2 September 2025

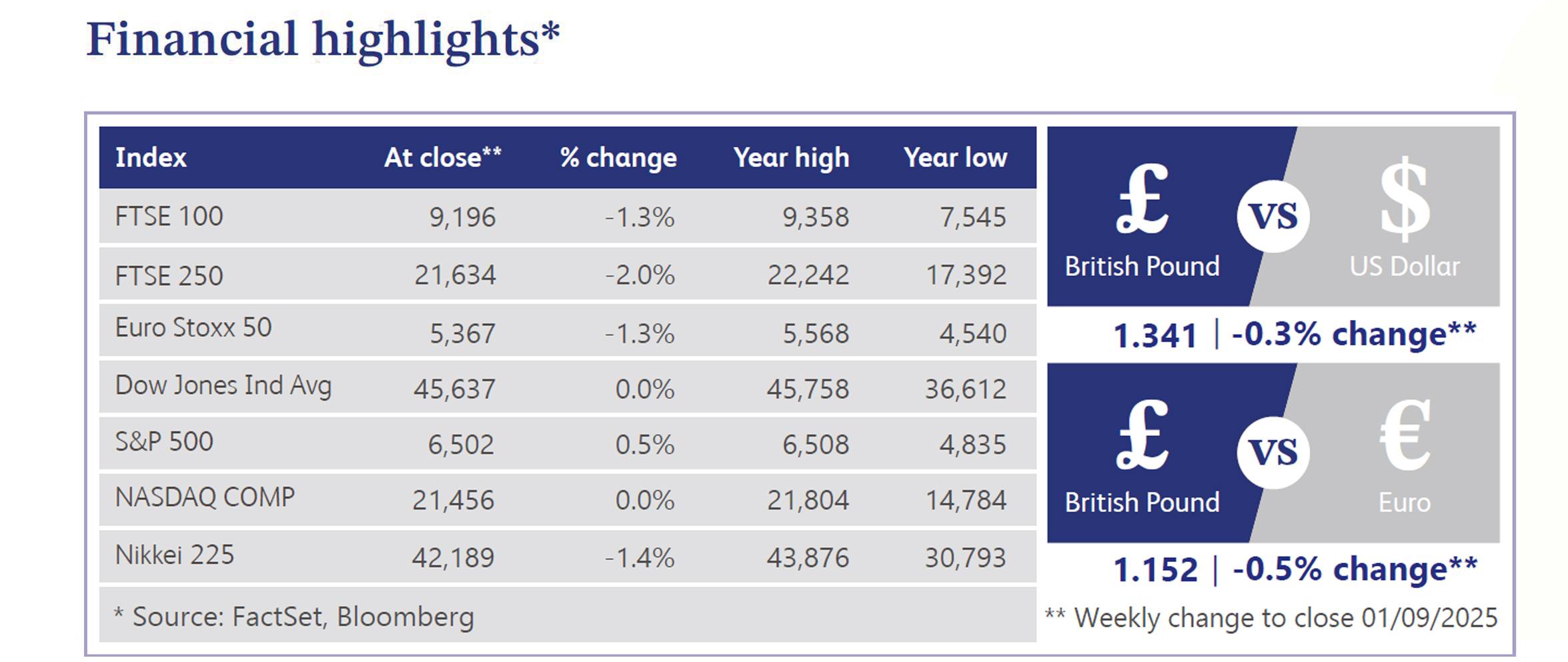

The UK economy presented a mixed picture last week as inflationary pressures persisted alongside signs of a weakening labour market. Food price inflation accelerated to 4.2% year-on-year, driven by higher global supply costs and seasonal pressures, while energy bills are set to rise by more than expected this winter, adding to household strains. Labour market data showed vacancies at a five-year low and analysts warned unemployment could soon reach 5%. Retail sales volumes also weakened for an 11th consecutive month in August. Meanwhile, shops have raised prices by the most since the end of 2023, according to the Confederation of British Industry (“CBI”) distributive trades survey. Meanwhile, Bank of England (“BoE”) officials struck contrasting tones: Governor Andrew Bailey flagged weak growth challenges, while Catherine Mann cautioned that inflation risks remain elevated, reinforcing the fragile balance the BoE faces between growth and inflation.

The UK fiscal landscape grew more precarious as rising migration, weak public finances and contentious tax debates dominated headlines. Migrant arrivals across the Channel hit a record 28,076 this year, intensifying political pressure, with Reform UK pledging mass deportations and withdrawal from the European Convention on Human Rights (“ECHR”). UK markets faced renewed strain as government borrowing costs climbed near multi-decade highs. Thirty-year gilt yields surged to 5.6%, levels last seen in 1998, mirroring moves in US Treasuries but adding further pressure on Chancellor Rachel Reeves to tighten fiscal policy ahead of the autumn budget. Economists warned of fiscal collapse risks, with some drawing comparisons to a 1976-style International Monetary Fund (“IMF”) bailout, though others dismissed such fears as exaggerated. The Treasury is reviewing options such as taxing landlords and banks, sparking concerns about potential impacts on housing and financial stability. Meanwhile, merger and acquisition activity surged, led by financial services and US investors, even as London’s initial public offering (“IPO”) market faltered, with Frankfurt and Zurich set to eclipse it.

US equities pulled back as sentiment turned cautious despite strong retail earnings and ongoing artificial intelligence (”AI”) optimism. The S&P 500 drifted lower, weighed by utilities, homebuilders and consumer staples, while small-caps and select cyclicals outperformed. Nvidia’s results, though robust with 56% year-on-year datacentre growth, underwhelmed against lofty expectations, tempering AI enthusiasm as they failed to match the premium investors had priced in. Political noise intensified after Trump’s firing of Federal Reserve Governor Lisa Cook, fuelling debate on central bank independence. Treasuries steepened, gold surged to record highs and crude edged up, underscoring risk-hedging flows amid persistent policy and trade uncertainty.

Zoopla’s latest update signalled a cooling in UK house price growth as rising supply weighs on the market. House prices have increased 1.3% over the past 12 months, slowing from 2% at the start of 2025. Buyer demand rose 4% month-on-month, but available homes climbed 10%, easing upward price pressure. Sales agreed are up 5% on last year, supported by improving affordability as wage growth continues to outpace house price inflation, offering some relief for prospective buyers amid softer conditions.

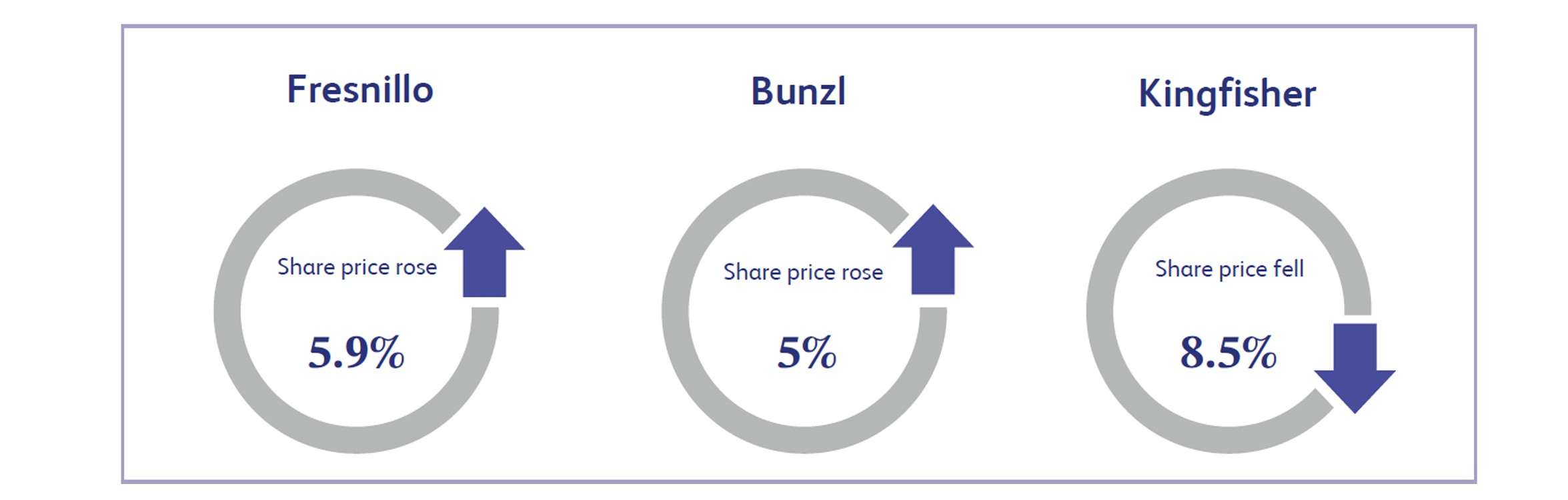

Fresnillo, the world’s largest primary silver producer and a major gold miner, saw shares rise 5.9% as bullion prices surged. Gold touched $3,457 a troy ounce, its highest level in four months, buoyed by expectations of a US interest rate cut and growing tariff uncertainty. Investors flocked to precious metals as a safe haven, lifting sentiment across London-listed gold miners. The rally placed Fresnillo among the FTSE 100’s top performers, as higher realised prices improved revenue and margins for producers. With gold edging closer to record highs, Fresnillo’s earnings outlook strengthened, explaining the sharp upward move in its stock.

Bunzl, a UK-based distribution and outsourcing group, gained 5% after posting stable first-half results and resuming its £200 million share buyback programme. The company reported 4.2% revenue growth at constant currencies to £5.76 billion, though margins slipped to 7% from 8% amid North American and European challenges. Operating profit fell 14% to £300.5 million, but guidance for 2025 was maintained, with moderate revenue growth expected. Analysts welcomed the reassurance after prior operational setbacks, noting progress in cost control and recovery initiatives. The dividend increase and renewed buyback boosted investor confidence, pushing shares to a three-month high and signalling resilience despite earlier caution.

Kingfisher, the UK-based home improvement retailer operating brands like B&Q and Screwfix, dropped 8.5% after Deutsche Bank downgraded the stock to hold from buy. Analysts cited weakening UK consumer demand and a deteriorating outlook for do-it-yourself (“DIY”) spending, noting that around 80% of Kingfisher’s profits come from the domestic market. Stronger performances in France and Poland are unlikely to offset the slowdown at home. Additionally, its robust first-quarter results were largely weather-driven, raising concerns over sustainability. With consumer headwinds expected to weigh heavily in the second half, investors reacted sharply, erasing prior gains and highlighting the retailer’s UK exposure.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management' own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority (FRN:226344) and is a member of the London Stock Exchange. Registered office: 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.