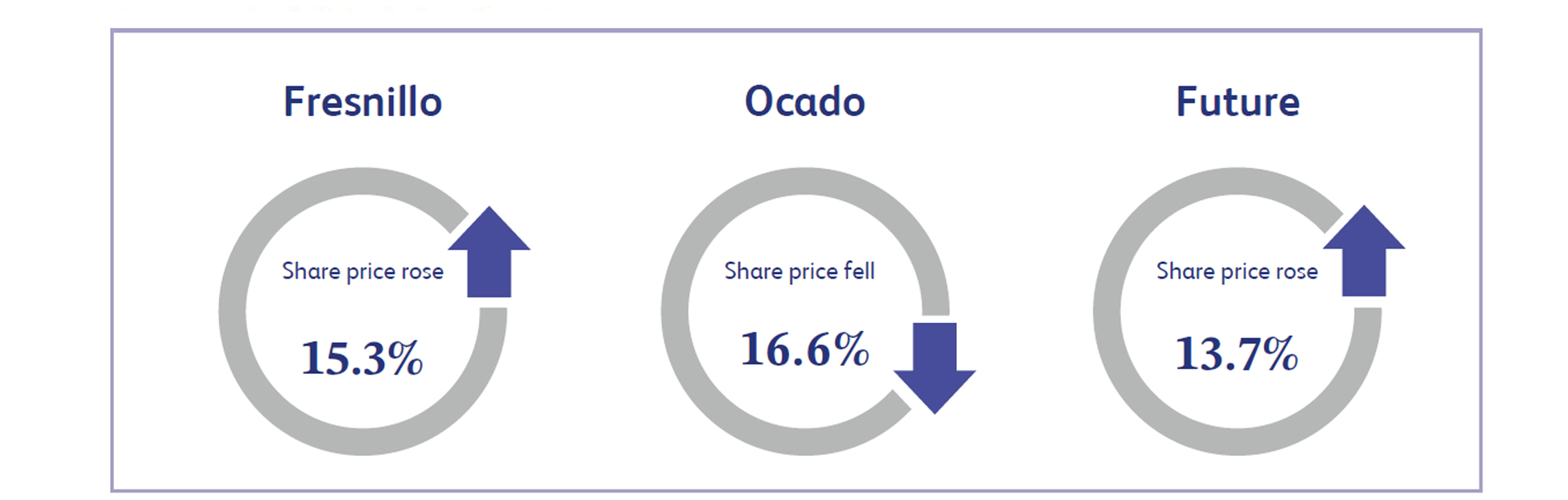

Fresnillo, the Mexican precious metals company specialising in the mining, beneficiation and sales of non-ferrous minerals and production, saw its share price increase approximately 15.3% last week. This largely came as a result of gold trading near recent all time highs as investors take a cautious approach with persistent economic challenges. Analysts noted how gold rallied following the termination of past rate hike cycles alongside continued strength as rate cuts ensued. Central banks have also been purchasing record amounts of gold since 2022, with China being the largest buyer adding 225 tonnes in 2023. Analysts noted a cheap valuation for Fresnillo, contributing to a bullish sentiment towards the share price.

Ocado, the UK based online grocer, witnessed its share price plummet by approximately 16.6% last week. The company announced that its Chair, Rick Haythornthwaite, will not seek re-election to the Ocado board in a year's time. This is as a result of Haythornthwaite’s recent appointment as the Group Chair of NatWest Group, which has seen an increase in his time commitment. Haythornthwaite stated that Ocado has a strong and stable board, a high quality management team and good momentum in the business performance alongside having sufficient time for a measured Chair succession. Investors appeared to view the announcement negatively, resulting in the declining share price for the week.

Future, a UK based company engaged in providing a global platform for specialist media, announced its latest trading statement last week which saw its share price close the week approximately 13.7% higher. The company announced that there was a return to organic revenue growth in the second quarter. The return to growth was largely driven by strong performance in Go Compare, alongside good growth in its business-to-business segment and resilient performance in its magazines segment. The company therefore announced that it is on track to deliver on its full year 2024 expectations, increasing investor sentiment regarding the shares.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management's own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority (FRN:226344) and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.