25 February 2025

Last week, Bank of England ("BoE") Governor Andrew Bailey reaffirmed a cautious policy stance, highlighting the UK economy’s stagnation despite a slightly stronger fourth quarter Gross Domestic Product (“GDP”). Inflation surprised on the upside, rising to 3% in January - its highest in 10 months - driven by transport and food costs. Wage growth showed mixed signals, with official data indicating resilience but private surveys pointing to a slowdown. The job market weakened, with rising redundancies ahead of April’s National Insurance hike. Retail sales unexpectedly surged in January, but consumer confidence hit its lowest level since Labour took office. Corporate insolvencies reached a five-year-high, particularly in construction and retail. Meanwhile, manufacturing volumes continued to decline, although future expectations improved.

UK Chancellor Rachel Reeves is under pressure to adjust fiscal policy, with reports suggesting tax rises next month despite her pledge for a single fiscal event per year. Reeves also faces pressure to raise £12 billion to meet defence spending commitments while also auditing regulators to boost growth. The UK is now expected to exceed borrowing forecasts due to weak tax revenues and increased public spending. A weaker economic backdrop and revised Office for Budget Responsibility (“OBR”) forecasts have eliminated fiscal space, potentially leading to spending cuts or further tax hikes. Reeves may extend the income tax freeze to raise £4 billion annually. Additionally, economists warn that bond-buying losses could force austerity measures. Meanwhile, the chancellor is engaging with investment bankers to boost economic growth, with discussions on regulatory easing and increasing retail investment amid speculation about further tax changes.

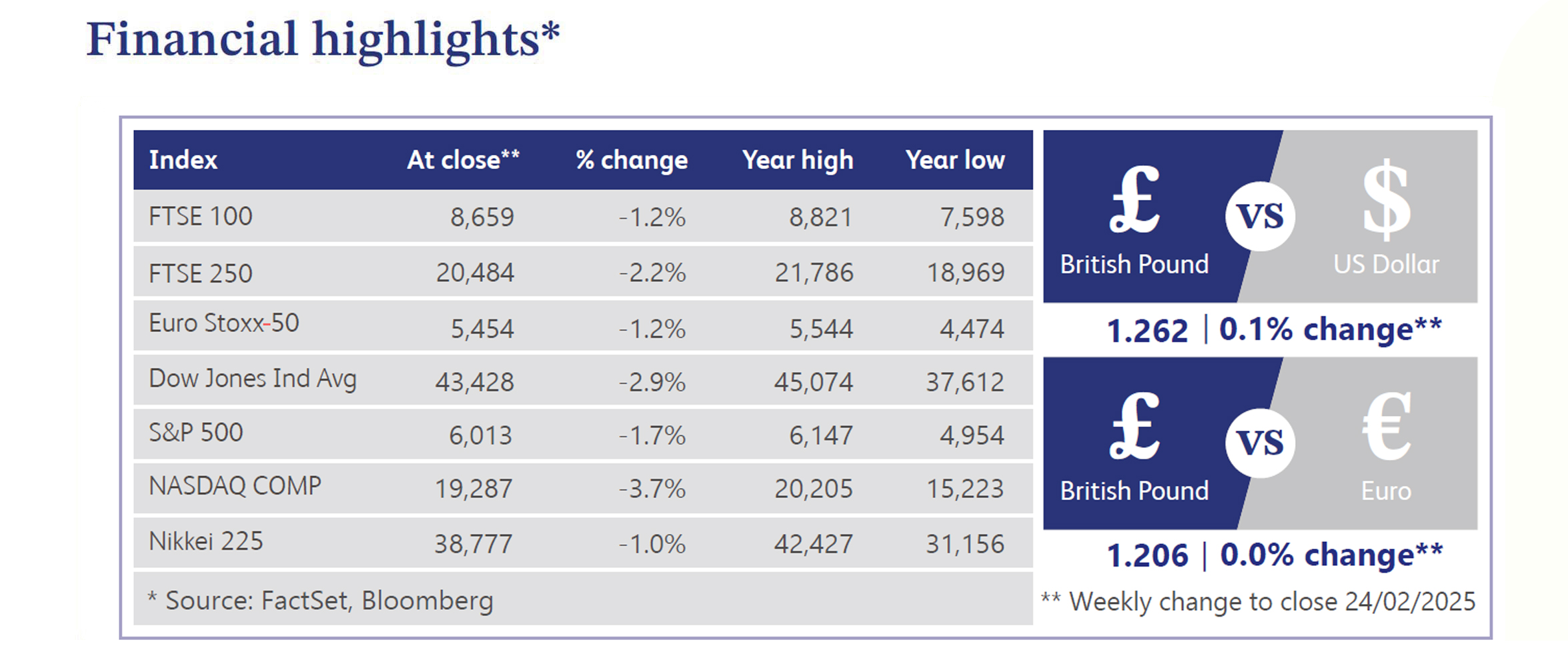

UK equities remain underweight in global portfolios, with investors shunning the market amid stagflation concerns. The UK is transitioning to T+1 settlement by October 2027, aligning with the US. In the US, equities declined, reversing record highs seen earlier in the week, with tech stocks underperforming. Defensive sectors gained traction, while concerns over tariffs, inflation and political uncertainty weighed on sentiment. Treasuries firmed, gold hit record highs and Bitcoin fell. Economic data was mixed, with weaker services Purchasing Managers’ Index (“PMI”) and housing data offset by stronger manufacturing figures. Federal Reserve minutes signalled patience, with rate cut expectations unchanged for 2025.

The UK housing market faces near-term pressure from upcoming tax changes, with February house price growth slowing to 0.5% from 1.7%. A record-high number of properties for sale has tempered price increases, but demand remains strong, with new sellers up 13% and agreed sales 15% higher. Mortgage lending is forecast to double in 2025 as BoE rate cuts support affordability. However, first-time buyers are struggling, with only 11.5% able to buy without family help. London prices fell 2.7% in real terms in 2024, while rental growth slowed to 0.3% in January, but remains up 11% year-on-year.

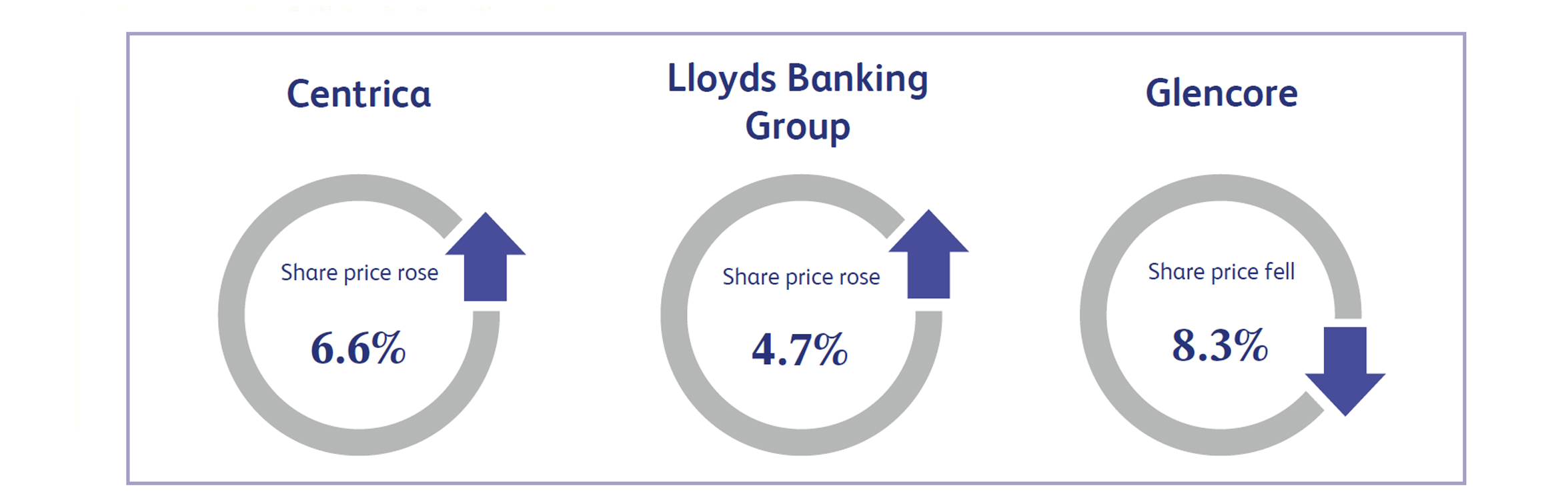

Centrica, supplier of energy and services to UK homes and businesses, saw its share price rise 6.6% as investors welcomed its stronger-than-expected earnings, despite a profit decline. The company reaffirmed its 2025 guidance by announcing an additional £500 million share buyback and raised its final dividend by 13%. Analysts viewed its capital allocation clarity and medium-term targets positively. While revenue and profit fell due to energy market normalisation, results exceeded forecasts, boosting confidence. Its commitment to dividend growth and financial resilience supported investor optimism, driving the share price higher.

Lloyds Banking Group saw its share price rise 4.7% as investors reacted positively to its £1.7 billion share buyback announcement, signalling confidence in its financial strength. Despite a decline in fourth-quarter earnings per share, results exceeded analyst expectations. Revenue increased to £4.71 billion, surpassing forecasts of £4.36 billion, driven by strong net interest income. The buyback program is seen as a shareholder-friendly move, enhancing earnings per share and reflecting surplus capital. Investors welcomed the bank's commitment to returns despite a challenging economic backdrop, driving the stock higher.

The producer of metal, mineral, energy and agricultural commodities, Glencore, saw its share price decline 8.3% last week as the company reported a $1.63 billion loss for 2024, a sharp reversal from its $4.28 billion profit in the prior year. Earnings per share fell to -$0.13 from $0.34, disappointing investors despite a rise in revenue to $230.94 billion. The unexpected loss overshadowed revenue growth, raising concerns about profitability and cost pressures. Investors reacted negatively to the weak earnings performance, leading to a sell-off in Glencore shares.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management's own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority (FRN:226344) and is a member of the London Stock Exchange. Registered office: 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.