9 September 2025

UK economic signals painted a mixed picture last week. Retail sales beat expectations in July, though sharp backward revisions tempered optimism, while Halifax data showed house prices at record highs despite affordability concerns. Yet headwinds remain, as employment contracted at its fastest pace in four years following the payroll tax raid and borrowing costs climbed, heightening the risks of a housing slowdown. Services Purchasing Managers’ Index (“PMI”) growth offered resilience, but manufacturing and construction remained weak, with cement production at 1950s lows. Bank of England (“BoE”) officials struck a cautious tone, signalling slower rate cuts and bond sales, as inflation expectations ticked higher, underscoring persistent structural fragility.

UK fiscal policy debates intensified, as political reshuffles and looming budget challenges reshaped the landscape. Chancellor Rachel Reeves was undermined by Keir Starmer’s decision to bring senior economic advisers into No. 10, raising concerns she may lose influence ahead of the November budget. Reeves sought to regain footing by naming London Stock Exchange’s (“LSE”) John Van Reenen as a growth adviser, while signalling commitment to fiscal rules. Market focus remained on how she will close a potential £20–50 billion gap. With investors urging spending cuts, unions pressing for wealth taxes and borrowing costs rising, expectations of a tough and tax-heavy budget have intensified.

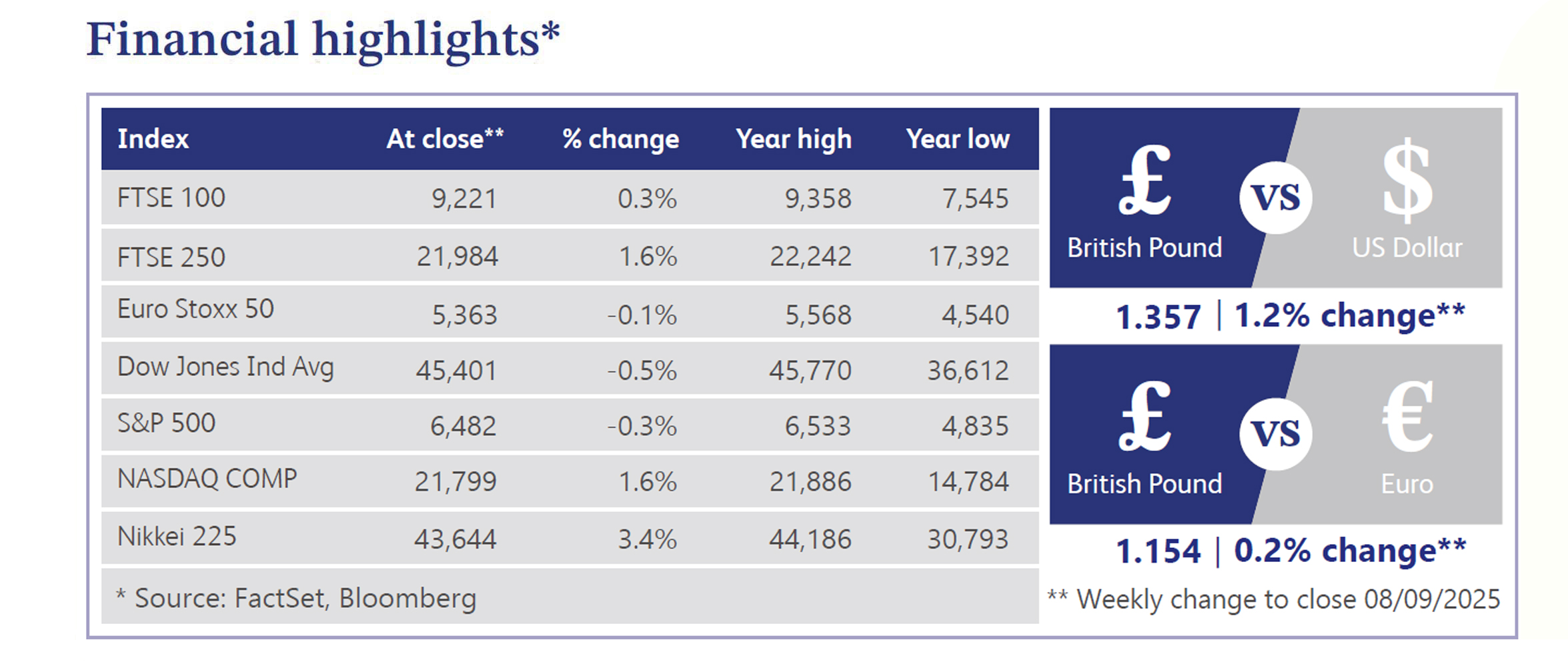

UK markets came under pressure last week, with gilts and sterling sliding as fiscal worries dominated sentiment. The 30-year gilt yield rose to its highest level since 1998 (above 5.7%) before easing after the chancellor pledged a “tight grip” on spending. Analysts noted that gilt moves largely tracked US Treasuries, but the sell-off underscored investor anxiety over rising UK debt servicing costs and the government’s limited budget options. Meanwhile, Calastone data showed UK equity funds suffered £1.31 billion outflows in August, while money market funds saw strong inflows, reflecting heightened risk aversion.

US equities started September with a mixed tone, with the S&P 500 touching fresh record highs midweek before easing into the holiday shortened close. Tech led the rally as Alphabet jumped 10.4% and Apple gained 3.2% after a favourable antitrust ruling, while homebuilders, retail and biotech also outperformed. Conversely, energy, financials and industrials lagged. Treasuries rallied sharply, with the 2-year yield at its lowest since early April, as August payrolls showed just 22,000 new jobs and downward revisions, reinforcing expectations for Federal Reserve (“Fed”) cuts this year. The dollar was flat, gold surged 3.9% to a record and oil slipped 3.3% on Organisation of the Petroleum Exporting Countries’ (“OPEC”) plans to raise output.

Nationwide reported UK house price growth slowed to 2.1% year-on-year from 2.4%, with August prices unexpectedly dipping 0.1% month-on-month against forecasts for a 0.2% rise. It cited affordability pressures but expects demand to be supported by easing borrowing costs and income growth outpacing prices. Separately, BoE data showed mortgage approvals rose, the strongest in six months and above consensus. Approvals, a leading indicator of housing activity, suggested resilient demand, while consumer credit rose £1.6 billion, indicating firm household borrowing.

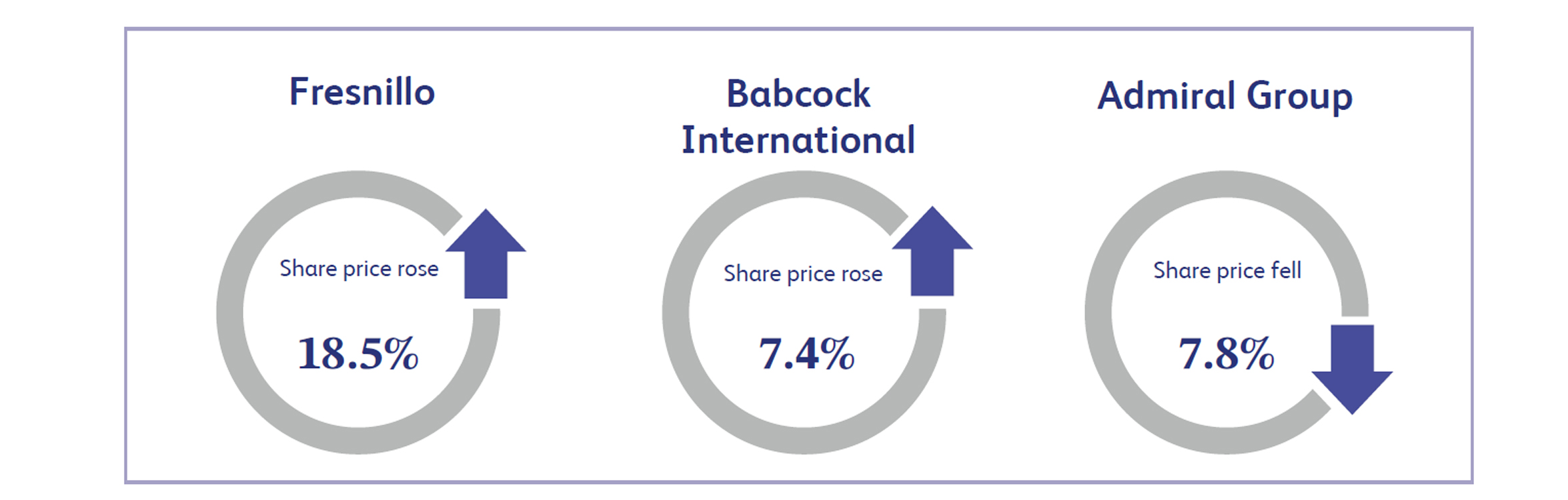

Fresnillo, the world’s largest primary silver miner and a leading gold producer, rallied 18.5% to top the FTSE 100 risers as precious metal prices surged. Gold futures climbed as high as $3,616.90/oz, up nearly 5% this week, driven by safe haven demand amid equity and bond sell off and expectations of imminent Fed rate cuts. Analysts highlighted ongoing tariff uncertainty as an additional tailwind. With bullion approaching record highs, investor confidence in gold miners soared, boosting Fresnillo’s earnings outlook and driving its shares sharply higher on prospects of stronger cash generation and sector-wide resilience.

Babcock International, a UK based aerospace and defence group specialising in naval support and engineering, advanced 7.4% after Britain secured a £10 billion deal to supply Norway with new warships. The agreement will see a combined fleet of 13 anti-submarine warfare frigates operated jointly by both nations, strengthening Northern Europe’s defence capabilities. The announcement lifted European defence stocks, with the UK defence sub-index up 1.7%. Babcock is expected to deliver mid-single digit growth in its marine division over the medium term, and the deal reinforced confidence in its order book, prompting strong investor demand for the shares.

Admiral Group, a leading UK motor and home insurer, dropped 7.8% after Peel Hunt downgraded the stock to Sell from Reduce. Analysts warned underwriting margins in the UK motor market are beginning to erode from elevated levels as pricing softens, raising concerns over 2026 profitability. While Admiral has gained significant market share over the past two years, questions linger over how far it will push growth at the expense of margins. With discipline required across the sector in the second half of 2025, investors reacted negatively, sending the shares lower on fears of a sharp margin squeeze ahead.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management' own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority (FRN:226344) and is a member of the London Stock Exchange. Registered office: 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.