4 February 2025

The Bank of England (“BoE”) faces a tough policy decision ahead of its 6th February meeting, as economic pressures mount. Business activity has slumped to its weakest since the Covid-19 pandemic, with firms cutting jobs and raising prices in response to tax hikes. Consumer spending remained fragile, and corporate profit warnings are at a post-dot-com high. Market expectations point to an 80% chance of a 0.25% rate cut to 4.50%, though inflation risks may limit further easing. Employers have tightened wage growth, and firms have depleted pandemic-era cash reserves. While shop price deflation continues, food prices have risen at their fastest rate in nine months. Morgan Stanley has slashed the UK’s growth outlook to 0.9% for 2025, citing weak business confidence. Despite a slight improvement in employer sentiment, overall business confidence has dropped to a 13-month low.

UK Chancellor Rachel Reeves continues to push an ambitious fiscal agenda to boost economic growth, despite criticism of her budget. Key measures include unlocking £160 billion in pension surpluses for investment and advancing major infrastructure projects like the Oxford-Cambridge Growth Corridor and Heathrow’s third runway. Meanwhile, Prime Minister Keir Starmer has vowed to cut red tape and prioritise pro-growth policies, ensuring all public spending passes a "growth test." However, Reeves has not ruled out tax increases in March, awaiting the Office for Budget Responsibility’s forecast. Business groups welcomed her plans but cautioned that regulatory and labour market challenges remained. BoE Governor Andrew Bailey also warned that structural headwinds, including an ageing population, could limit fiscal flexibility.

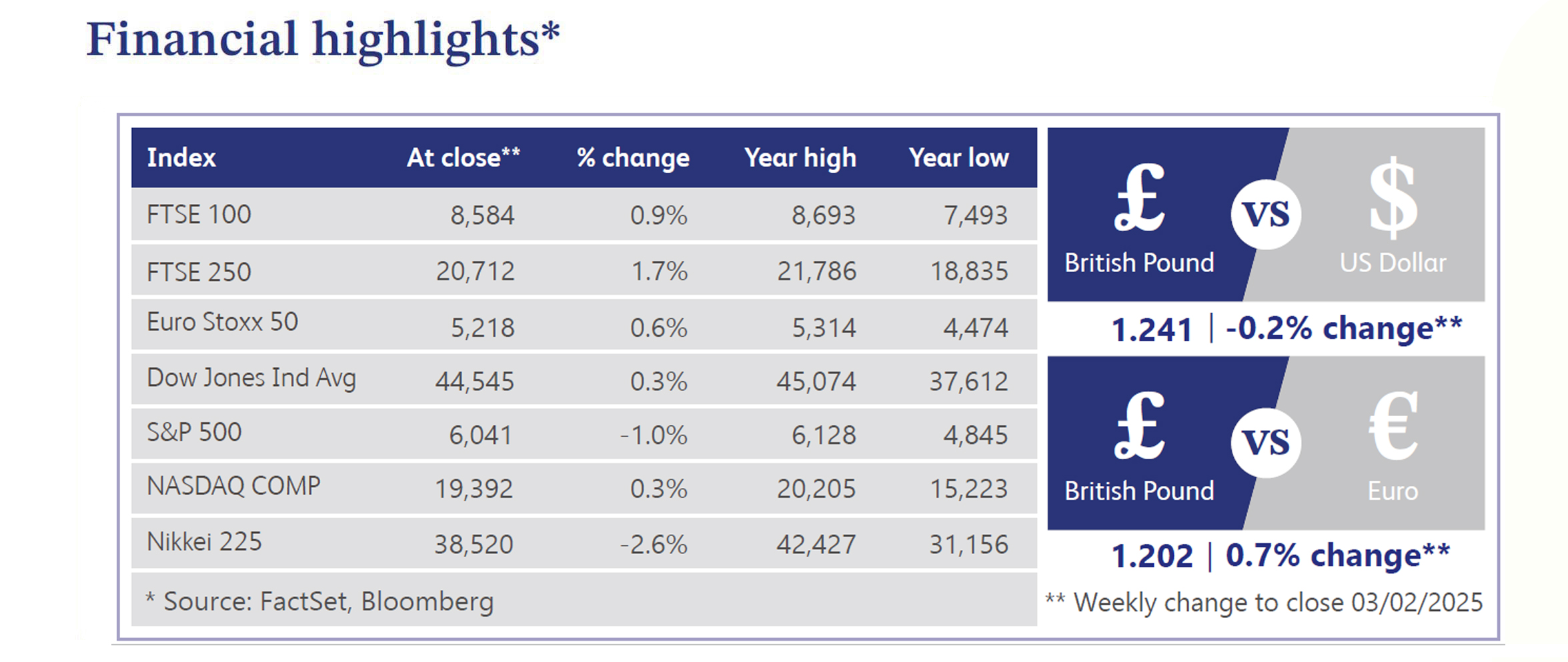

UK markets faced mixed conditions as dividends declined, sterling weakened, and bond markets evolved. UK dividends fell 0.4% on an underlying basis in 2024, driven by a 40% slump in mining payouts, despite headline dividends rising to £92.1 billion due to one-off payments. The pound’s recent drop adds inflationary pressure, complicating BoE rate cut plans. On the other hand, US equities were mostly lower, with the Nasdaq underperforming as artificial intelligence (“AI”) fears hit chipmakers, notably Nvidia (-15.8%). However, broader markets held steady, buoyed by strong consumer data and sector rotations. AI concerns emerged as China’s DeepSeek model challenged US dominance, sparking fears of lower AI-related capital expenditure. Trump’s tariff threats and the Federal Reserve’s caution added to market uncertainty, while data showed moderating inflation and steady economic growth.

UK housing market data was published this week showing average private rents have fallen for the first time since 2019, with improved property supply easing pressure, though London rents hit a record high (£2,695). BoE data suggested positive momentum, with mortgage approvals and net borrowing rising, with mortgage rates falling slightly. However, house price growth cooled in January, with Nationwide reporting a 4.1% annual increase, down from 4.7%. While affordability has slightly improved, first-time buyers still face challenges, particularly as some lenders have raised mortgage rates amid bond market volatility.

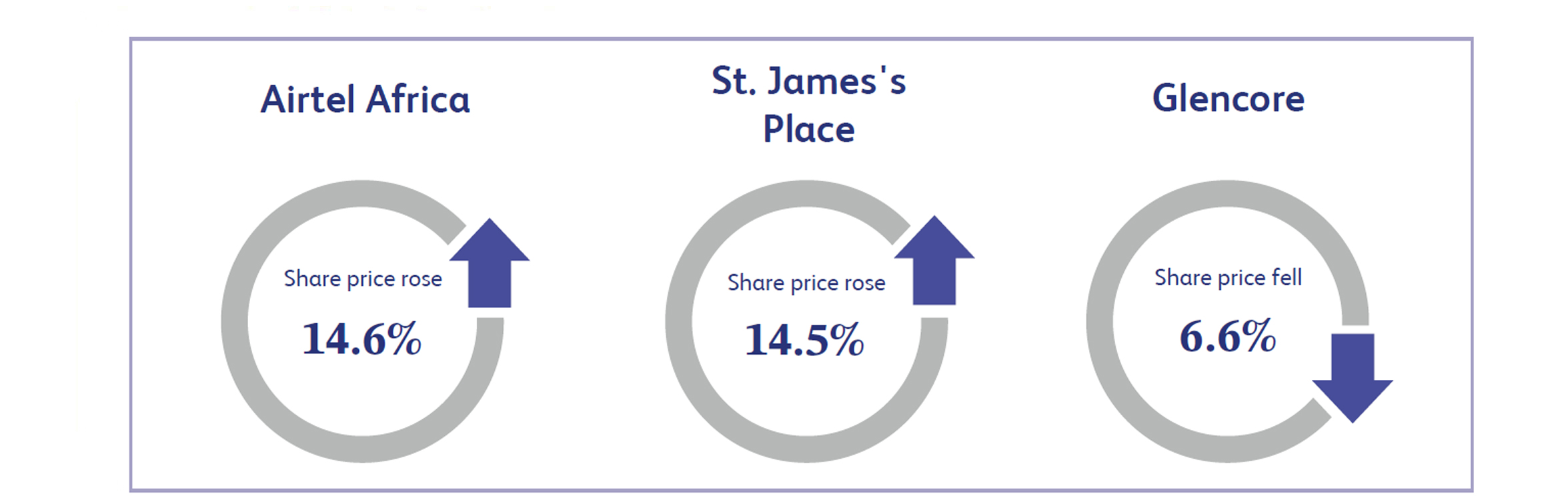

Airtel Africa, provider of telecommunications and mobile money services, surged 14.6% to a two-year high as investors reacted positively to strong revenue growth and encouraging regulatory developments. The company posted a 20.4% rise in nine-month revenue to $3.64 billion, driven by a 7.9% increase in its customer base to 163.1 million. While earnings before interest, taxes, depreciation, and amortisation (“EBITDA”) fell 11.9%, due to higher fuel costs and weaker Nigerian contributions, Chief Executive Office (“CEO”) Sunil Taldar highlighted supportive tariff adjustments from Nigeria’s regulator, signalling a more stable operating environment. Investors welcomed the outlook, seeing potential for margin recovery and sustained growth despite near-term cost pressures.

St. James’s Place, the UK wealth management business, surged 14.5% after reporting better-than-expected fourth quarter inflows, boosting investor confidence. Jefferies highlighted that net flows turned positive across all fund segments, a significant improvement from the previous year. The company also saw adviser and client growth, driven by a large cohort of new advisers graduating from its academy in September. This strong inflow performance eased concerns about client retention and business momentum, leading to a sharp rally as investors reassessed the firm's growth prospects in a challenging wealth management environment.

Glencore engages in the production and marketing of metals, minerals and energy, as well as agricultural commodities. Its shares dropped 6.6% after reporting a broad decline in 2024 production across key commodities, raising concerns about future earnings. Copper output, a major revenue driver, fell 6% year over year, while cobalt, zinc, nickel, gold and silver also saw declines. Energy coal production slipped 6%, adding to market worries amid volatile commodity prices. Although steelmaking coal surged 165%, it wasn’t enough to offset weakness elsewhere. Investors reacted negatively to the overall drop in output, fearing lower profitability and operational challenges, leading to a sharp sell-off in the stock.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management's own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority (FRN:226344) and is a member of the London Stock Exchange. Registered office: 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.