9 July 2024

Recent updates indicate an optimistic shift in the UK economy. KPMG has revised its gross domestic product growth forecast for 2024 from 0.3% to 0.5% and projects 0.9% growth for 2025. This is supported by anticipated Bank of England (“BoE”) rate cuts, potentially reducing the bank rate to 3% next year. This economic boost is further aided by political certainty due to expected fiscal policy changes under a Labour government.

A BoE survey indicates moderate inflation expectations with one-year inflation projections down to 2.8% and wage growth expectations for the coming year decreasing to 4.3%. These developments signal cautious optimism of a steady recovery for the UK market. In the US, expectations for a September Federal Reserve (“Fed”) rate cut increased due to cooling inflation and weaker labour market data, supported by dovish comments from the Fed Chair Jerome Powell. These factors led to a Treasuries rally, reversing the prior sell-off.

In May, British consumers increased their borrowing by £1.5 billion, the highest in four months, reflecting a rise in consumer spending. The S&P global manufacturing Purchasing Managers Index (“PMI”) for June was revised down to 50.9 from 51.4, indicating slower growth. Meanwhile, the services sector PMI was revised up to 52.1, although it still represented a seven-month low. Despite these mixed economic signals, UK investors displayed strong interest in equity funds, investing a record £11 billion in the first half of the year, with a continued significant focus on North American and global markets.

Labour's landslide victory is expected to foster closer EU ties, political stability and fiscal responsibility, resulting in a positive market reaction. The FTSE 100 and FTSE 250 indices saw strong gains, while sterling experienced its longest winning streak in four years. In the US, political uncertainty following the Biden debate fallout and rising Trump re-election odds have heightened Treasury market volatility. Despite these concerns, US stocks rebounded strongly, with the S&P 500 and Nasdaq hitting new record highs. Big tech, including Tesla (+27.1%), led the market, reaffirming investor confidence amid persistent global economic challenges and geopolitical tensions.

UK house prices showed resilience in June, with the Nationwide UK house price index rising by 0.2%. Prices climbed 1.5% from 1.3% the previous year, and are now only 3% below their peak in summer 2022. Nationwide noted that housing market activity has remained subdued over the past year, with total transactions down approximately 15% compared to 2019 levels. Affordability remains a concern, as higher mortgage rates have offset gains in earnings growth in recent years. Meanwhile, BoE data for May showed net mortgage approvals slightly below expectations and indicating a summer slowdown in the housing market.

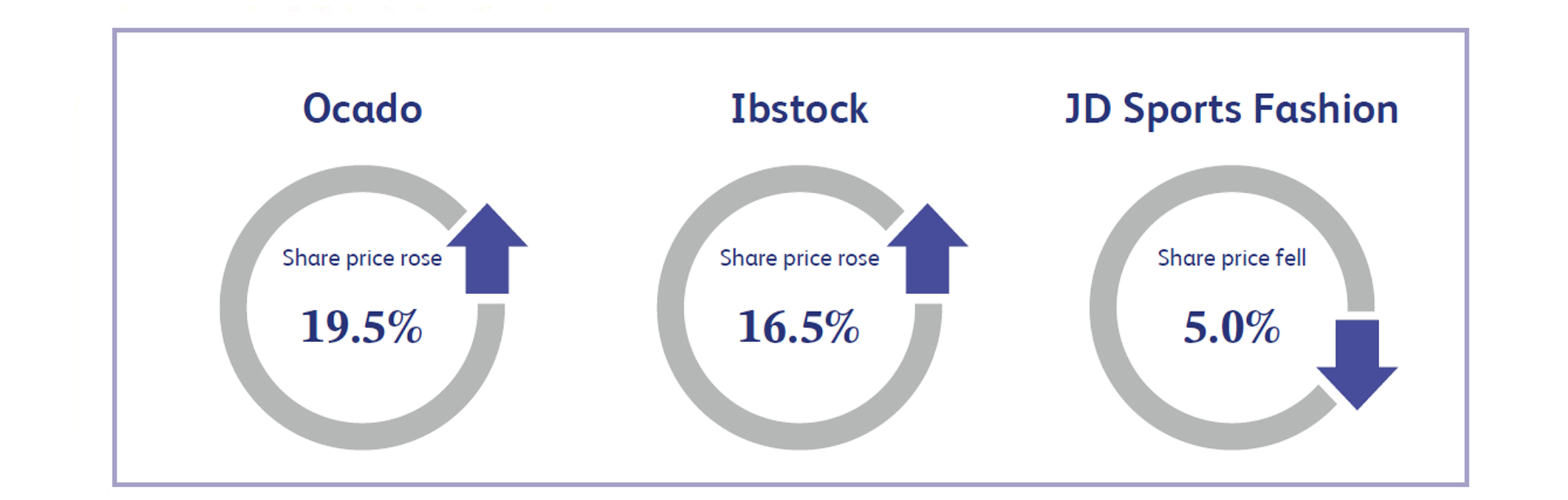

Ocado, the UK-based online grocery retailer, saw its share price surge approximately 19.5% last week. The company’s share price rose after Ocado and AEON announced the continued expansion of their partnership, with plans to construct a third customer fulfilment centre in Kuki-Miyashiro, Japan. In addition to the network expansion, AEON will also upgrade its live operations with the latest Ocado technologies including On-Grid Robotic Pick. This will bring increasing levels of labour productivity to AEON's operations.

Ibstock, a British manufacturer of clay bricks and concrete products, saw its share price rise by 16.5% last week following Labour's victory. Labour is likely to put housing near the top of its governing agenda and has already pledged to ‘get Britain building again’. This is potentially good news for companies involved in the provision of materials to the property sector and for housebuilders. Predicting the shape and speed of the housing market recovery in the next couple of years, Ibstock continues to be one of the businesses most operationally geared towards a pick-up in volumes.

JD Sports Fashion, the UK sports-fashion retailer, saw a share price decline of 5% last week after major financial institutions downgraded brokerage ratings. Forecasts for a surprise drop in Nike’s annual sales amplified investor concerns about the pace of the sportswear giant's efforts to stem market share losses to upstart brands such as On and Hoka. The downgrade was prompted by Nike's weak fourth quarter, given the brand represents around 50% of JD’s revenue exposure.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority (FRN:226344) and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.