28 October 2025

The UK economy presented a nuanced picture last week, with signs of stability tempered by persistent structural challenges. Inflation held steady at 3.8% year-on-year, below forecasts, fuelling speculation of a Bank of England (“BoE”) rate cut in December, with futures now pricing a 75% probability. However BoE officials remained cautious as Governor Andrew Bailey highlighted Brexit’s drag on growth, while Monetary Policy Committee (“MPC”) member Megan Greene resisted quarterly cuts. Economic data were mixed, with the Purchasing Managers' Index (“PMI”) rising to a two-month high (51.1) and retail sales surprising positively, while borrowing hit a five-year peak and construction activity reached an 11-year low. Consumer sentiment improved slightly, but UK public inflation expectations over the next 12 months climbed to 4.2%, underscoring the BoE’s delicate balancing act.

Ahead of the November Budget, Chancellor Rachel Reeves signalled welfare reforms and potential tax rises to rebuild fiscal headroom. Reports suggest Income Tax or National Insurance may rise to close a £30 billion gap, though falling gilt yields could ease pressure. Reeves plans a “blitz on bureaucracy” to save UK firms £6 billion per year and a national green energy plan creating 400,000 jobs. Pension funds pledged £2 billion in regeneration projects under the “Sterling 20” initiative. Concerns remain over higher employer pension contributions and tax changes, while economists and industry leaders warned against excessive sector-specific levies that could undermine growth and investment confidence.

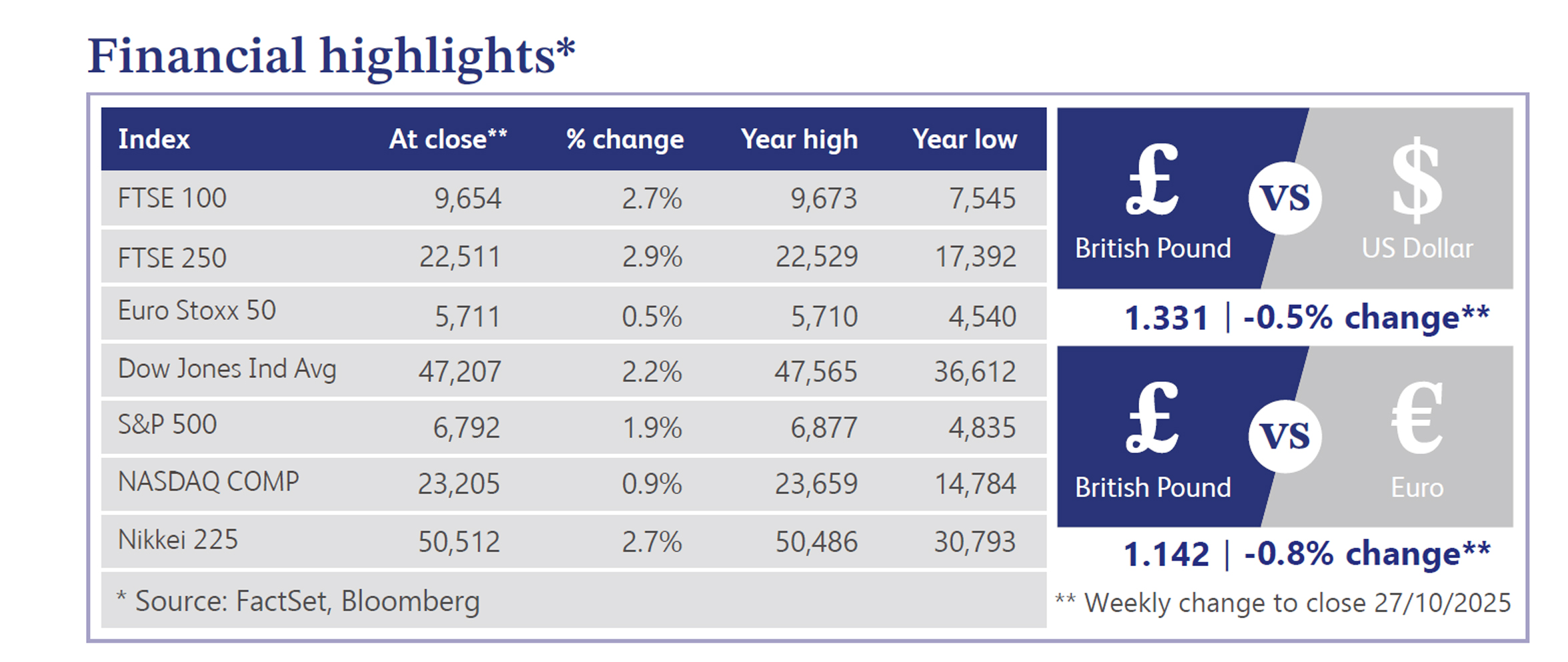

UK equities rallied sharply, with the FTSE 100 up 3.1% (21.6% YTD) and the FTSE 250 up 3.5% (12.5% YTD), supported by softer inflation and rising rate cut expectations. Meanwhile, sterling weakened against the dollar amid dovish sentiment. The BoE drew attention after reports that it is exploring a private credit stress test, with Financial Policy Committee (“FPC”) member Jonathan Hall warning that some bond market participants remain underprepared, highlighting rising risks outside regulated banking.

In the US, equities hit record highs, driven by strong third quarter earnings, cooling inflation and sustained Federal Reserve easing optimism. The S&P 500 and Nasdaq gained, led by technology and semiconductor stocks, whilst West Texas Intermediate (“WTI”) crude surged 7.6% on new US sanctions against Russian oil majors. Gold fell 1.7%, and Treasury yields flattened on soft Consumer Prices Index (“CPI”) data. Escalating US-China trade tensions added volatility, though markets largely looked through it. With over a quarter of S&P 500 firms having reported, earnings are up 9.1% year-on-year, reflecting resilient corporate profitability amid global headwinds.

The UK housing market is slowing ahead of the November Budget. Rightmove reported average asking prices rose just 0.3% in four weeks to 11 October, below the 1.1% long-run trend, as buyers stayed on the sidelines amid property tax reform speculation. In London, Savills data showed third quarter prime property sales fell nearly 20% year-on-year. Meanwhile, alternative lenders to the commercial real estate sector saw default rates exceed 20%, highlighting elevated risk in higher-yielding credit segments.

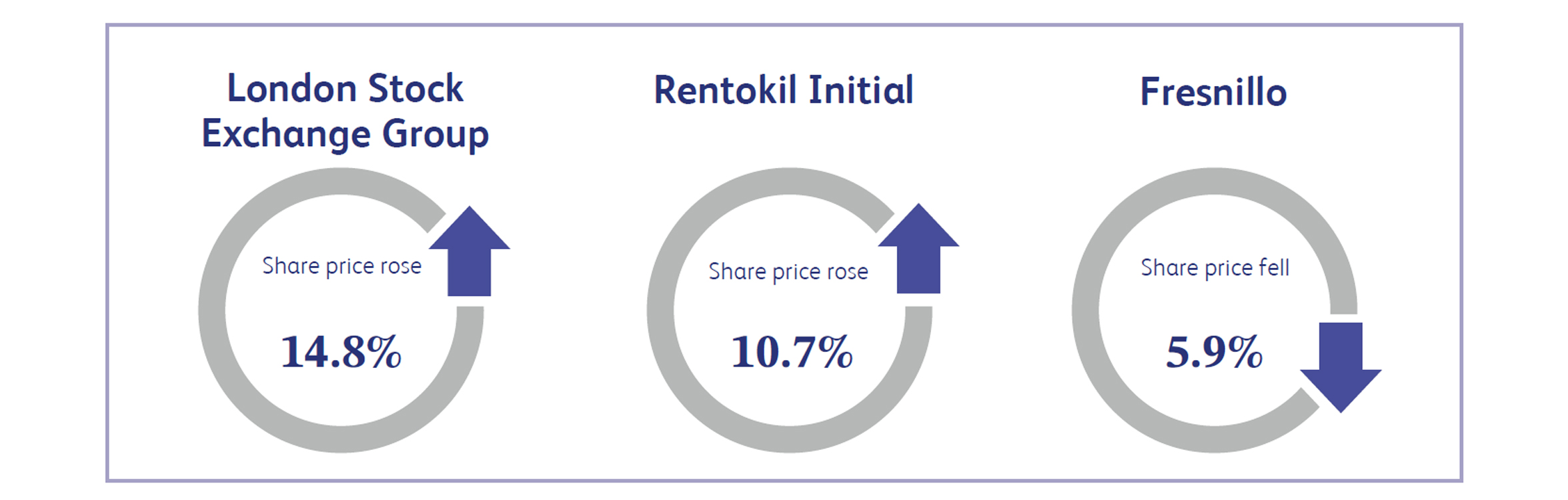

London Stock Exchange Group (“LSEG”), operator of one of the world’s leading financial markets, surged 14.8% last week following the announcement of a £170 million deal to sell a 20% stake in its Post Trade Solutions business to 11 major global banks, valuing the unit at £850 million. CEO David Schwimmer also confirmed a repeat £1 billion share buyback by February, boosting investor confidence. While annual subscription growth eased slightly to 5.6%, LSEG is leveraging data and AI integration, including Microsoft 365 Copilot, and revising SwapClear revenue-sharing, signalling strong long-term margin expansion.

Rentokil Initial, a global pest control and hygiene services provider, rose 10.7% after reporting third quarter organic revenue growth of 3.4%, exceeding Jefferies’ 2.4% forecast. Strong performance in the US market and ongoing recovery momentum impressed analysts, with the company reiterating FY2025 guidance in line with expectations. Investor sentiment was further supported by confidence in consistent organic growth across its pest control operations, positioning Rentokil as a resilient player amid broader economic uncertainties.

Fresnillo, a London-listed precious metals miner primarily in gold and silver, fell 5.9% last week as gold prices eased to $4,072.60/oz amid optimism over a potential US-China trade deal. Falling bullion prices weighed on investor sentiment across the sector, with London and Johannesburg miners broadly retreating. Fresnillo’s valuation and near-term revenue are closely linked to gold prices, making it sensitive to shifts in macro trade developments and risk sentiment.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management' own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority (FRN:226344) and is a member of the London Stock Exchange. Registered office: 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.