15 October 2024

The UK economy returned to growth, expanding by 0.2% after two months of stagnation, according to reports from The Times, Reuters and Bloomberg. This growth was driven by strong rebounds in manufacturing and construction, despite weaker-than-expected growth in the services sector. Retail sales showed resilience, rising 2% in September, the fastest in six months, as retailers geared up for the Christmas season. However, concerns remain as the British Chambers of Commerce reported declining business confidence, driven by fears of tax hikes in the Labour government's upcoming autumn budget and geopolitical uncertainties. Meanwhile, Kantar data highlighted renewed pressure on consumer budgets, while prices fell for household and pet products. The economic outlook remains mixed as businesses and consumers navigate these challenges.

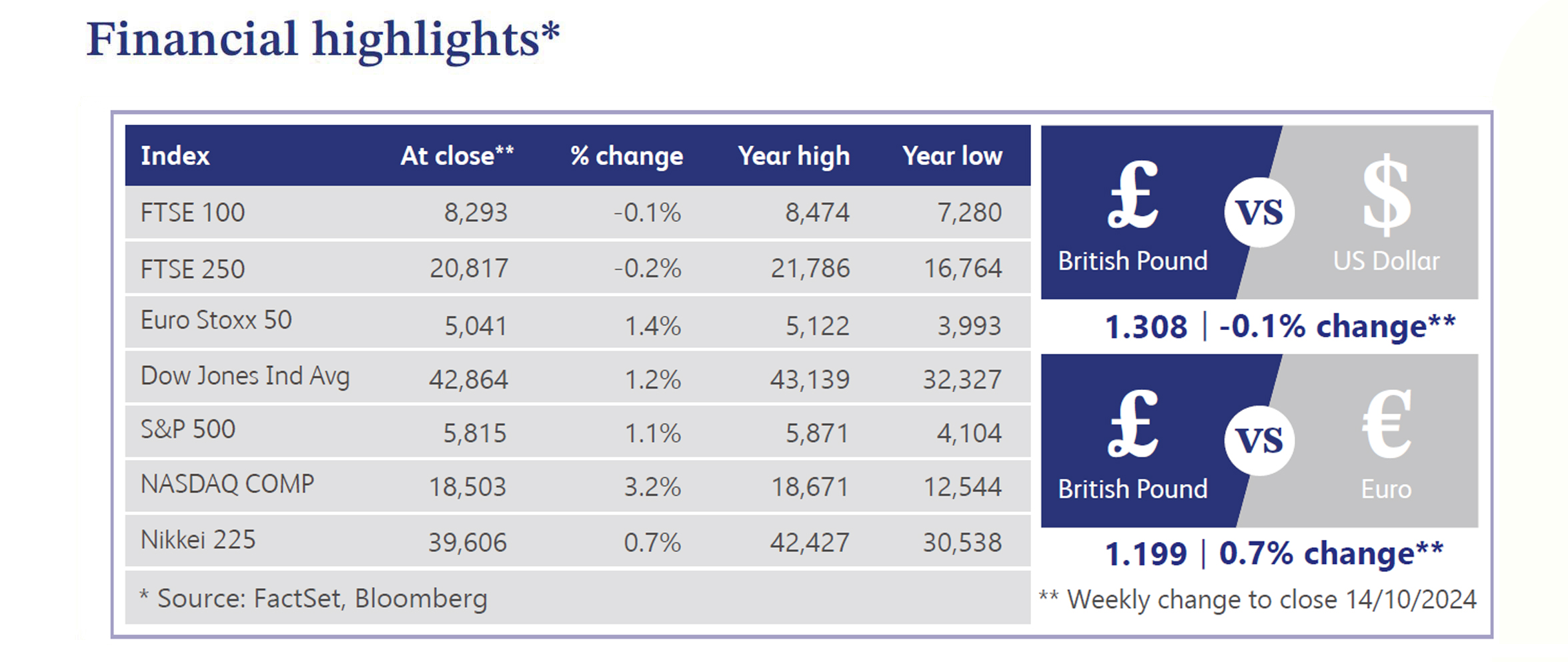

Last week, Chancellor Rachel Reeves' upcoming budget dominated discussions, with her approach to a £22 billion fiscal shortfall under scrutiny. Emphasising a strategy to "invest, invest, invest" while managing borrowing, Reeves faced pressure from the Institute for Fiscal Studies for introducing reforms to capital gains tax and demands for clearer tax policies from the Confederation of Business Industry. Meanwhile, Labour is reconsidering a planned tax increase on private equity, following concerns that it might generate less revenue than anticipated. Speculation also swirled around a potential hike in employer National Insurance contributions and efforts to attract foreign investment, amid economic uncertainty. The Conservative leadership race, with a shift toward more right-leaning policies, adds another layer of complexity. UK borrowing costs rose sharply last week as concerns about budget and persistent inflation pushed yields higher, widening the gap with Germany to its largest in over a year. Simultaneously, the pound faced pressure after dovish comments from Bank of England (“BoE”) Governor Andrew Bailey, with markets anticipating faster rate cuts. This shift has dented investor confidence in sterling, marking a potential turning point after its recent strength, as economic uncertainty around the upcoming budget continues to weigh on sentiment. As a result, Reeves’ budget is seen as a crucial inflection point, with significant implications for the UK’s economic direction, investor confidence and the broader business environment.

US equities advanced last week, with the S&P and Nasdaq logging their fifth consecutive week of gains and the S&P reaching a new all-time high. US Federal Reserve commentary was generally consistent, keeping expectations for a 0.25% interest rate cut in November intact. Inflation data showed slight increases, while earnings season kicked off with promising bank reports and expectations for third quarter earnings growth exceeding initial forecasts. Despite optimism around a soft/no-landing scenario, concerns linger about economic resilience potentially due to slowing rate cuts, extended valuations and geopolitical risks, including the upcoming US presidential election.

UK house prices rose for the third consecutive month in September, driven by cheaper mortgages and rising incomes, according to Halifax. The Royal Institute of Chartered Surveyors also reported a stronger property market, showing the first growth in prices and sales in two years, though rental sector pressures remain high. However, the BoE’s Credit Conditions Survey highlighted that UK lenders expect mortgage default rates to increase through November. Also, rising government borrowing costs have led Barclays to raise rates on some fixed mortgage deals, reflecting broader challenges in the lending market.

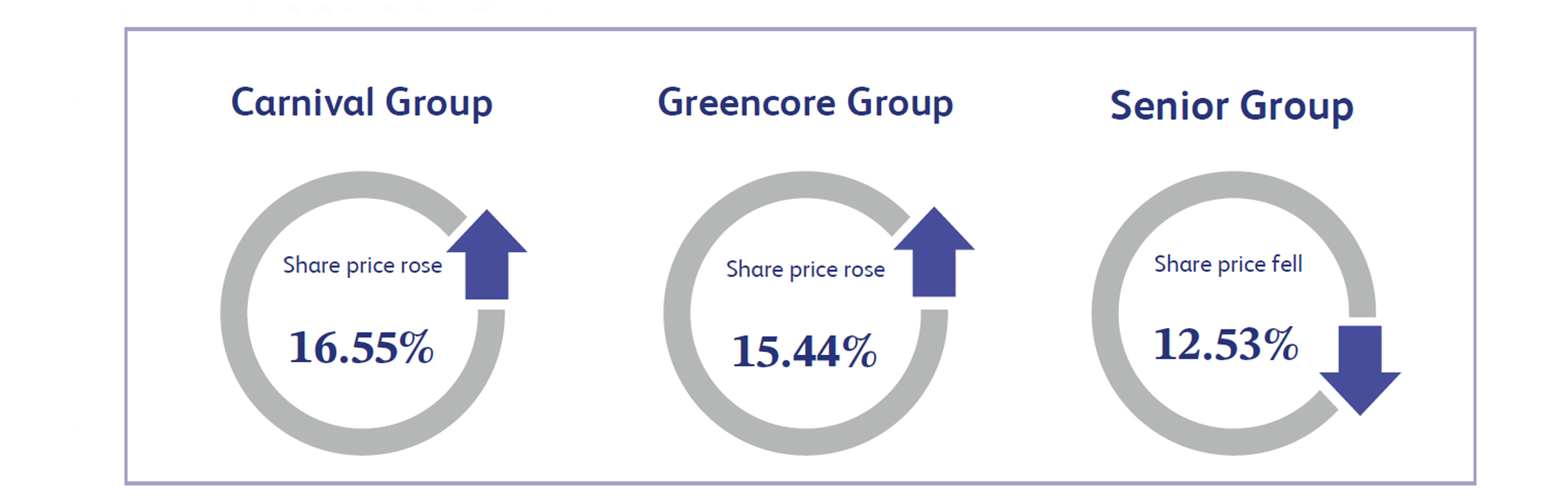

Shares in Carnival Group, the global cruise operator, rose 16.55% last week. The momentum was driven by a bullish outlook from Citigroup analysts, who raised their price target for the stock. The cruise industry has enjoyed strong demand this year, with consumers opting for experience-based spending, leading to record booking rates for cruises. September's cruise traffic was among the highest on record, and pricing trends remain strong, extending into 2025, according to Citi’s analysis of web traffic. This positive sentiment, combined with higher ticket prices and solid future booking trends, bolstered investor confidence in Carnival, contributing to its strong stock performance last week.

Greencore Group engages in the manufacturing and supply of convenience foods. Its share price surged 15.44% last week after a strong trading update highlighted better-than-expected profit performance. Despite revenues aligning with forecasts, profits exceeded expectations due to commercial initiatives and operational efficiencies. Fourth quarter like-for-like sales grew 3.7%, driving full-year growth to 3.4%. The company raised its full year 2024 adjusted operating profit guidance to £95-97 million, surpassing the market consensus of £87 million. Additionally, net debt levels are expected to be at the lower end of the target range, and the company's commitment to a dividend further bolstered investor sentiment. The positive outlook and raised profitability estimates led to increased market confidence, driving the stock's rally.

Senior Group, the engineering solutions provider, saw its shares fall 12.53% last week after announcing job cuts and furloughs due to challenges in the commercial aerospace sector. The company faces significant headwinds, including a prolonged strike at Boeing and supply chain issues at Airbus, which have impacted its operations. Senior warned that its aerospace division's performance in the second half of the year would likely be weaker than in the first half, further weighing on investor sentiment. The company is cutting costs by reducing headcount, postponing capital expenditures and aligning material orders to demand. Despite a 5% year-over-year revenue increase, near-term uncertainty overshadowed the outlook.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority (FRN:226344) and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.