5 November 2024

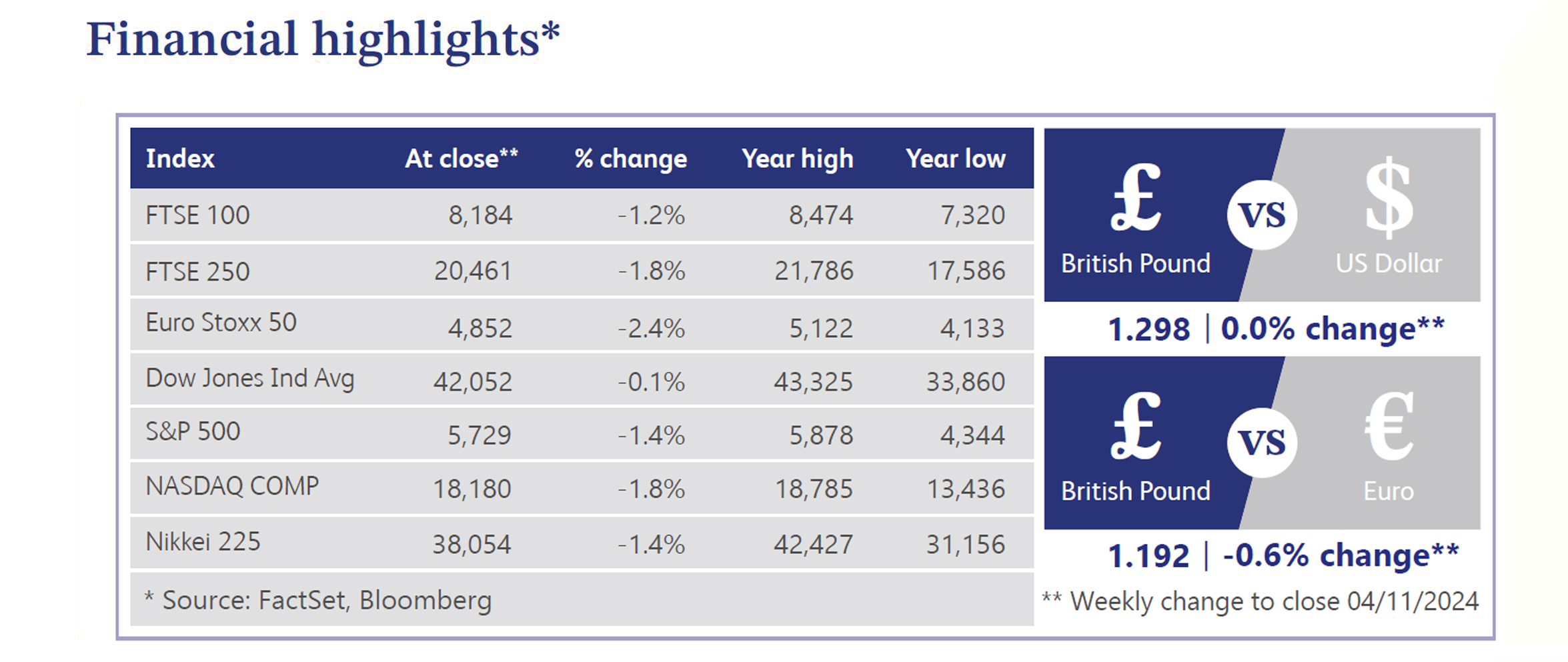

The UK economy showed mixed signals last week, with key developments impacting market expectations. The budget delivered by Rachel Reeves, which included a £70 billion spending boost, led to predictions of a shallower rate-cutting cycle by the Bank of England ("BoE"). A Reuters poll indicated economists largely expect a cautious BoE approach, with rates potentially reaching 3.5% by the end of 2025. Job vacancies in London continued to lag, sitting 25% below pre-pandemic levels, partly due to the rise in hybrid work and lower demand for retail roles. Shop prices declined by 0.8% year-on-year, hinting that inflation could stay below the BoE's 2% target. Meanwhile, full-time pay rose 6.9% annually, with the strongest gains in hospitality and customer service roles. The UK manufacturing Purchasing Managers' Index (“PMI”) slipped to a contractionary 49.9, reflecting slower growth and stretched supply chains.

Labour's first budget in fourteen years focused on increasing public spending to address deficiencies in Britain’s public services, with measures like a £40 billion tax rise, mainly targeting businesses through increased employer national insurance contributions. Despite International Monetary Fund ("IMF") backing for the Labour government's tax-based deficit reduction approach, the budget sparked market concerns, with gilts and sterling selling off. The Office for Budget Responsibility (“OBR”) projected little change in long-term growth, at around 1.5%. Moody’s also warned that frequent adjustments to the UK's fiscal rules could weaken policy credibility, highlighting limited fiscal buffers for future shocks. With state spending now at 44% of gross domestic product (“GDP”), Reeves faces pressure to balance economic stability and potential future tax hikes if growth remains stagnant.

Meanwhile, UK borrowing costs surged to their highest level this year as 10-year gilt yields neared 4.5%, reflecting market unease over £30 billion in additional government borrowing outlined in the recent budget. Investors sold off bonds, pushing yields higher amid concerns that increased spending and borrowing could delay BoE rate cuts. While volatility spiked post-budget, the Debt Management Office expressed confidence in the market’s ability to absorb this higher issuance.

US equity markets were mostly lower last week, with the S&P 500 and Nasdaq breaking multi-week winning streaks, largely due to big tech underperformance. Mixed earnings from “Magnificent 7” tech giants weighed on sentiment, as the equal-weight S&P outperformed its cap-weighted counterpart. Friday’s weak October nonfarm payrolls report, with just 12,000 jobs added, pointed to a cooling labour market, though consumer confidence and third quarter GDP were strong. Investor sentiment remained cautiously optimistic, with hopes for Federal Reserve easing and solid consumer spending, though higher yields, mixed tech earnings, and geopolitical uncertainties kept markets defensive.

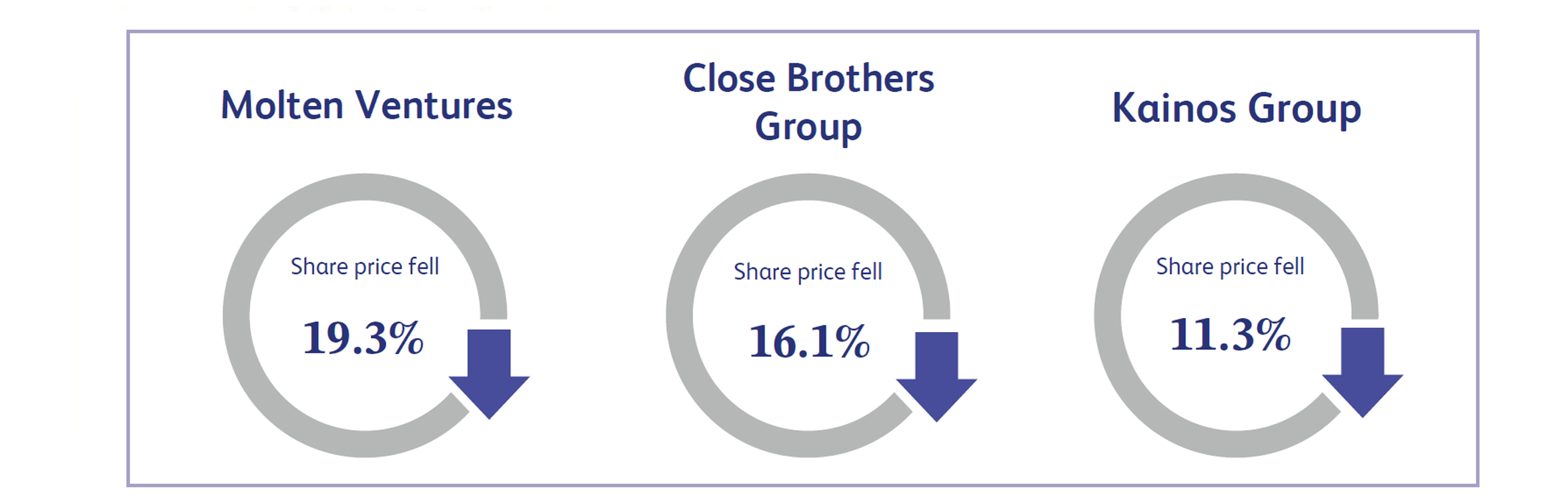

Molten Ventures, engaged in the creation, funding, and development of technology businesses, saw its shares fall by 19.3% after its half-year update highlighted weaker financial performance and management changes. The firm reported a 2.7% drop in Net Asset Value ("NAV") per share, largely due to adverse Forex impacts, declining from the prior year. Despite modest growth in portfolio value to £1.34 billion, the NAV drop raised concerns about the firm’s valuation resilience. Additionally, Chief Executive Officer (“CEO”) Martin Davis's immediate resignation added uncertainty, leading to doubts about strategic stability. Chief Financial Officer (“CFO”) Ben Wilkinson was named as Davis’s successor, but investor apprehension over the leadership transition likely contributed to the sharp share price decline.

Close Brothers Group, the UK merchant bank, saw its share price decline 16.1% as regulatory and legal uncertainties intensified. A recent court ruling supported a claimant's appeal against the bank regarding undisclosed motor finance commissions, signalling that the Financial Conduct Authority ("FCA") may pursue stricter actions in its sector-wide investigation. This raised concerns that Close Brothers could face larger-than-expected financial repercussions. With the UK regulator potentially scrutinising commission practices more rigorously, investors fear further costs and reputational damage, especially as Close Brothers warned of a substantial financial impact. These developments sent Close Brothers' stock to its lowest level in 29 years, amplifying market jitters.

Kainos Group, a software company headquartered in Belfast, saw its shares drop 11.3% as the company revised its fiscal 2025 outlook downward due to ongoing economic pressures. The IT firm now expects revenue to fall "moderately below" market consensus, with adjusted pretax profit also impacted. Challenges in the digital and workday services divisions, including delayed client decisions, contributed to this weakened forecast, despite growth in its workday product business. However, Kainos noted a strong cash position of £126 million and announced a potential share buyback program, offering some optimism amid the cautious outlook.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management's own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority (FRN:226344) and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.