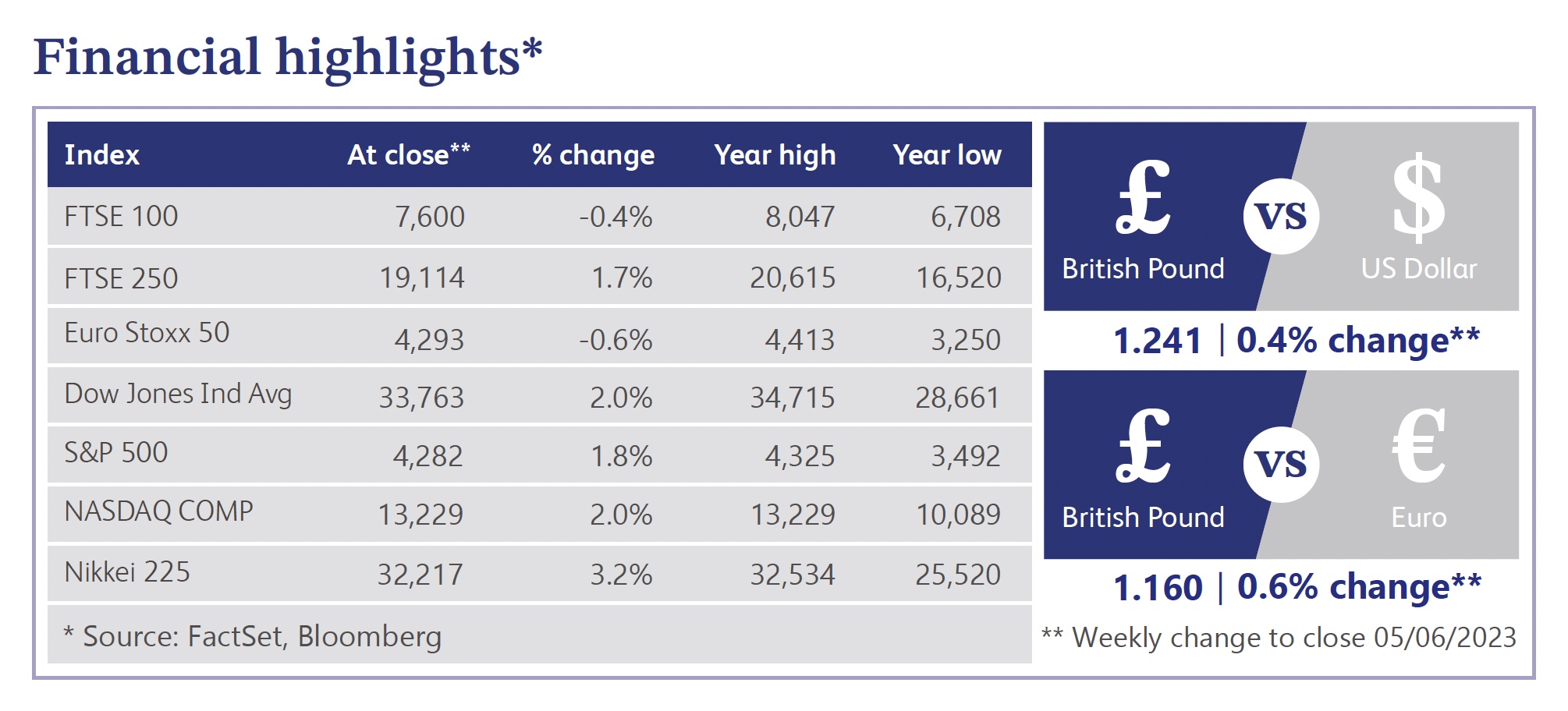

6 June 2023

Last week Nationwide’s Chief Economist, Robert Gardener warned of headwinds for the UK housing market after the building society’s house prices figures showed a 0.1% fall in May versus a 0.4% gain in the previous month. On a year-on-year basis, UK house prices are down 3.4%. There is no real surprise in this analysis from Nationwide as further rate rises are highly anticipated with rates staying higher for longer. So far, the UK housing market has shown its resilience compared with predictions at the start of the year. This is largely due to savings built up during Covid lockdowns, low levels of unemployment and softer mortgage rates in the early part of the year. Many economists are renewing their calls for softer house prices in the latter part of the year as rate hikes weigh on affordability. Mortgage rates are forecast to remain close to 5% for the remainder of the year, but Nationwide still predicts a relatively soft landing for prices.

Former Bank of England (“BoE”) officials stated last week that markets may still be underestimating terminal rate expectations. The week before last saw terminal rate expectations increase up to 5.5% due to hotter than expected inflation data. Underlying inflation may continue to force BoE rate-setters to continue implementing steady, incremental tightening which could see the key bank rate reach 6%. However, former monetary policy committee member Iain McCafferty, a long-standing hawk, warned forecasters should not read too much into one month’s data because of the lag between policy moves and impact.

Mergers and acquisition (“M&A”) activity within the UK dropped to its lowest level in seven years largely as a result of increasing interest rates. The total value of M&A transactions involving UK companies has more than halved to $89 billion in the first five months of the year. The number of deals announced also dropped by 29%. It was said that renewed uncertainty over the trajectory of inflation and interest rates were a significant contributor to the decline, alongside increased intervention by the UK’s competition watchdog.

In the US, President Biden signed a bill that suspends the $31.4 trillion debt ceiling, removing concerns over a US default. Negotiations went down to the wire as the Treasury Department had warned that it would be unable to pay all its bills on Monday if a deal was not reached. The bill signing marked a symbolic end to a potential economic crisis.

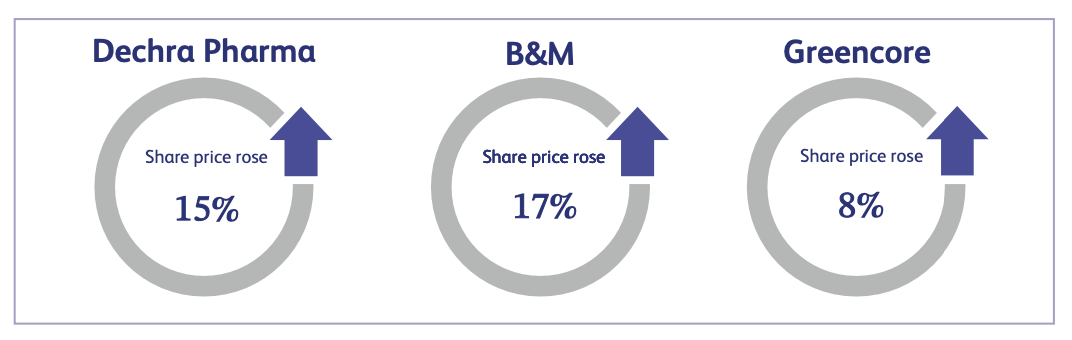

Dechra Pharmaceuticals, a business involved in the development and marketing of veterinary products, saw its share price increase approximately 15% last week. This was after a cash offer made by Freya Bidco Limited for the entire issued, and to be issued, ordinary share capital of Dechra for 3,875p per share. This represented a 44% premium to the closing price of 2,690 pence on the 12th April, the last business day before the commencement of the Offer Period.

B&M European Value Retail, a British multinational discount home store, announced its full year results which sent its share price soaring approximately 17%. Full year results were largely in line with expectations, but showed a positive start to full year 2024 trading. The company announced adjusted earnings before interest, taxes, depreciation and amortisation of £573 million for fiscal 2023, down from £619 million the previous year. However, this figure is expected to rise in the new year with analysts estimating a figure between £600 million and £610 million.

Greencore, a leading manufacturer of convenience foods, saw an increase in its share price of approximately 8% last week after announcing its second quarter results for 2023. The company announced revenue of £925.8 million which was an increase of approximately 20% from a year ago. Greencore also announced it is to re-commence its share buyback programme of up to £10 million between 30th May 2023 and 29 September 2023 subject to market conditions. This is part of a £50 million return of capital to shareholders announced in May 2022. To date, Greencore has returned £25 million of the intended £50 million return of capital.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.