9 February 2026

James Richards Chartered FCSI, Investment Director

I was once on a three-hour train from Pisa to Rome with an acquaintance that I had only met that day. Inevitably, with conversation having covered work, he asked me how he should invest some savings he had built up.

I recalled a wise old mentor telling me his advice was “only as good as the fee that one pays for it” - i.e. do not give free advice! I decided that payment of a couple of drinks was however sufficient given this was a somewhat informal chat (guidance not advice), and I did not want to have an awkward remaining journey by refusing to help. I suggested a passive investment into a US equity index tracker, left for 20 years would be fine. Whilst this is not how I invest for my clients or personally, if one is to make an investment decision that is going to be locked up in a box (or a pension perhaps) and not monitored for decades, then it is a straightforward option.

If we instead think of the colourful, ordered garden of a retiree who can water and tinker daily, it will look quite different to the cactus and succulent filled apartment of a 30-year-old pilot. Both can bring equal utility to their respective owner, whilst the opposite would likely cause disappointment to the retiree and a lot of dead vegetation for the pilot! The message is that there is more than one religion when it comes to investing, but it is important that investors have faith and remain disciplined to theirs.

Our investment philosophy of Protect and Compound is a simple one to explain – protect capital in falling markets and compound the growth in real terms over the long-term – but requires diligent, continuous work. We believe that buying what we consider to be quality investments will hold up in the bad times and prosper in the good. We have a strong process that is repeatable, allowing both consistency and reassurance in times of stress. I think back to Covid-19 as a great example of this when the market fell precipitously for a couple of days and there were calls to “sell everything”. Apart from the fact there was not the liquidity in the market to allow this, it would have been herd mentality and not good long-term thinking. To paraphrase Warren Buffet, if you liked an investment at £10 and it has fallen to £8, you should like it a whole lot more, not be selling it.

The military are drilled not to look slick on parade, but as a way of installing togetherness and an ability to keep calm and know what to do in the heat of battle, a strong investment process works in a similar way. Unlike the military, we try to install a flat and meritocratic structure which allows healthy debate. No one is too junior to have an opinion nor too senior not to be challenged. We have recently installed the Japanese culture of asking the most junior colleagues to speak first in a meeting as this hopefully allows them to give their honest opinion rather than feel they have to fall in line with seniors who have already made their mind up.

When looking for new investments, a key stage of our due diligence process is to measure the investment against our Great Eight Principles of Fund Management. We do not expect every investment to get ‘8 out of 8’ but it is unlikely for a fund that is only aligned to 3 or 4 of our principles to make it into our client portfolios. Importantly, past (and particularly recent) performance does not feature as one of the principles. This is because one can easily be swayed by good recent performance and forget this may be cyclical or non-repeatable. The fundamental data of the underlying businesses is however reviewed and critiqued in great detail. High profit margins; low debt ratios; and high (or rising) returns on capital are key characteristics we look for when considering if an investment meets our Quality criteria.

So back to the titular question, what makes a good investment? Well, it depends on the beneficiary as well as the investment itself. There are many factors such as age, wealth, objectives and willingness to take risk that are all relevant and intertwined. These are all data points to be analysed by an investment manager at the start of a relationship, but crucially also throughout the years as clients move through their lives. This is why some investments and styles are appropriate for one person, but not for others.

A key tenet of our approach is to aim for consistency of returns over time. We believe timing market calls repeatedly is at best, lucky and at worst, impossible. As such, we much prefer to look for investments and fund managers that align with our definition of quality as we believe that is the best way to survive and thrive over the long term.

Why do we prefer this quality focus? Well, it is through the effect of compounding – allowable by being patient investors – that we believe produces both consistent and superior results. I might be able to throw a lucky treble 20 on a dart board, but I will also get a 1 and probably miss the board with any 3 throws at the oche. In comparison, a professional will regularly get 3 treble 20s (180) – a consistent and superior return.

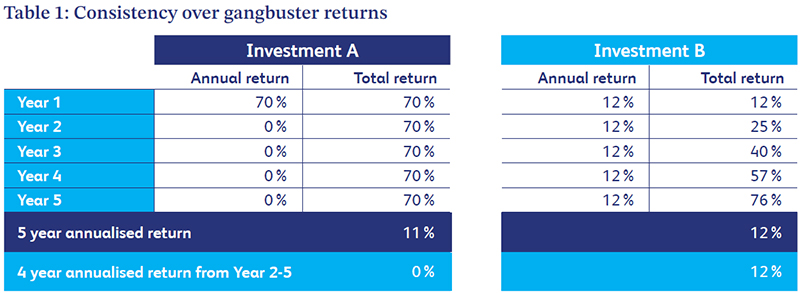

Turning to an investment example: If Investment A returns 70% in its first year and then remained flat (zero return) for the next 4 years, it would have returned 70% over 5 years. That is a reasonable return for those who timed their investment on day one and held for the 5-years (and even better if they decided to sell after year 1!), but a terrible investment for someone who saw the great return in year one and bought in year 2 – they had a 4-year holding period with 0% growth.

In contrast, if Investment B returned 12% every year for 5 years, not only would it have a higher return (76%) over the same 5-year period, but it would have been an equally good investment (on an annualised basis) for someone buying in year 2 or indeed year 3 or 4 and holding until the end of year 5. This example is depicted in Table 1 below.

Clearly this is an extreme example, but the point is that it is not about timing, rather time in the market that we prefer. Quality companies will rarely make huge annual returns like those seen with Investment A above, because they are doing what they have done for years, often dominating a niche market, making marginal gains to improve, building protection in the good times to prepare for the unavoidable, exogenous falls (such as Covid-19) in the bad times.

An example of this is Booking (Nasdaq: BKNG), a leading online travel agency, which had reserves on its balance sheet that allowed it to continue to operate without revenue during the Covid-19 period, and so whilst it was not immune from the market volatility, it was able to continue operating as a profitable business, which allowed its share price to recover relatively quickly and is now up over 180% since the start of 2020.

If we think conversely of EasyJet (LSE: EZJ), there was a 6-month period between October 2020 and April 2021 that saw its share price rise over 100%, however it has also had two falls of more than 50% since the start of 2020 and is still trading at a third of the value of its share price peak in 2015.

Two companies in similar industries; one more resilient to shocks with fundamental profitability underpinning it, the other more cyclical, heavily affected by exogenous oil prices – we prefer the former.

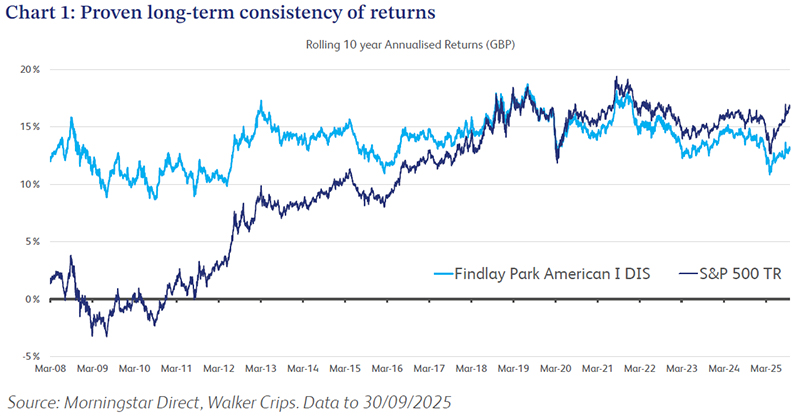

As shown in the Chart 1 below, Findlay Park, an active fund manager that aims to buy and hold around 50 US-based companies at any one time, has returned between 9-14% on an annualised basis over rolling 10-year periods since its inception in 1998. Over that same time period, the S&P 500 (a US equity index tracker) has had periods where it has done better than this, but it has also had 10-year periods with negative returns(!). If one is monitoring this and believes they can time the market then they may have done quite well going in and out of the tracker, but if you had bought £10,000 of Findlay Park American Class 1 at inception and locked it away in a box for the past 27 years (March 1998 to September 2025), with all the income reinvested into the fund, that investment would now be worth £286,000. The same investment in the S&P 500 would be worth £127,600 – a still useful figure, but less than half the return.

The key for us here is the consistency of returns – there have been multiple periods when the index has outperformed the active fund manager, but it comes back to what type of investment one is looking for. Findlay Park American’s worst 10- year period was 8.7% annualised, which is a total return of 130%. In contrast, the S&P 500’s worst 10-year period (the same 2000 to 2010 period) was -2.0% per annum, an 18% fall in value.

Over the last 10 years (data to October 2025), the S&P 500 has returned 16.9% per annum (376% total return), compared to only 13% per annum (239% total) for Findlay Park American. Clearly in hindsight it would have been better to have been invested in the index over the latter period, but when we are making fresh investment decisions looking forward, we must use the tools we have, such as the predictability of returns (and riskadjusted returns) in trying to achieve our desired outcomes.

Nothing in investing is guaranteed, but if I have one investment that has a high likelihood of returning between 8% and 15% against one that returns between -2% and 18%, I prefer the former. This is incredibly valuable for what we are trying to do, which is to enable all of our clients to have real growth (inflation adjusted) in their wealth over the long term rather than simply thinking about beating an arbitrary stock index. Consistency aids future planning (be it for retirement, gifting or annual expenditure) and allows people to enjoy their lives with peace of mind.

Another key consideration for many investors is income, but people do not really mean income, they mean a source of cash flow. A favoured term for the younger generations now seems to be “passive income” where one is able to live off the yield on their investments (be that stocks, property or royalties), without having to eat into the capital (or “earn” income through employment). Whilst the phrase might be new, the concept certainly is not, with many of our investors in the fortunate position of receiving handsome regular dividends from long-held UK blue chip stocks. The UK market has a long history of paying good dividends to shareholders, particularly compared to our compatriots across the pond who tend to reinvest profits or give back via share buybacks.

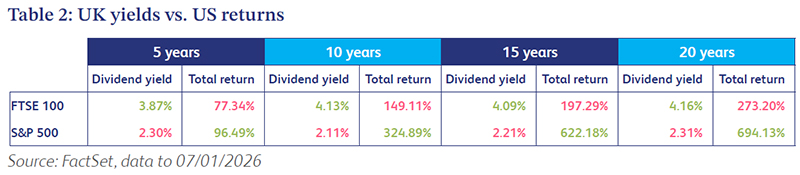

History shows that reinvesting profits (in profitable, growing businesses) internally is the most efficient way to grow and help the compounding effect. This is shown in Table 2 below where the US market (S&P 500) has repeatedly out-returned the UK market (FTSE 100) even though the UK’s dividend yield is significantly greater than the US.

What I am trying to say is that just because a company pays a good yield, does not mean it is a great investment.

Utility companies are good examples of this, often called ‘bond proxies’ because like a bond, they have limited capital growth, but a regular income. If that is what an investor wants, then they could get that from a bond, such as a Gilt (UK government bonds) or US Treasuries (US government debt), for less risk.

So, bond proxy type companies are not necessarily wrong, but if one is willing to take equity-like risk by holding company shares, why not pick ones that benefit from compound growth with profits reinvested in the business to make more profits? This should in theory lead to both greater capital and dividend growth.

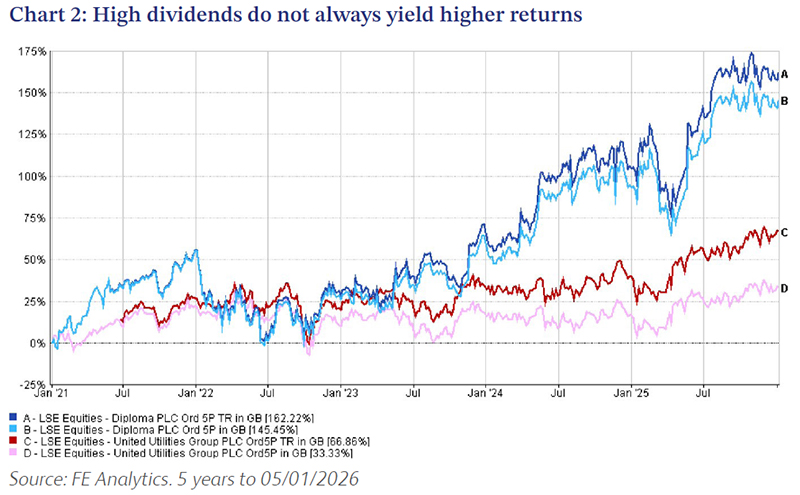

In Chart 2 below, we see the price return of United Utilities (LSE: UU.), a UK provider of water services, over the past 5 years. Its shares have returned 33%, a somewhat pedestrian return for an equity, but when we look at the total return, which includes the 4.5% average annual dividend yield, we get to a return of double that at 66%. This is a classic example of a Bond Proxy stock. Chart 2 also shows both the price and total return (dividends reinvested) of Diploma (LSE: DPLM), an industrial services company specialising in the distribution of value-add technical products such as controls and seals.

Whilst Diploma’s dividend yield is significantly less at 1.5%, and so the total return is predominately made up of the price return, in Chart 2 below we see the benefit of a profitable business that is reinvesting profits internally rather than paying out dividends. Its 5-year total return is nearly three times that of United Utilities at 162%.

This idea of clients needing cash not strictly income, we believe holds through time, but is presently enhanced in the UK – at least whilst current legislation lasts – as capital gains are generally taxed at a lower rate to income and dividends and so it can be more tax efficient to trim some capital from a growing investment for one’s income needs than go for a high dividend stock and pay income tax on the yield. This is less of an issue in tax-wrapped vehicles like ISAs and pensions, but the philosophy is around the need for cash from a portfolio to cover one’s expenditure rather than specifically needing an income for this.

There are plenty of ways to skin the proverbial investment cat and multiple may be right at the same time, but for very different reasons. If we think back to my Pisa train journey, the right style for my friend was different to me with our different touchpoints and fee levels. The important thing is to have a reason for your approach and make sure it is repeatable, but adaptable in the face of a changing environment. A religious-like faith in a philosophy is important, but it must sit hand in hand with a scientific-like ability to evolve.

Our focus on high quality companies that can survive in times of economic hardship and then come out stronger and prosper in the good times, will not always be flavour of the month as these types of companies are often called “boring” rather than the latest fad that goes to the moon, but then falls back to earth just as quickly. This preference may seem dull, but should result in more predictable growth than an index that is effectively a momentum call – i.e. we like the tortoise over the hare.

Einstein called compounding the 8th Wonder of the World, and it is achieved through long holding periods in quality investments. Which asset classes or criteria make up that definition of quality will evolve, but the philosophical North Star remains the goal.

James Richards Chartered FCSI

Investment Director

February 2026

Active management: A strategy where a fund manager or investment team makes specific decisions on which underlying assets to buy or sell. The goal is typically to outperform a specific benchmark or provide more consistent, risk-adjusted returns.

Compounding: In financial terms, compounding is the process where the returns on an investment (interest, dividends, or capital gains) are reinvested to generate their own returns over time. Often described as “interest on interest,” it transforms a linear growth pattern into an exponential one as the investment “snowballs”.

Dividend yield: A financial ratio that shows how much a company pays out in dividends each year relative to its stock price. It is expressed as a percentage.

Gilt: A bond issued by the UK government. They are generally considered lower-risk investments because they are backed by the government.

Passive management: A strategy where an investment simply replicates the underlying index or benchmark. These are sometimes called “Trackers” because they track the benchmark rather than actively selecting or deselecting certain underlying investments.

Real growth/returns: The return on an investment after adjusting for inflation, ensuring that the investor’s purchasing power actually increases over time.

Total return: The overall return on an investment, combining both capital appreciation (the increase in share price) and any dividends or interest received.

This white paper is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority (FRN:226344) and is a member of the London Stock Exchange. Registered office: 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.