4 March 2025

The UK economy showed further signs of strain last week, with job postings hitting a four-year low in January. Wages continued to rise, reaching a record average of £40,846, adding to the Bank of England’s (“BoE”) inflationary concerns. Retailers warned of price increases due to higher national insurance and minimum wage hikes, particularly in the food sector. Meanwhile, a Reuters poll suggested the BoE could cut rates to 3.75% this year, with housing prices expected to rise as borrowing costs fall. The net-zero economy remained a bright spot, growing three times faster than the overall economy and contributing £83 billion in Gross Value Added (“GVA”). However, higher energy bills and taxation concerns are weighing on businesses, with two-thirds of hospitality firms set to cut jobs. Despite economic pressures, Lloyd's business barometer showed optimism, rebounding to its highest level since August 2024.

UK fiscal policy took centre stage last week as Prime Minister Keir Starmer announced an unexpected increase in defence spending to 2.5% of Gross Domestic Product (“GDP”) by 2027. The move, aimed at impressing US President Trump ahead of key discussions, signals a shift in the UK’s budget priorities. Chancellor Rachel Reeves backed the increase, though economists argue the real annual cost is closer to £6 billion, largely financed by reducing the aid budget. In parallel, UK ministers relaunched trade negotiations with India, seeking a free trade deal to revitalise the economy. Meanwhile, the government aligned with France to persuade Trump against unilateral negotiations with Moscow and called for tougher G7 sanctions on Russia. Starmer also pushed for a US security guarantee in Ukraine but faced resistance from Trump, who urged Europe to take greater responsibility.

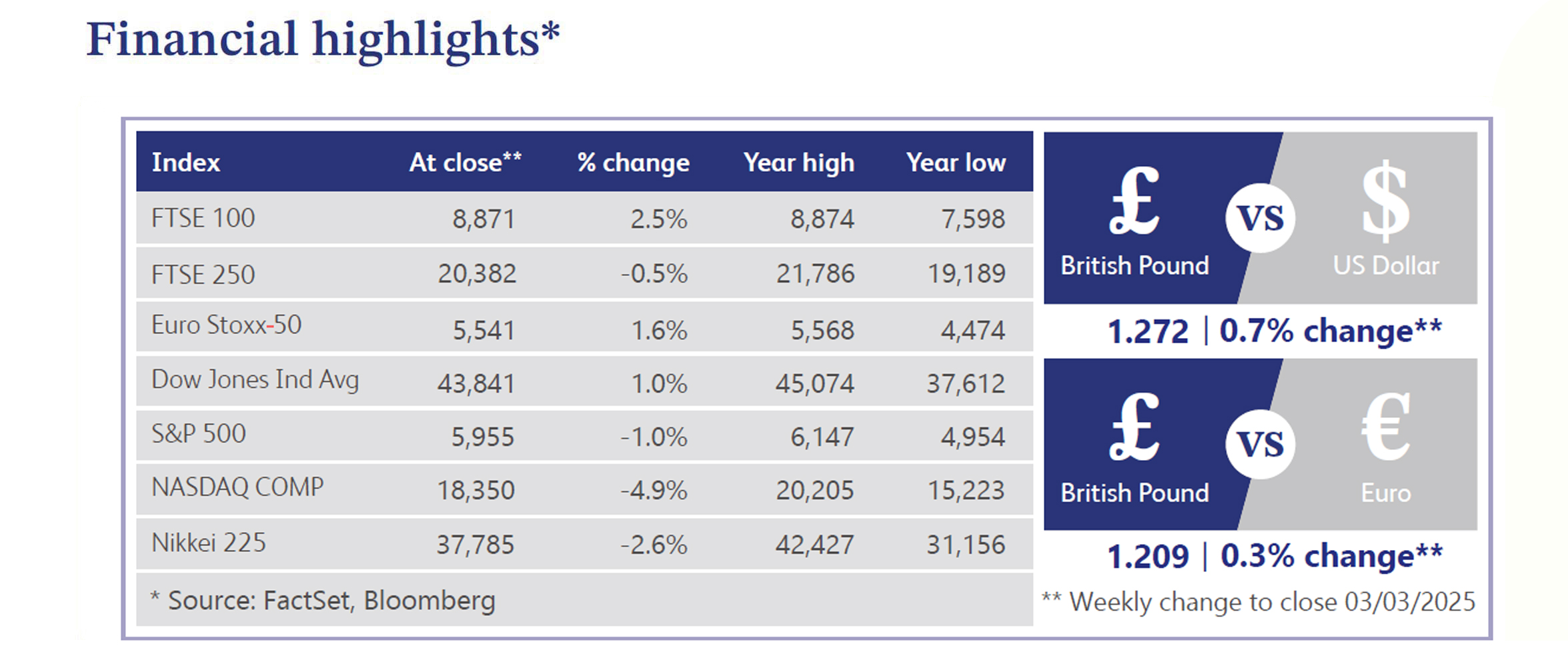

In the UK, investor concerns deepened as £67.4 billion remained trapped in underperforming funds, with short-selling of FTSE 250 firms reaching post-mini-budget highs. Market sentiment weakened due to outflows exceeding £5 billion this year and economic uncertainty following tax and wage policy changes. However, sterling outperformed, buoyed by stronger than expected economic data, including positive retail sales and GDP surprises. In the US, markets extended losses, weighed down by big tech underperformance, with Tesla (-13.3%) and Nvidia (-7.2%) leading declines. The S&P equal-weight index eked out gains, while treasuries rallied, pushing the 10-year yield to 4.38%. Political uncertainty, Trump's tariff threats and budget negotiations fuelled risk-off sentiment. Weak consumer confidence and mixed economic data further clouded the outlook, though Artificial Intelligence-driven optimism from Nvidia and Microsoft provided some support.

UK house prices rose for the sixth consecutive month in February, with a 0.4% month-on-month increase, beating expectations of 0.2%. Annual growth reached 3.9%, slightly down from January’s 4.1%. Prices are now just 0.6% below the 2022 peak, marking the highest level since the mini-budget turmoil. Analysts suggest buyers are accelerating purchases ahead of upcoming stamp duty changes in April, which could increase costs. Despite economic uncertainty, the market remains resilient, supported by improved confidence and stable mortgage rates. However, affordability concerns persist, with prices still stretched relative to incomes.

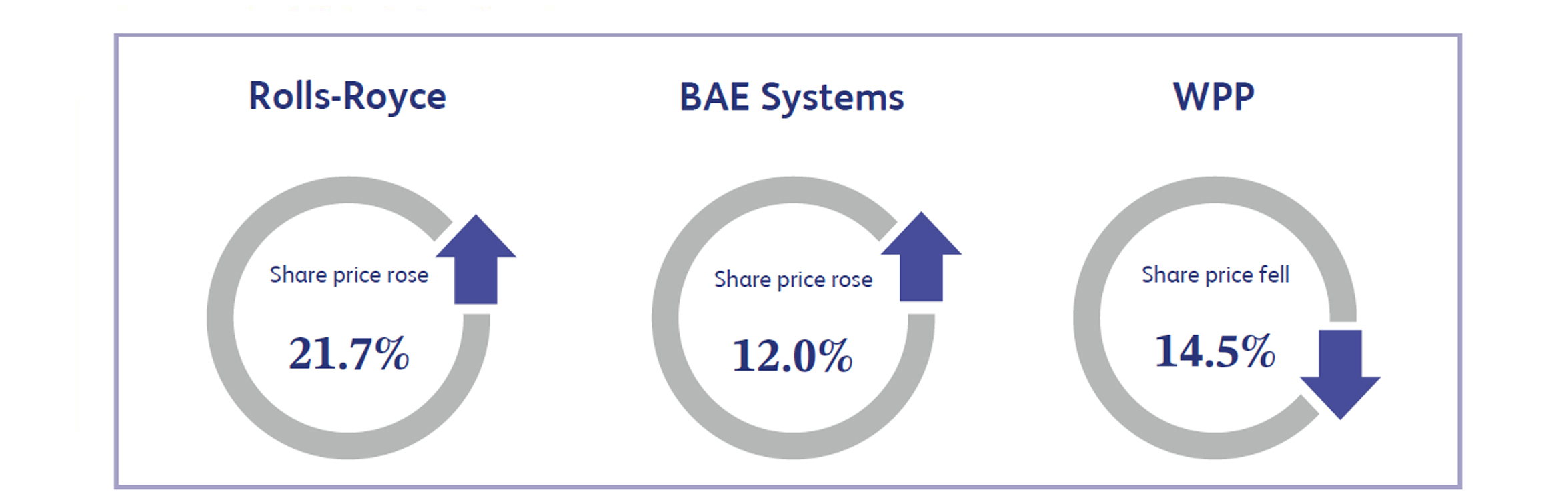

Rolls-Royce, the aerospace and defence company, soared 21.7% to an all-time high after the company reinstated dividends, raised midterm guidance and announced a £1 billion share buyback. Strong full-year earnings, surpassing expectations, were driven by a rebound in civil aerospace, with a 28% jump in engine servicing revenue. CEO Tufan Erginbilgic’s turnaround strategy has significantly improved operational efficiency, boosting investor confidence. The company also made progress in the nuclear sector and small modular reactors. With new ambitious targets, including higher profitability and free cash flow, analysts see Rolls-Royce as a transformed, high-performing business, fuelling its share price rally.

BAE Systems, provider of defence products and services, saw its stock climb 12.0% as defence spending surged across Europe amid rising geopolitical tensions. The company extended its agreement with Triumph Group to support the US Army’s M777 Howitzer platform, reinforcing its position in military supply chains. Investor sentiment was further boosted by expectations that Germany will lead European nations in ramping up defence budgets, potentially reaching €200 billion. Analysts highlighted that increased military investment, particularly in the technology and defence industries, has become a key market theme. As a major defence contractor, BAE Systems stands to benefit significantly from this long-term spending trend.

The global marketing and advertising company, WPP, tumbled 14.5% after the company forecast flat revenue and profit growth for 2024, citing weakness in China and uncertainty in the US. A 1% decline in organic revenue missed analyst expectations, raising concerns over its turnaround strategy. Multiple brokerages, including Morgan Stanley and Deutsche Bank, slashed price targets, while Barclays downgraded the stock, citing a lack of momentum and missed growth targets. The sluggish performance and prolonged restructuring have cast doubt on WPP’s ability to achieve its 2026 goals. As a result, investor confidence weakened, leading to a sharp decline in its stock price.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management's own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority (FRN:226344) and is a member of the London Stock Exchange. Registered office: 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.