4 November 2025

The Bank of England’s (“BoE”) Monetary Policy Committee meets this Thursday to determine the UK’s next interest rate decision, with markets broadly expecting rates to remain unchanged. However, a growing camp of analysts believes recent macroeconomic developments could tilt the balance towards a rate cut. Governor Andrew Bailey’s vote will likely prove decisive, though the contrasting stances of Deputy Governors Sarah Breeden (dovish) and Clare Lombardelli (hawkish) underscore the committee’s divisions. The meeting takes place against a backdrop of persistently weaker UK business sentiment, with the Institute of Directors’ (“IoD”) confidence index registering lower, close to September’s record low. On the inflation front, employers expect pay settlements to ease to 3%, and shop prices have fallen for the first time since March; both developments strengthen the case for a more dovish BoE stance.

Fiscal policy will dominate headlines this month as investors await the November Budget. Chancellor Rachel Reeves faces mounting pressure to address the UK’s widening fiscal gap, now estimated at £40 billion – higher than previous forecasts of £20-30 billion. A potential productivity downgrade by the Office for Budget Responsibility (“OBR”) could deepen the shortfall by another £20 billion, leaving Reeves with limited fiscal room. Market speculation points towards tax rises targeting the wealthy, including a possible “mansion tax” through higher council tax bands and an “exit tax” on residents relocating abroad. Prime Minister Keir Starmer has also signalled further tax hikes, marking a shift from Labour’s own manifesto. Market observers suggest the government’s overriding priority will be to maintain market credibility and reassure bond investors after years of fiscal strain.

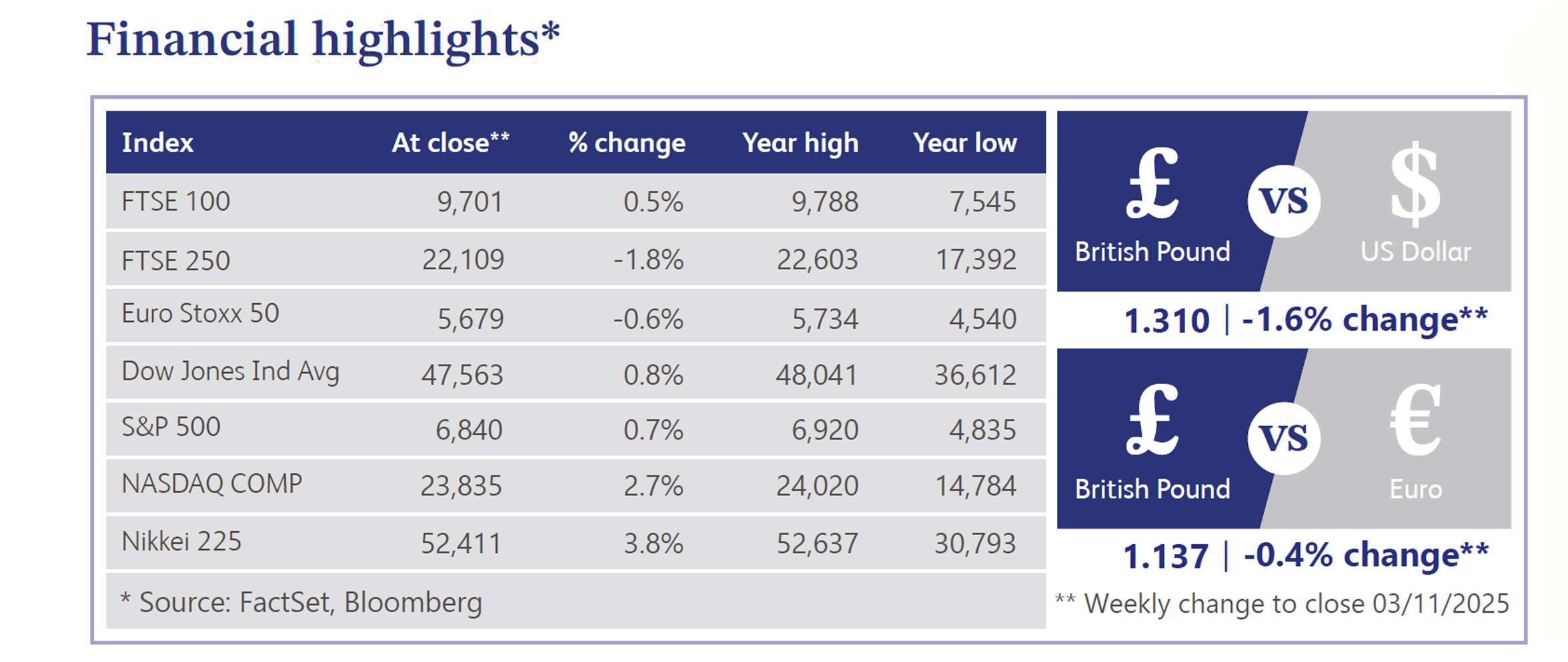

In the UK markets, gilts were among the top performers in October, supported by expectations of softer growth and potential monetary easing. Investors continue to find value in the asset class, with the 10-year benchmark yield hovering near 4.4%, offering compelling real yields. Sterling, however, remains under pressure, recently touching its weakest level against the euro since 2023, as fiscal tightening and subdued growth weigh on sentiment. Across the Atlantic, US equity markets delivered a mixed performance. The S&P 500 and Nasdaq notched their third consecutive weekly gains, driven by robust earnings from major technology firms, while the Russell 2000 underperformed. Cyclicals and Big Tech led the rally with Amazon and Google posting strong cloud revenues, and Nvidia surging 8.7% on renewed artificial intelligence (“AI”) optimism. However, Meta fell around 12% after guiding for higher AI-related capital expenditure in 2025. US Treasuries weakened, with the two-year yield rising 0.12%, after the Federal Reserve (“Fed”) cut rates by 0.25% and ended its quantitative tightening (“QT”) programme. Fed Chair Jerome Powell signalled a cautious approach to further easing, dampening expectations for another December cut. The dollar firmed, while gold and oil prices declined.

The UK housing market offered mixed signals. Nationwide reported a 2.4% year-on-year rise in October house prices, while BoE data showed mortgage approvals exceeding forecasts, suggesting underlying resilience. Yet, sector-specific data paints a softer picture, with Zoopla recording the first annual fall in sales in two years, and Savills reporting new-build transactions at their lowest since the 2007/08 financial crisis. Analysts attribute the divergence to buyer caution ahead of the November Budget, as uncertainty over property tax changes keeps many prospective homeowners on the sidelines.

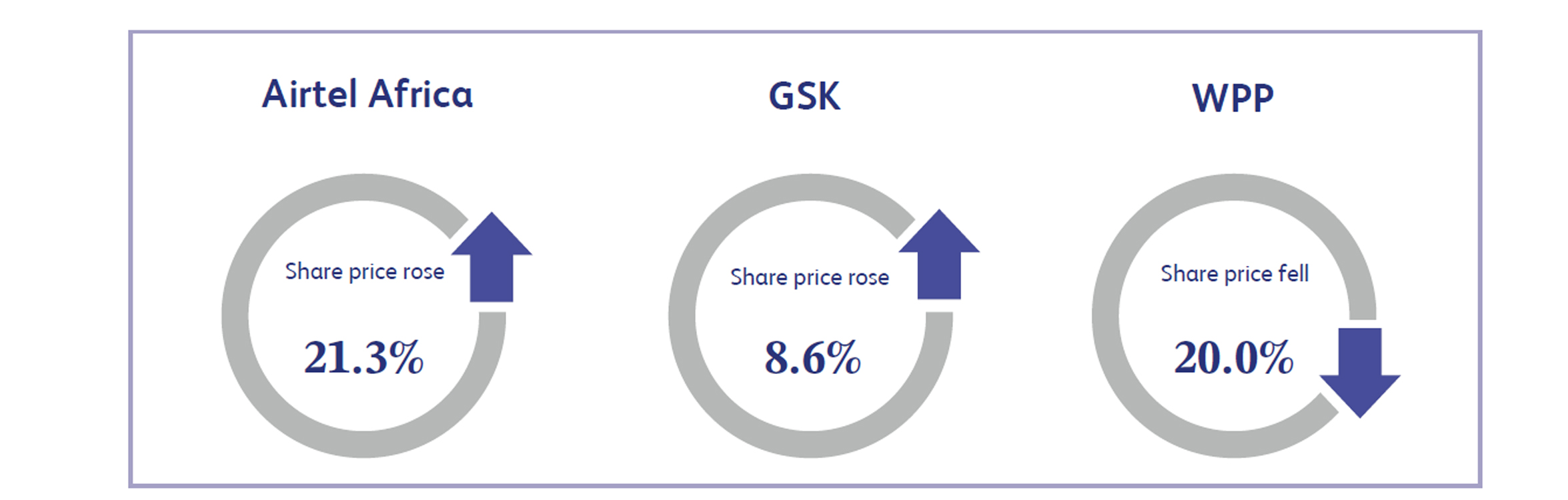

Airtel Africa, a leading provider of telecommunications and mobile money services, was the FTSE 100’s top performer last week, soaring 21.3% after delivering robust half-year results. Net profits surged to $376 million from $79 million, driven by an 11% increase in customer numbers and a 23.1% rise in constant currency mobile services revenue. Data revenue is now the company’s largest growth driver, underscoring its successful digital expansion strategy. Management further boosted investor sentiment by announcing a 9% increase in the interim dividend and a $100 million share buyback, reinforcing confidence in the group’s cash flow strength and earnings resilience.

GSK, the global healthcare and pharmaceuticals group, climbed 8.6% after issuing its second upgrade to 2025 guidance, signalling continued operational strength. The company now expects full-year revenue growth of 6–7% and core profit growth of 9–11%, supported by an impressive third quarter performance. Total sales rose 8% to £8.5 billion, with speciality medicines up double digits and oncology sales surging 39%. The Shingrix shingles vaccine was another highlight, generating £800 million in quarterly revenue. The upbeat outlook comes as CEO Emma Walmsley prepares to step down at year-end, leaving GSK on a firm trajectory of innovation-led growth and improved profitability.

WPP, the global advertising and communications group, tumbled over 20% after cutting its annual revenue and margin guidance for the second time this year. Following a 5.9% decline in third quarter organic growth, the company now expects full-year revenue to fall between 5.5% and 6%, with margins reduced to 13%. The downgrade reflects weaker client spending amid macroeconomic uncertainty, particularly in the tech and auto sectors, and intensifying competition from AI-driven marketing tools. The newly appointed CEO described the results as “unacceptable” and pledged decisive restructuring to stabilise operations and restore investor confidence in the group’s growth outlook.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management' own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority (FRN:226344) and is a member of the London Stock Exchange. Registered office: 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.