11 February 2025

Last week the Bank of England ("BoE") cut interest rates by 0.25%, with Governor Andrew Bailey urging caution over the split vote. Markets are still priced in for two more cuts this year, despite inflation forecasts remaining above target until 2027. The UK manufacturing sector contracted for the fourth month, with rising input costs squeezing small firms. Meanwhile, the services Purchasing Managers' Index (“PMI”) edged down, with job cuts accelerating. Grocery inflation slowed, but supermarkets warned of rising costs due to tax and wage increases. Budget retailers struggled, highlighting pressures on low-income consumers.

US President Donald Trump suggested UK trade tensions could be resolved, sparing the nation from immediate tariffs, while Prime Minister Keir Starmer balanced EU ties and a US deal. Chancellor Rachel Reeves faced scrutiny over potential cash Individual Savings Account (“ISA”) tax reforms, with concerns around pensioners’ savings. The Office for Budget Responsibility’s initial forecasts pointed to weaker growth, limiting fiscal flexibility, while government departments were told to prepare for budget freezes. Public confidence in the government’s economic plans remained low, and Reform UK overtook Labour in polls for the first time. Reports also emerged that Keir Starmer is considering a cabinet reshuffle due to declining government popularity. The UK’s economic outlook remains uncertain, with fiscal constraints and sluggish growth shaping future policy decisions.

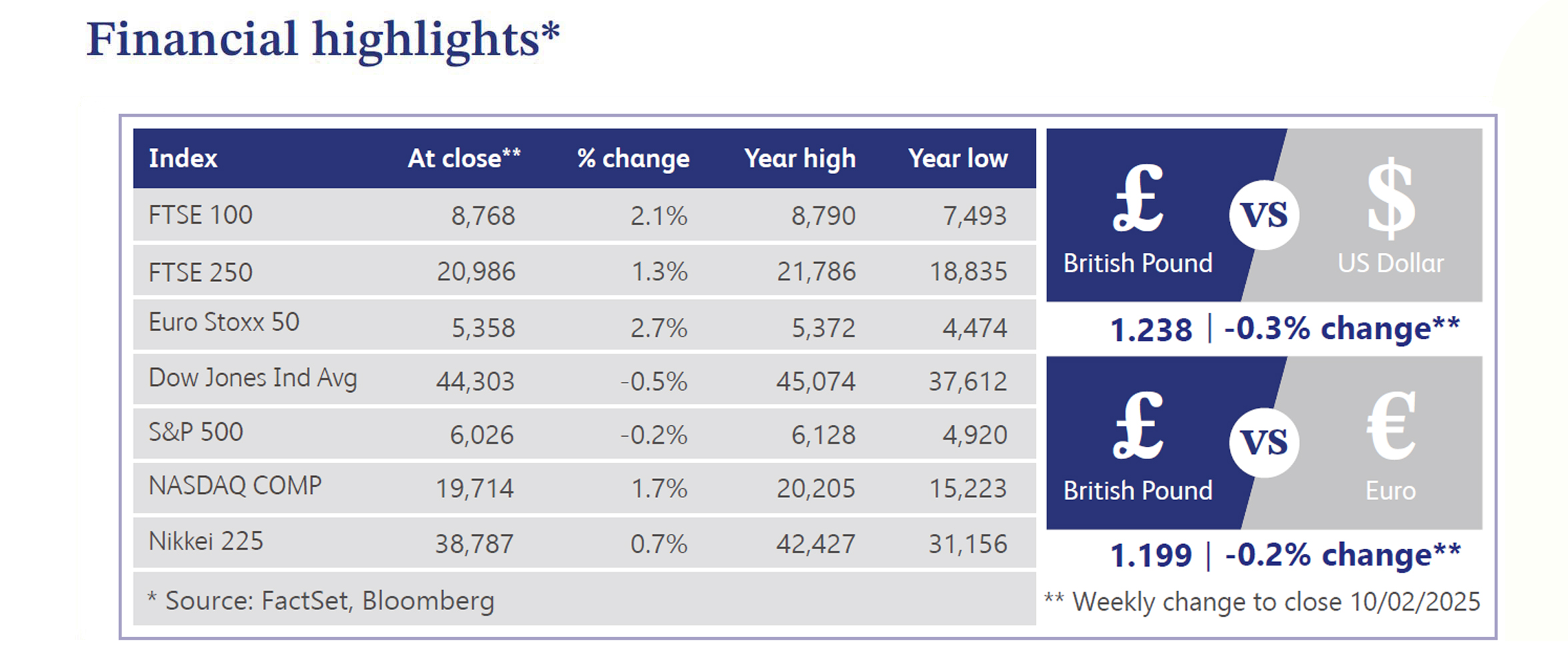

Last week the pound strengthened for eight consecutive days, buoyed by improved EU relations and Trump’s hint that the UK might avoid tariffs. However, investor sentiment towards UK equities remained weak, with £640 million in outflows from equity funds in January. The BoE’s liquidity drain lifted the Sterling Overnight Index Average (“SONIA”) rate for the first time in months, while Britain faced calls to issue fewer long-dated bonds. Gold at the BoE traded at a discount due to tariff fears. Meanwhile, investors positioned for further sterling weakness, as downgraded growth forecasts and BoE rate cut signals weighed on the currency’s outlook.

US markets faced another week of declines, with major indices posting their second consecutive weekly loss. Tech stocks struggled, particularly Alphabet and Amazon, while defensive sectors like staples and industrial metals outperformed. Treasury yields fluctuated, with the 10-year ending near 4.50%. Trade war tensions intensified as Trump imposed tariffs on China, while Canada and Mexico secured temporary exemptions. Economic data was mixed, with weaker job growth but strong wage inflation. Investors remain cautious amid uncertainty over tariffs, fiscal policy, and Federal Reserve rate cuts, with inflation data in focus this week.

UK housing faced mixed signals last week with Deloitte’s survey highlighting high building costs limiting new developments, despite overall construction activity remaining strong. Government building ambitions are also being hindered by rising costs and economic uncertainty, with the January construction PMI falling sharply to 48.1. However, Halifax reported UK house prices reaching a record high in January, with a 0.7% monthly increase. While affordability remains a concern, demand is being driven by first-time buyers rushing to complete transactions before the end of March due to impending stamp duty changes.

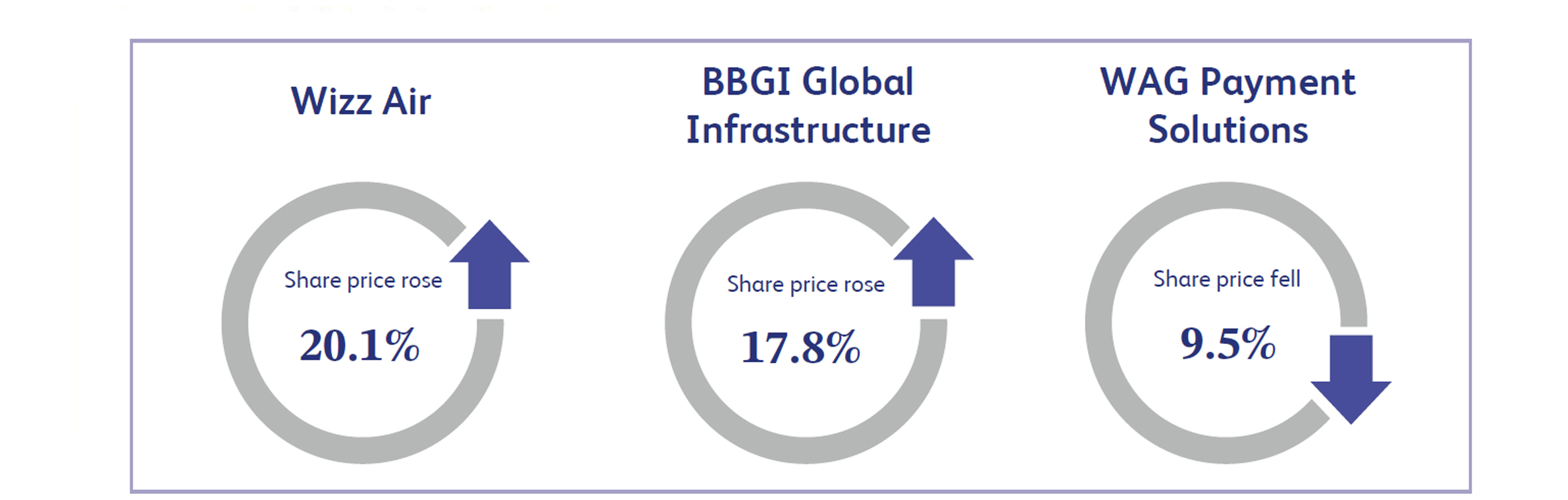

Budget airline Wizz Air surged 20.1% last week after HSBC upgraded its rating to "buy" and raised its price target. Analysts cited strong demand growth in Eastern Europe, where Gross Domestic Product (“GDP”) is expected to outperform broader European trends. Wizz Air’s expansion plans, including increased flight frequency and fleet growth, should enhance market presence, attract corporate passengers and secure better airport slots. Increased capacity is also expected to lower airport charges and improve asset utilisation. With air travel demand rising faster than supply in its core market, investors welcomed the airline’s growth prospects, driving a sharp rally in its share price.

BBGI Global Infrastructure soared 17.8% last week after Canada’s British Columbia Investment Management Corp (“BCI”) announced a £1.06 billion takeover. The offer of 147.5p per share represented a 21.1% premium to BBGI’s prior closing price, driving strong investor interest. BBGI’s supervisory and management boards unanimously recommended the deal, which will see the company delisted upon completion, expected in the third quarter. The acquisition reflects confidence in BBGI’s high-quality infrastructure portfolio, providing stability and long-term value.

WAG Payment Solutions (“Eurowag”), which processes freight and road payments across Europe, fell 9.5% after warnings of a weaker macroeconomic outlook in Europe. The company flagged short-term challenges, including lower free cash flow forecasts, which unsettled investors. Despite the drop, industry analysts highlighted the potential for long-term gains, citing Eurowag’s ability to sustain growth and improve cash flow over time. The payments and mobility platform remains well-positioned to capture market share, but near-term economic uncertainty weighed on sentiment. Investors reacted to the cautious outlook, leading to the stock’s sharp decline, despite confidence in its resilience and long-term prospects.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management's own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority (FRN:226344) and is a member of the London Stock Exchange. Registered office: 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.