10 February 2026

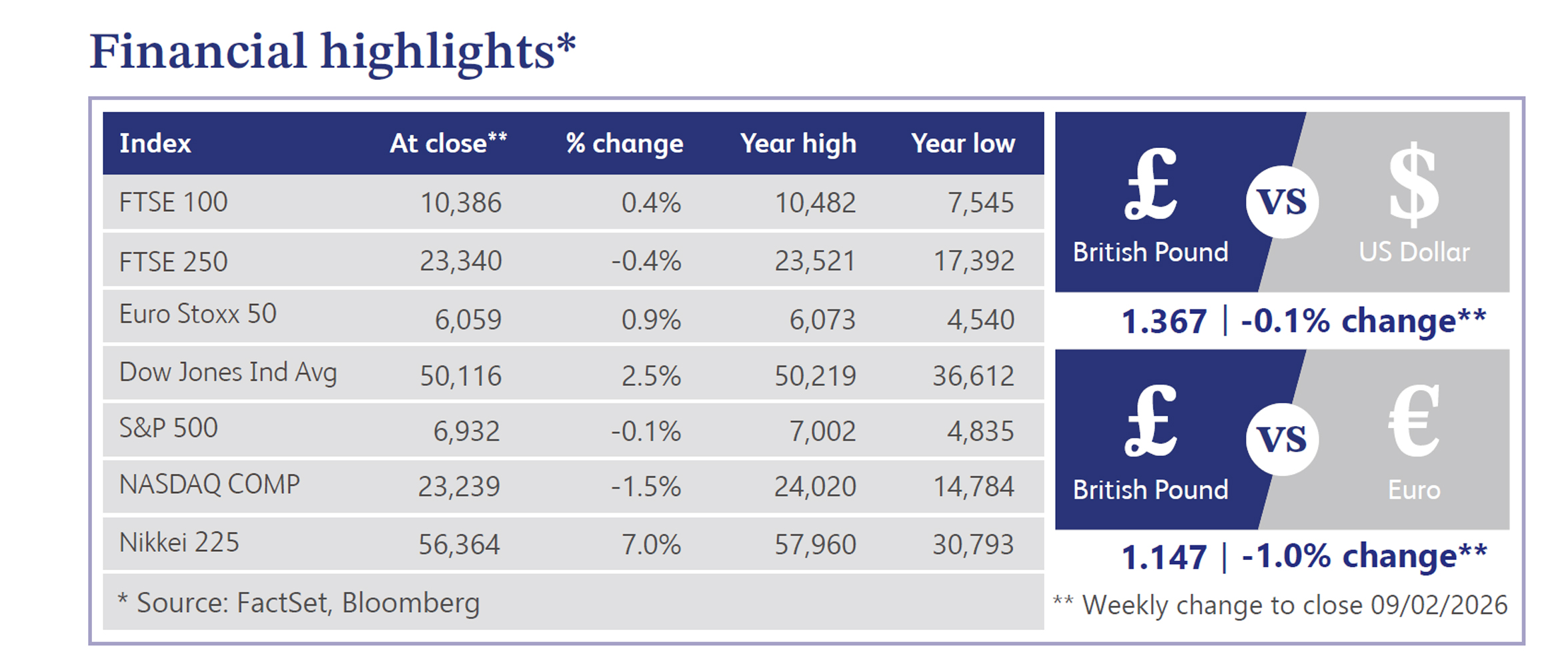

In the first week of February, the Bank of England held rates at 3.75% in a split 5-4 vote, with Governor, Andrew Bailey, stating a March cut was a “50-50 call”. Data shows actual business activity is healthy: the Services sector (54.0) and Manufacturing (51.8) are both well above the 50.0 neutral mark, indicating solid growth. The job market is also stabilising as hiring downturns ease. However, future confidence is low as surveys show CEOs prioritising "resilience over investment" due to political uncertainty, with 80% of firms pausing capital plans to weather the storm. The political instability is partly a consequence of the Peter Mandelson appointment controversy, which has put Prime Minister Keir Starmer's position in peril. Starmer ousted Chief of Staff Morgan McSweeney over the weekend to suppress opposition, yet Cabinet ministers are reportedly urging him to stand aside as Angela Rayner and Wes Streeting are preparing leadership challenges. This volatility is forcing a repricing of UK assets, pushing 10-year gilt yields to 4.54% and weighing on sterling. To stimulate growth, Chancellor Rachel Reeves is shifting policy toward stronger EU economic relations.

In the markets, strategic Merger and Acquisition activity defies the gloom: PwC reports deal values rose 12% to £131 billion, driven by artificial intelligence (“AI”) and infrastructure demand despite lower volumes. This "flight to quality" is evident in NatWest’s £2.7 billion acquisition of Evelyn Partners and Zurich’s bid for Beazley. Conversely, public market sentiment remains fragile, illustrated by Starling Bank withdrawing its London initial public offering (“IPO”) plans.

Across the Atlantic, the US market experienced divergence last week, characterised by a rotation from technology into broader cyclical sectors. While the Dow Jones (+2.50%) and Russell 2000 (+2.17%) rallied, the Nasdaq (-1.84%) lagged as AI anxiety triggered massive capital flight. AI company Anthropic’s new plugins sparked fears of industry-wide replacement, wiping out nearly $1 trillion in software market cap while concerns were compounded by Amazon’s $200 billion CAPEX (“Capital Expenditure”) guide, which overshadowed strong Amazon Web Services (“AWS”) growth. Consequently, the equal-weight S&P 500 hit record highs as investors moved away from concentrated “Big Tech” risk. Politically, President Trump signed an executive order cutting India tariffs to 18% and signalled a potential Russia-Ukraine peace deal by June. Meanwhile, treasuries firmed as yields fell following weak labour data, including the highest January layoffs since 2009. Gold surged 5%, nearing $5,000/oz, whilst WTI Crude oil fell 2.5% on easing US-Iran tensions. Bitcoin plunged 16.5%, its worst week since 2022.

In the housing market, the residential sector showed renewed momentum at the start of the year, driven by improving mortgage affordability and steady wage growth. Last week's Halifax data revealed UK average house prices crossed £300,000 for the first time in January, rising 0.7% monthly. Falling mortgage rates (below 4%) and strong wage growth are supporting the market despite affordability constraints. The recovery shows sharp regional divergence: Northern Ireland (+5.9%) and Scotland (+5.4%) lead gains, contrasting with annual declines of over 1% in London and the South East. The possible March rate cut has boosted housebuilders, who report strengthening order books ahead of a promising spring.

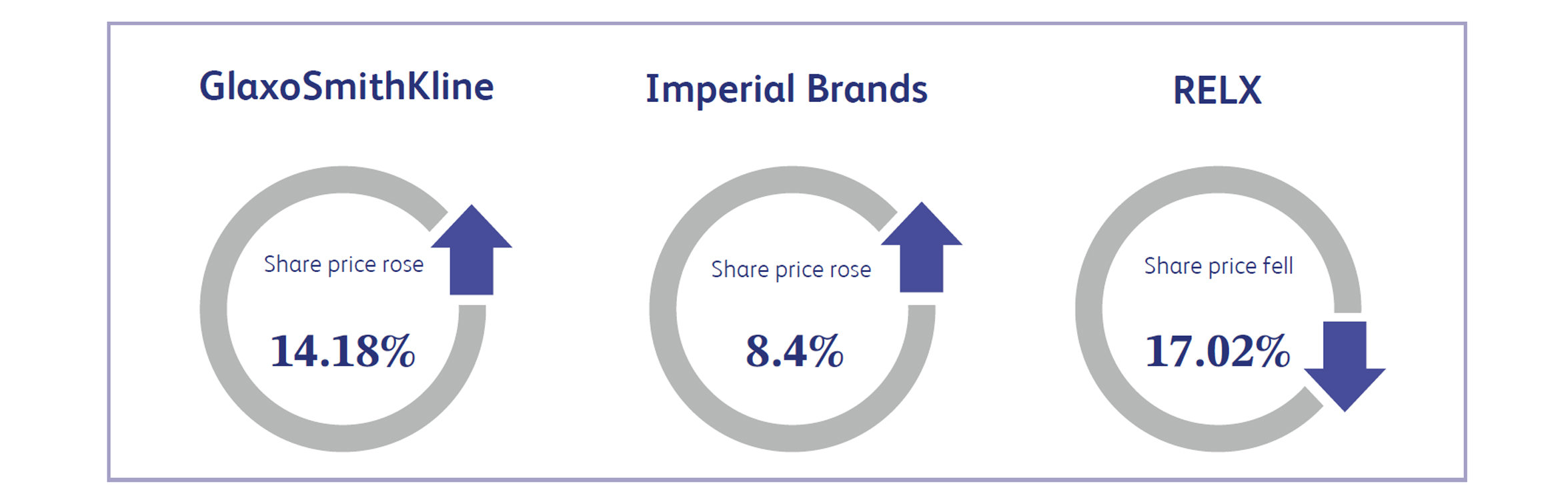

GSK, a global biopharmaceutical leader specialising in innovative medicines and vaccines, was the week’s top performer, surging 14.18% as investors embraced a shift in the company’s growth trajectory. The rally followed robust 2025 results, with sales rising 7% to £32.7 billion and specialty medicines jumping 17%. Under new CEO Luke Miels, the group outperformed Quarter 4 (“Q4”) expectations, signalling it is finally stepping out from the shadow of its peers. Analysts noted that sharpening pipeline execution in oncology and HIV has reinforced confidence in a 2031 revenue target of over £40 billion.

Imperial Brands, a multinational tobacco and next-generation product company known for its high-dividend income profile, climbed 8.4% as it benefited from shifting interest rate expectations. As a classic income play, the stock gained momentum following a Bank of England survey indicating the Bank Rate could drop to 3% by early 2027. Falling bond yields typically drive demand for tobacco stocks, and with the market pricing in further cuts for 2026, sentiment remained resilient. The price increase is also supported by an ongoing share buyback programme.

RELX, a global provider of information-based analytics and decision tools for professional and business customers, was the week’s primary laggard, plunging 17.02% amid intensifying fears over AI disruption. The introduction of a legal productivity tool by AI company Anthropic sparked a sell-off, driven by the belief that AI poses a threat to established software companies. While some market participants argued that the recent panic was misplaced, suggesting that ownership of proprietary data assets remains a significant advantage over large language models, the stock continues to be negatively affected by the speculative bearish view on whether its earnings are sustainable in the age of AI, leading to a continued sell-off by investors.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management's own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority (FRN:226344) and is a member of the London Stock Exchange. Registered office: 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.